[ad_1]

Google Pay is apparently just as much of a disaster internally as the transition of apps has been externally. That’s the big takeaway from a recent Business Insider article detailing an exodus of executives from Google’s payments division, lower-than-expected app adoption and employees frustrated by the division’s slow pace. .

Business Insider spoke to former employees and learned that “dozens of employees and executives have left” the Google Payments team in recent months, including “at least seven team leaders with roles of director or vice-president “. The biggest departure, of payments chief Caesar Sengupta, sparked the exodus in April, and now employees are worried about further reorganization and slower progress. Many of the core team are also said to have left, with the story saying, “A former employee estimated that half of the people working in the Google Pay business development team, a group of around 40 people, have left the company. In recent months. “

In 2018, Sengupta took over the payments division, which oversees the Google Pay app and the broader Google payments infrastructure. India.”

It’s a reference to the big Google Pay overhaul in March, which killed the existing app and website and essentially replaced them with a whole new service. We weren’t big fans of the update, which had a lot of reduced features and a clunky transition plan for existing users. It seems that we were not alone in our disappointment; the report quotes a former payments clerk saying, “Caesar [Sengupta] the departure was the cornerstone of much of the frustration felt by the employees. The product was not growing at the rate we wanted. ”Sengupta left Google a month after removing the old Google Pay and making its new app mandatory for all users in the United States.

The disaster of the “new Google Pay”

The new Google Pay app was launched in November 2020 in the United States, and for about four months Google used two “Google Pay” apps: the old Google Pay (which had been around since 2011, first as Google Wallet, then Android Pay, then Google Pay) and this new Google Pay, which was a fundamental rewrite that the company launched for the Indian market. April 2021 closed the final death of the old Google Pay service, which had been shutting down since January. The two services were both called “Google Pay”, but other than that they weren’t related in terms of features, contacts, or accounts.

We reviewed the new Google Pay around this time and found it to be a pretty poor service compared to what Google had before. The new service used SMS instead of a Google account for your identity, meaning it didn’t support multiple devices, didn’t support multiple accounts, and no longer supported the use of websites. . Your phone was the only way to access working Google Pay, and everything was tied to your carrier’s phone number.

NFC payments on Android generally worked the same, but P2P users had to go through an awkward transition. Users of the new app could not send money to users of the old app. Therefore, as your contact list has shifted, Google Pay has become a unusable mess for the next few months. “I sent you money on Google Pay” was no longer enough; users had to determine for themselves whether “Google Pay” meant the new or the old app. Google should have worked to ease the transition, but it didn’t, and the result was months of what was essentially break time for the service. Sending money via “Google Pay” was no longer reliable except for the most sophisticated users, due to version incompatibilities.

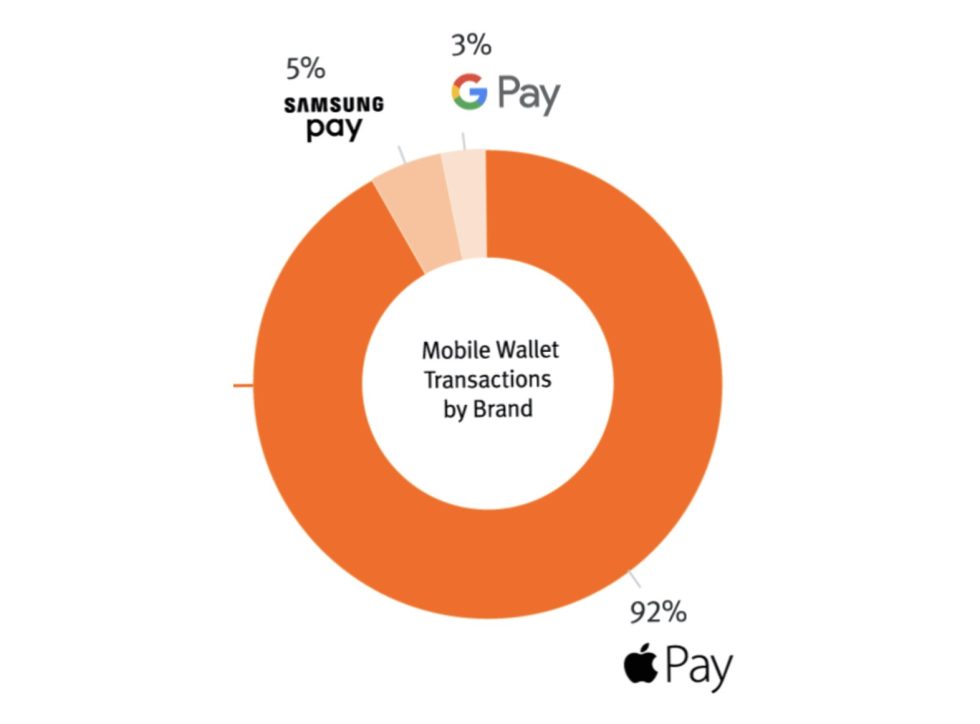

Google’s change to Google Pay is not completely demotivated. A survey last year by Pulse, a company of Discover, said Google Pay has a meager 3% market share, while Apple Pay, which has joined the NFC payments market. years after Google, held 92% of mobile payments. Something probably needed to change for Google Pay, but these are statistics for NFC payments, and New Google Pay has hardly changed anything for NFC payments.

Next step: Google bank accounts? !

The next step for the new Google Pay app is the launch during the year of a “Plex” banking service, which will be a fully-fledged Google bank account, through a partnership with Citibank. One of the employees Business Insider spoke to said, “Plex was completely [Vice President] Felix [Lin] and Caesar [Sengupta’s] original idea, “and now these two executives no longer work at Google. Progress on the bank account has already been” slower than expected “, according to the report, and without its two main architects, Plex could be delayed.

There’s one question I’m not sure anyone from the payments team asked, and it might be worth considering: does anyone want to a Google bank account?

[ad_2]

Source link