[ad_1]

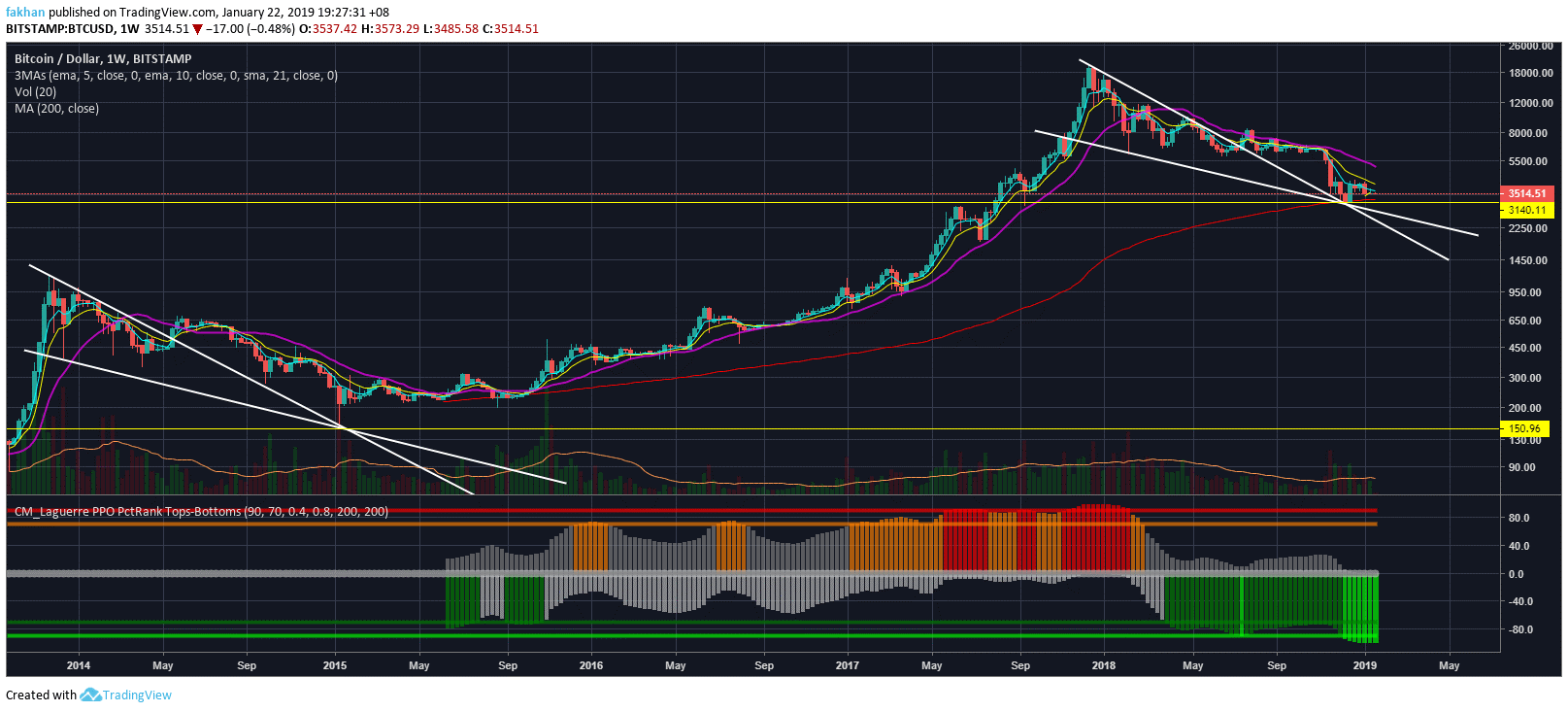

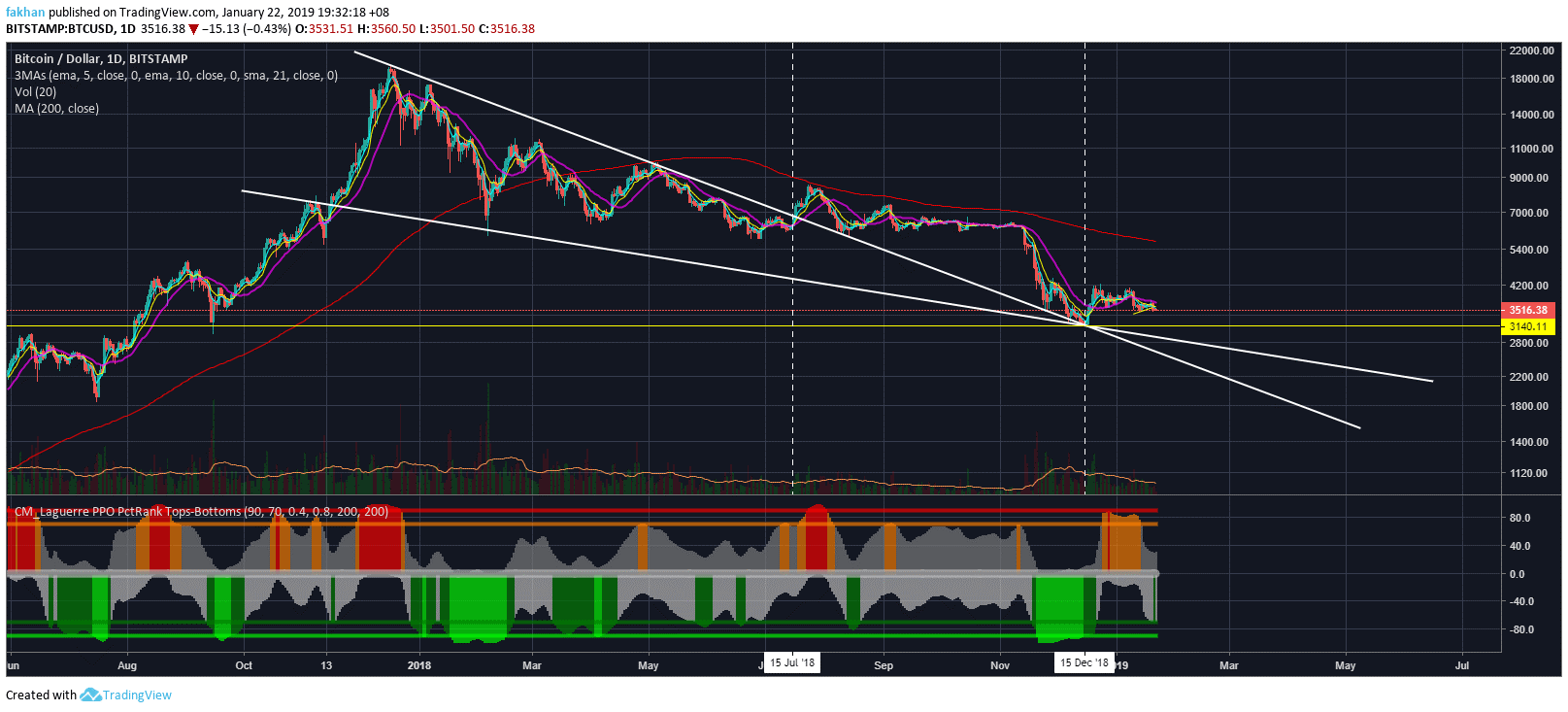

Bitcoin (BTC) has traded sideways for a few weeks while the majority of cryptocurrency enthusiasts are waiting for lower levels to fall. However, it is becoming increasingly clear that we may not see a drop, as many silent bulls are waiting to buy each dip, especially between $ 3,000 and $ 3,500. BTC / USD has already tested the model 200 weeks and it does not need to fall again to test it again. That being said, people waiting on the sideline will not come in before Bitcoin (BTC) makes a decisive decision. There are tight discussions around a big move in February, but it is unclear what will be the catalyst behind this move. One of these catalysts could be the Van Eck Bitcoin ETF. The SEC has until February 27, 2019 to approve or reject this ETF.

As the SEC is legally bound to make a final decision by February 27, 2019 without further delay, February is expected to be a significant month for Bitcoin (BTC). If this ETF is approved, we will have the catalyst we have needed for a long time for Bitcoin (BTC) to reach a new record, perhaps in 2019. However, if the ETF is rejected, the price may drop to 3000 $ or lower levels. In any case, we will have a decisive direction for the coming months. The current sentiment is too bearish and the number of people who expect Bitcoin (BTC) to drop to USD 3,000 or lower is much higher than those who think the BTC / USD has already reaches its lowest level.

Some also believe that Bitcoin (BTC) could reach $ 50,000 or more, even in 2019, but for now, such statements do not seem at all plausible. However, as we have seen in the past, Bitcoin (BTC) surprises most of us. Not so long ago, people were paying Bitcoin (BTC) pizzas worth several million dollars today. In 2014, the price exceeded $ 1,000 and many people expect that those who bought a lot of bitcoins (BTC) at about these levels and who did not sell at summit will sell now near the bottom. This is nothing more than wishful thinking.

It is much easier to be bearish than bullish on BTC / USD because the global sentiment is currently opposed to Bitcoin (BTC). Large financial institutions and governments still see an experience and the media place it in the same category as speculative badets such as equities. While this may be the case for other crypto-currencies, Bitcoin (BTC) is something totally different. There are ways in which Bitcoin (BTC) is even better than Gold because it is easier to store and difficult to confiscate. Bitcoin (BTC) also has a known limited offer, which means that we know for sure how many of these are outstanding and how many have yet to be extracted. The same can not be said for gold.

Source link