[ad_1]

Will Goldman’s New S&P 500 Target Hit the Target?

kazuhiro nogi / Agence France-Presse / Getty Images

The news that the COVID-19 vaccine from drugmaker Pfizer PFE,

and its partner BioNTech BNTX,

is 90% efficient, according to Bernstein Research strategist Inigo Fraser Jenkins, sent actions rushing like “traces left in a cloud chamber from particles dispersing in an accelerator.”

Goldman Sachs strategists, led by David Kostin, say the vaccine is a bigger development for the economy and markets than the forward-looking policies of a Biden presidency. “The divisive US presidential campaign was actually a backdrop to the main event: a public health crisis that has tragically claimed 240,000 lives in the United States since it began. However, in less than a year, a vaccine was discovered, ”they say.

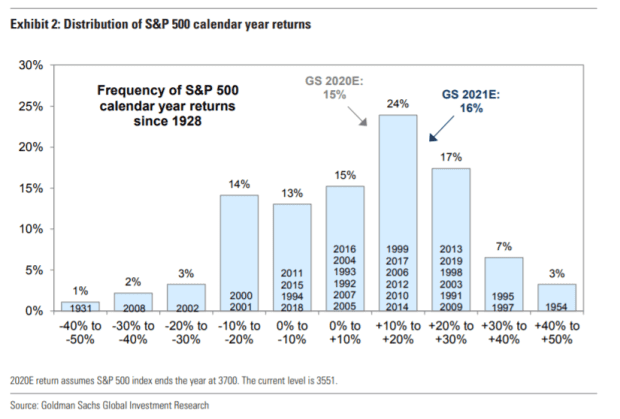

The Goldman team raised their year-end price target on the S&P 500 SPX,

at 3,700 from 3,600, which isn’t that far from Tuesday’s closing level of 3,545.53. Goldman is also targeting 4,300 by the end of 2021 and 4,600 by the end of 2022.

They predict that the Pfizer vaccine, and possibly others, will receive emergency use authorization by the end of January, and that sufficient doses will be available to the American population in the first half of 2021. They increased revenue estimates, mainly reflecting better-than-expected results for the third quarter. They also expect better growth in the United States next year than the market, at 5.3% compared to the consensus forecast of 3.8%. A weakening U.S. dollar DXY,

and a weak job market should support the S&P 500 sales and margins, they add.

They’re not too worried about the weight of tech giants – Facebook FB,

Amazon AMZN,

Apple AAPL,

Microsoft MSFT,

and Alphabet GOOG, owner of Google,

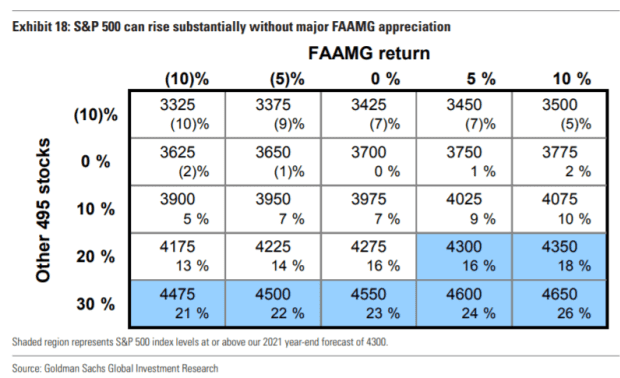

The S&P 500 would rise 9% if FAAMG stocks traded sideways and the remaining 495 stocks would rise from the historic 12-month median rise of 12%. And the S&P 500 would rise 16% if FAAMG stocks rose 5% and the remaining 495 by 20%, which would represent an 80th percentile movement based on the historical distribution since 1990.

As for the debate over value or growth, the Goldman team likes both. For value stocks, the team noted that Monday was the biggest one-day increase in factor history since 1980, while saying growth stocks should continue to benefit from weak economic growth trend. and low interest rates.

“When reflecting on the potential resolution of the current record valuation dispersion, investors often remember the unfolding of the tech bubble, characterized by a two-year bear market and significant negative absolute returns from previous market leaders. More often, however, recoveries tend to occur in rising markets, in which high valued stocks also rise, but are outpaced by lower valued companies. We expect this “catch-up” dynamic to occur in the coming months as a vaccine is approved and distributed, ”they say.

Also read: Here’s what strategists are saying about tech stocks and value turnover

The buzz

Coronavirus hospitalizations hit a record high in the United States on Tuesday, due to increases in states such as Oklahoma, Minnesota and Texas. Mobility measures are starting to decline, a sign that Americans are becoming more cautious, even as few states impose new lockdowns.

Alibaba BABA shares listed in Hong Kong,

JD.com JD,

and Tencent 700,

tumbled after the Chinese Communist Party introduced rules against monopoly practices in the tech industry. China has also decided to disqualify four pro-democracy lawmakers in Hong Kong.

The Trump campaign said it has taken legal action to stop the certification of Michigan election results. UK betting markets assign Trump a 10% chance of serving a second term.

Rideshare company Lyft LYFT,

said it recovered more than half of its business after the days leading up to the pandemic in the third quarter. Datadog DDOG application monitoring company,

fell even as the company increased its financial outlook.

The steps

Nasdaq-100 NQ00 Futures,

jumped after Tuesday’s sell-off, while S&P 500 ES00 futures,

also won. Outside of China and Hong Kong, most foreign stock markets also rose.

Futures on crude oil CL.1,

rallied, while the GCZ20 gold,

was stable. The 10-year Treasury yield TMUBMUSD10Y,

edged up to 0.98%.

Random readings

The Chinese city of Shenzhen has made time off mandatory in an attempt to reduce burnout.

One of Jupiter’s moons is probably glowing in the dark.

Need to Know starts early and is updated until the opening bell, but sign up here to receive it once in your inbox. The emailed version will be sent out at approximately 7:30 a.m. EST.

[ad_2]

Source link