[ad_1]

Photographer: Samuel Corum / Bloomberg

Photographer: Samuel Corum / Bloomberg

A battered treasury bill market faces another tough week as it will have to absorb a massive list of maturity-driven auctions that have been squashed amid improving growth and inflation prospects.

It has been a month since a A disastrous seven-year auction sent the bond market into a tumble that spilled over into financial markets and helped put benchmark yields on track to pre-pandemic highs. Now that maturity is on the schedule again, with a $ 62 billion bid looming as a source of anxiety for dealers in the week ahead.

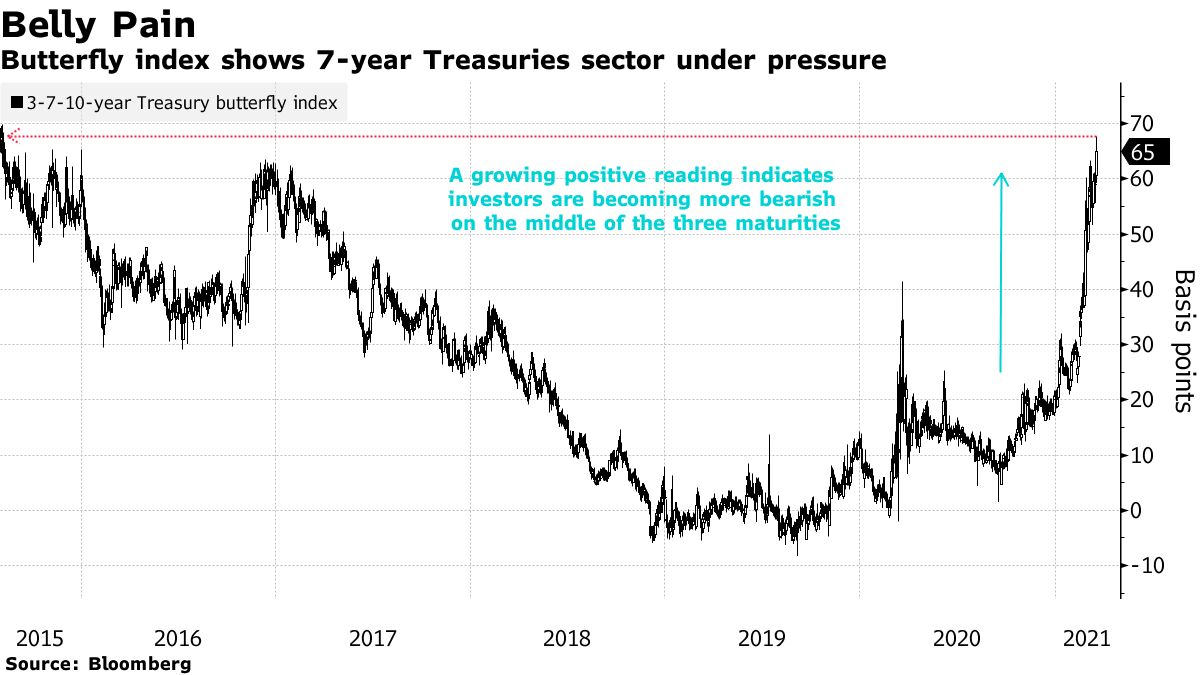

The government will sell in a market that has gone through a painful period, leading to an index of longer maturities in a bear market. A key part of the yield curve just hit its highest level in more than five years after the Federal Reserve reaffirmed its intention to keep rates close to zero until 2023. The seven-year zone, particularly vulnerable to shifting monetary policy speculation, has taken a beating as traders bet the central bank will not be in able to wait that long. It is the most underperforming of the surrounding maturities since 2015.

“Sourcing will be a very important part of next week,” said Justin Lederer, strategist at Cantor Fitzgerald. “We’ll really see what kind of end-user demand comes through in these auctions, and whether the last seven years of the past month have been so poorly sponsored due to the volatility of that day or if this is a theme. continued. There is just a lot of volatility now and one wonders if higher rates are going to impact stocks. “

In February, as investors were already pulling out of bonds amid stimulus talks and vaccine rollout, the government received record demand for the seven-year auction. The added result fueled a sell off in Treasuries that extended to a seventh straight week.

The auction listing highlights another concern. Mainly treasures ignored the Fed’s decision on Friday to allow banking regulatory exemptions that have supported the bond market since the start of the pandemic to expire. But the dealers were the unloading of Treasuries, and for some analysts, the Fed’s move may increase the stress around auctions.

Long-term pain

The fixed income slump hit longer maturities the hardest. On Thursday, a Bloomberg Barclays U.S. Treasury Index that tracks debt at 10 years or more was down about 22% from its March 2020 high, putting it in bearish territory – at least by that gauge. The 10-year yield hit 1.75% this week, the highest since January 2020.

The bull market in treasury bills that started in 1981 is finally over

Yields and inflation expectations also took off after Fed Chairman Jerome Powell pushed back on any need to tackle the hike. A market indicator of inflation over the next decade has climbed to around 2.3% this week, the highest since 2013.

Powell reiterated this week that he would only see a problem with selling bonds if accompanied by “disorderly market conditions or a persistent tightening of financial conditions that threaten the achievement of our goals.” Tech stocks appeared to suffer at times over the past week as yields prolonged their ascent.

This leaves traders watching a large number of Fed speakers, especially Powell, for new information. A continued message of patience over rate tightening may prompt some to exit bets that the hikes may come sooner than the Fed plans.

“I suspect the Fedspeak will stay in line with Powell’s views this week that they let inflation rise a bit and are unlikely to move rates or cut asset purchases” for a long time, Tom said. di Galoma, head of government business management and strategy at Seaport Global.

He expects 10-year yields to hit around 1.9% to 1.95% by the middle of the year, and he sees a 2.25% margin depending on the mix and location. the size of any additional stimulus proposal.

What to watch

-

The economic calendar:

- March 22: Chicago Fed National Activity Index; Sales of existing homes

- March 23: current account balance; sales of new homes; Richmond Fed Manufacturing Index

- March 24: MBA mortgage applications; durable goods / equipment orders; PMI Markit

- March 25: jobless claims; GDP; Consumer comfort Langer; Kansas City Fed Manufacturing

- March 26: advance of the goods trade balance; wholesale / retail inventories; personal income / expenses; PCE deflator; University of Michigan sentiment

-

The Fed’s schedule:

- March 21: Thomas Barkin of the Richmond Fed at the Asian Investment Conference of Credit Suisse

- March 22: Powell in the BIS panel; Barkin; Mary Daly of the San Francisco Fed; Vice President responsible for oversight Randal Quarles on the Libor transition; Governor Michelle Bowman

- March 23: James Bullard of the St. Louis Fed; Raphael Bostic of the Atlanta Fed; Barkin; Powell and Secretary of the Treasury Janet Yellen before the House committee; Governor Lael Brainard in two appearances; John Williams of the New York Fed

- March 24: Barkin; Powell and Yellen before the Senate committee; Williams; Daly; Charles Evans of the Chicago Fed

- March 25: Williams; Clarida; Bostic; Evans; Daly

-

The auction calendar:

- March 22: invoices for 13, 26 weeks

- March 23: invoices for 52 weeks; 42-day cash management invoices; 2 year notes

- March 24: 2-year variable rate notes; 5 Year Notes

- March 25: invoices from 4 to 8 weeks; 7 Year Notes

– With the help of Elizabeth Stanton and Ye Xie

[ad_2]

Source link