[ad_1]

Photographer: Michael Nagle / Bloomberg

Photographer: Michael Nagle / Bloomberg

Corners of the US stock market are showing signs of foaming, according to Goldman Sachs Group Inc., but that shouldn’t put the market as a whole at risk.

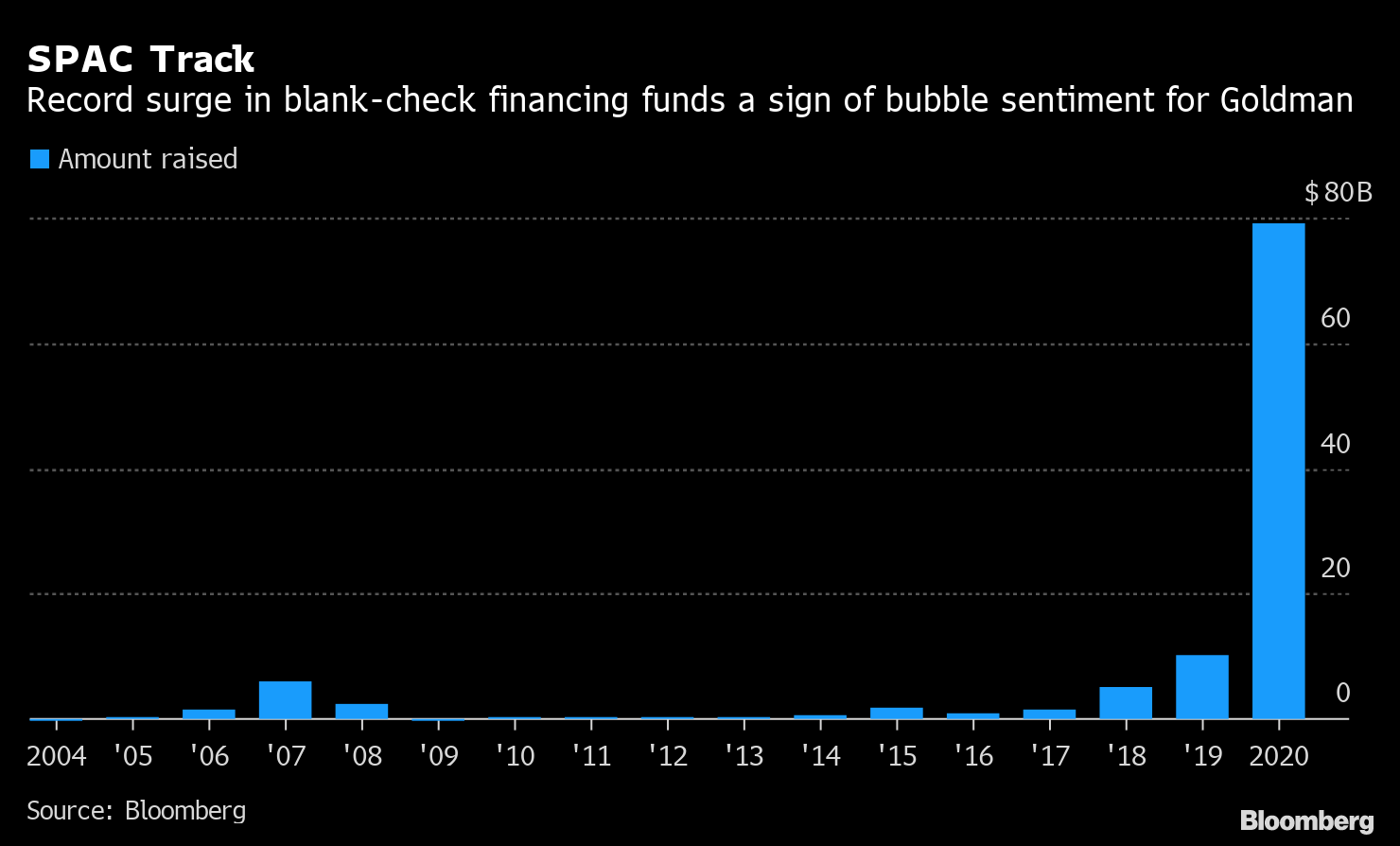

Very high growth, multiple multiples stocks “look frothy” and the boom in special purpose acquisition companies is one of many “signs of unsustainable excess” in the US stock market, wrote strategists including David Kostin in a note on Friday. The recent surge in negative earnings stock trading volumes is also at an all-time high, they said.

However, the overall stock index is trading at below-average historical valuations after taking into account Treasury yields, corporate credit and cash, the strategists added.

“Pockets of the market recently appeared to demonstrate consistent investor behavior with bubble sentiment,” the team wrote. “But these excesses present a low systemic risk for the entire market given their modest share of market capitalization. “

SPAC track

Record surge in blank check financing is a sign of a bubble for Goldman

Source: Bloomberg

As global stocks are trading at record highs, investors are questioning the potential for future returns amid sweeping valuations and signs of speculative behavior. The MSCI AC World index jumped 74% from the low in March of last year, the high-growth Nasdaq 100 index rising more than 90%.

Goldman’s peers at Citigroup Inc. acknowledged that stocks around the world look “increasingly foamy,” in a separate note on Friday, but suggested valuations continue to lag behind “mega-bubble periods.” And that risky assets could continue to rise.

“Eventually a real bear market will happen, it always does after a bubble,” wrote the Citi team, including Robert Buckland. “But the markets can start to get more bubbly.”

– With the help of Crystal Tse

[ad_2]

Source link