[ad_1]

A discarded face mask rests on fallen autumn leaves in Berlin’s Kreuzberg district on November 7, 2020 amid the novel coronavirus (Covid-19) pandemic.

david gannon / Agence France-Presse / Getty Images

With the US presidential election in the past, the surge in COVID-19 infections on both sides of the Atlantic is increasingly visible and will weigh on major economies in the near term, Goldman Sachs warned.

A team led by chief economist Jan Hatzius slashed growth forecasts in a note to clients on Saturday, as supporters of former Vice President Joe Biden celebrated an election victory projected early Saturday by the Associated Press and other media outlets.

Hatzius said Biden would likely work with a Republican majority in the Senate and settle for a $ 1 trillion stimulus package, less than half of what the bank expected if Democrats could have claimed the Senate in addition to the White House, while retaining control of the House of Representatives

Lily: What a Joe Biden Presidency Means for Taxes, Health Care, Housing, Student Debt – and Another COVID-19 Stimulus Package

This should “be enough for a small positive fiscal boost to US growth over the next few quarters,” he said. But that still leaves the short term unsettling and hence further downgrades from Goldman.

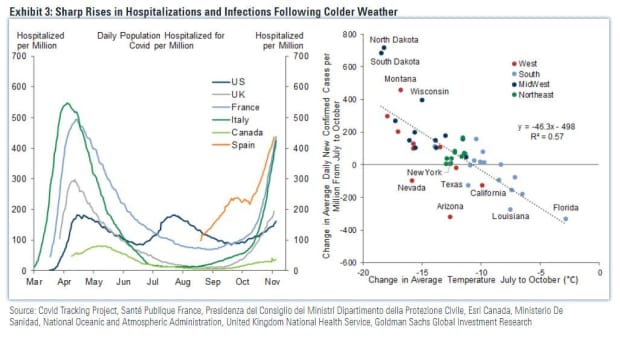

The team cut its first-quarter U.S. growth forecast from 7% to 3.5% and significantly reduced the fourth-quarter estimate for Europe from 9.1% to a contraction of 8.7% . “The risks are on the downside if news about the virus continues to deteriorate,” Hatzius and the team said.

The new lockdowns announced across Europe in recent weeks are one of the main reasons for these deep cuts to the region’s near-term growth prospects. And although U.S. states and municipalities have not announced tighter travel restrictions beyond multi-day quarantines for people traveling from certain states to others, economists have incorporated potential changes into this forecast.

News on the viruses was overshadowed by a long and bitter election in the United States, even as the country reported nearly 133,000 infections on Friday, a third consecutive record of cases in one day. Biden was due to announce a new COVID-19 task force on Monday, Axios first reported.

Europe has seen a surge in hospitalizations, especially in the Czech Republic and Belgium. When adjusted for population, the data shows that individuals are hospitalized with the virus at a much higher level in Europe than in the United States, which the New York Times also recently reported.

Goldman Sachs

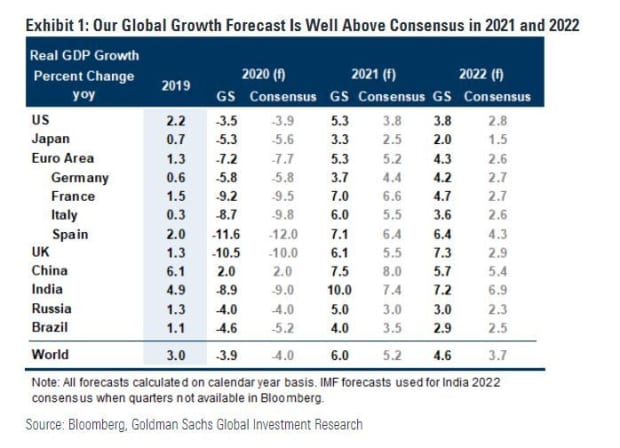

But for the long haul, Hatzius and the team say their forecasts are much more bullish than others.

They expect “current weakness will give way to much stronger growth when European lockdowns end and a vaccine becomes available.” In light of short-term growth downgrades, Goldman’s global forecast for 2021 now stands at 6%, which is still above the consensus of 5.2%, but a downgrade of half a point compared to that of the bank a month ago.

Lily: Dr Atul Gawande on COVID-19: ‘It’s never too late to save 100,000 more lives’

The team is specifically looking to have the Food and Drug Administration approve at least one vaccine by January and that mass vaccination of the general U.S. population begins thereafter. This should lead to a strong rebound in growth, or a V-shaped recovery in the second quarter, in which the “V” stands for vaccine, the Goldman team said.

Goldman Sachs

“An important assumption behind our forecast is that governments in countries hard hit by coronavirus infections will continue to do a reasonable job of replacing private sector income lost due to disruptions through wage subsidies, unemployment benefits improvements and other income transfers, ”said Hatzius and the team.

Lily: ’25 cent solution’ would have prevented COVID recession, says most accurate forecaster

Elsewhere, they maintain estimates well above the consensus for emerging countries in 2021-2022, except in China, where production has already returned to pre-pandemic levels.

[ad_2]

Source link