[ad_1]

Since the launch of Pay in 2015, it now sees more than 150 million monthly users in 30 countries. “But there is a lot more we can do,” said Google Pay CEO Caesar Sengupta. Managing our finances is too difficult for most Americans today. A new Insights section of the app can help alleviate that stress, Google said. This page will show all your expenses and pull information from connected bank accounts, credit and debit cards. It will remind you when invoices are due, alert you to important purchases (in case of suspicious activity) and show you your weekly expenses.

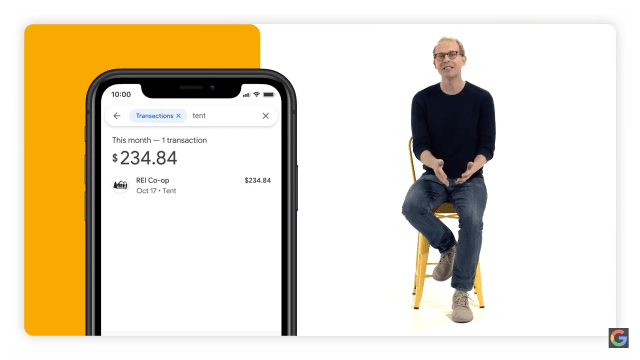

It looks a lot like the Mint financial app, but since it’s a Google product, Pay also has a powerful search tool built in to make the app easier to use. “Google Pay has a semantic understanding of the word food and it also includes the places where I bought food,” said chief product officer Josh Woodward.

You can search for food or “gas last month” and find those specific transactions. You can even get more details, especially if you have linked your maps and photos. If you took a photo of your receipt at REI, for example, you can search for the word “tent” and Google will even scan your photos for that word and display that transaction. You can also enable Pay to retrieve receipts from Gmail. Woodward explained in a panel discussion after the event that this helps reduce the need to tag every transaction so you can find it later.

Google will also send you reports on your activity. At the start of the week, for example, Pay will show things like “here’s what you spent this weekend,” Woodward said. It will also present pages of information that it deems useful, such as a list of services to which you have subscribed, for example.

With all of this sensitive data stored in one place, privacy and security are obviously important. Sengupta told a panel discussion after the event that the app featured a privacy-focused approach. Venkat Rapaka, head of Google Pay, said you should see this throughout your experience with the new app, from setup to months after. First, your money transactions and transfers are visible only to you (and the person you’re sending money to). The app will require authentication every time you open it and before transactions. Transaction data will not be shared with the rest of Google when it comes to targeting ads, Rapaka said.

Google also today announced Plex accounts in collaboration with financial institutions to provide more users with a mobile-friendly banking app experience. You can join a waitlist through the Pay app today, and the first of those accounts will be available next year.

[ad_2]

Source link