[ad_1]

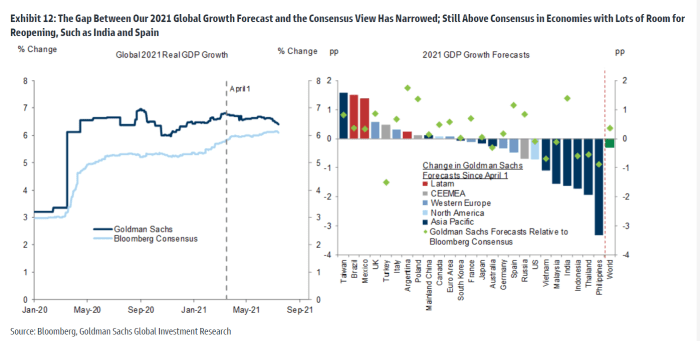

Goldman Sachs is proud of its bullish stance on the global economy, with its consensus above doing better than many of its banking rivals in predicting how resilient consumers and businesses have been.

Gross domestic product data released on Thursday shows the world’s largest economy, the United States, has already passed its pre-pandemic peak, and Eurostat on Friday announced a 13.7% year-over-year increase. the other of the economy of the euro zone in the second quarter.

Corn…

Goldman Sachs economists Daan Struyven and Sid Bhushan say the bank’s economics team is now less enthusiastic. They lowered economic growth projections for Asian economies with low vaccination rates, notably India and Australia, but also the United States – even improving forecasts for Brazil and Mexico – raising their growth forecasts. global for this year at 6.4%, only 0.3% above the Wall Street Consensus.

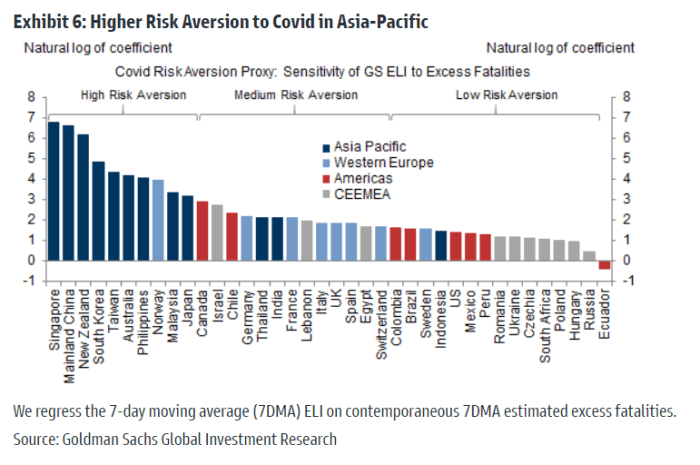

The more transmissible delta strain of the coronavirus implies slower recovery due to new outbreaks. The problem is not only government restrictions, but also the choices of individuals to limit high contact services.

“The share of Americans saying ‘always avoid’ high-contact activities has declined, but remains substantial at around 50% for public transport and large events, and 30% for travel,” they said, citing the data. by YouGov. “A new recovery will require not only increased vaccinations and associated medical improvements, but also time for individuals to become more comfortable.”

Related: Here are the good and bad news of the “Freedom Day” experience in England

And the United States is lumped into one of the countries with low risk aversion, based on the restrictions imposed on deaths. “China’s high risk aversion could keep quarantines and travel controls in place longer and delay the recovery of tourist economies such as Vietnam, Thailand and Singapore,” they said.

The pessimism comes amid a new report from the Centers for Disease Control and Prevention arguing that the delta variant is as transmissible as chickenpox.

Amazon misses forecast

Amazon.com AMZN,

sales expectations have slumped as CFO Brian Olsavsky said people are going out more and doing things other than shopping. Amazon shares fell 6% in pre-market trading.

Pinterest Pins,

the stock plunged 20% in after-hours trading after reporting a decline in US users and failing to provide guidance for the third quarter. Like Amazon, Pinterest said there was an “engagement end” that was seen when people were stuck at home.

Friday’s earnings list includes oil producers Exxon Mobil XOM,

and Chevron CVX,

as well as the machine builder Caterpillar CAT,

Chevon beat earnings estimates as it announced it would resume a share buyback program, while Caterpillar shares traded lower after beating earnings estimates.

The economic calendar includes the second quarter employment cost index, the June reading of PCE price inflation and consumer spending, and the Chicago PMI for July. St. Louis Fed Chairman James Bullard is scheduled to deliver a speech.

The first person sentenced in Hong Kong under the new National Security Law was sentenced to nine years in prison.

The steps

US ES00 equity futures contracts,

NQ00,

pointed out a lousy start to Amazon’s numbers, although the Dow industrial contract without Amazon YM00,

outperformed. The 10-year Treasury yield TMUBMUSD10Y,

was 1.25%.

The Hang Seng HSI,

ended an eventful week with a decline of 1.4%. Real estate company Evergrande 3333,

sunk 9%.

Table

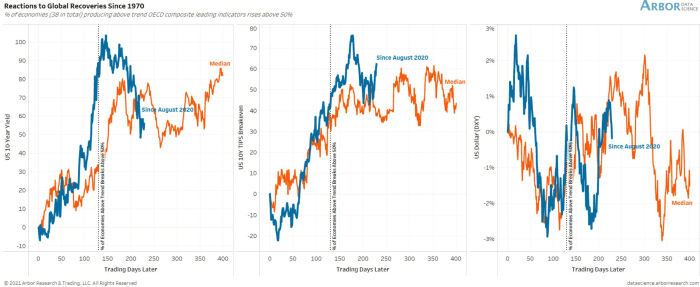

This time it’s… actually quite similar. Arbor Research has examined the performance of bonds and the US dollar during other economic recoveries. The blue lines indicate that the current performance more or less follows what has happened in previous years. “This historic playbook suggests conditions related to the beach over the coming months,” Arbor’s Ben Breitzholtz said on Twitter.

Random readings

Brazilians revel in the snow, although the unusual cold snap threatens major commodities.

An art dealer sold a giant yellow pumpkin made by famous Japanese artist Yayoi Kusama. Problem is, the dealership never owned it.

Need to Know starts early and is updated until the opening bell, but sign up here to receive it once in your inbox. The emailed version will be sent at approximately 7:30 a.m. Eastern Time.

Want more for the day ahead? Sign up for Barron’s Daily, a morning investor briefing, featuring exclusive commentary from the editors at Barron’s and MarketWatch.

[ad_2]

Source link