[ad_1]

Gran Tierra Energy (NYSEMKT: GTE) is an energy company founded in mid-2005. The company currently has a portfolio of assets spread across both Colombia and Ecuador. As we will see throughout this article, the company's unique asset portfolio, growing production and financial improvements are expected to generate significant potential returns for shareholders.

Gran Tierra Energy – Gran Tierra Energy

Gran Tierra Energy Asset Portfolio

Gran Tierra Energy has an impressive asset portfolio that supports the long-term growth and financial results of the company.

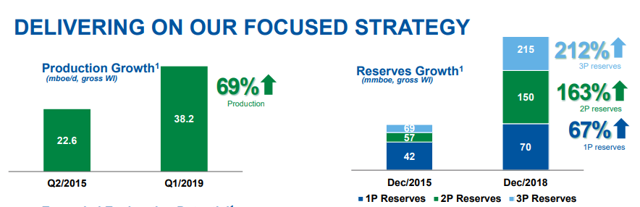

Gran Tierra Energy Strategy – Investor Presentation Gran Tierra Energy

Gran Tierra Energy strives to implement its impressive strategy. The new management took office in 2015 in the middle of one of the most difficult oil crises in recent history, and has since focused on improving its positions. From mid-2015 to early 2019, the company managed to improve its production by almost 70%, which was incredibly impressive.

The company has managed to increase production from 22,600 to 38,200 barrels per day. At the same time, while continuing to use production, the company has been able to significantly increase its reserves and net asset value per share. These improvements in the company's reserves are expected to support continued growth in production over the long term.

At the same time, the company's assets offer significant transportation opportunities. Transport accounts for a large share of oil production expenditure and, therefore, it is important to have sufficient spare capacity. One of the main problems of its assets with Africa Oil Corporations is the lack of delivery capacity of the company. Existing take-home sales capacity should help reduce costs.

In addition, Colombian production has recently declined. This should further reduce sales capacity, which should help reduce business expenses for the long term.

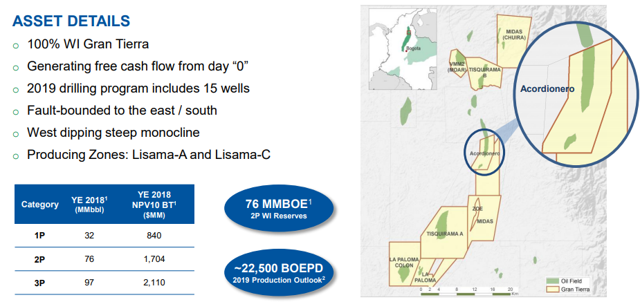

Gran Tierra Energy Acordionero Field – Presentation to Gran Tierra Energy Investors

To deepen the assets of the company, we start with its field Acordionero, its most important asset. The company has a 100% WI in this area and started generating free cash flow from day 0. This area accounts for almost half of the company's production, which shows how important it is for the financial and long-term revenue potential of the company.

The company's drilling program includes 15 wells, which should help to significantly increase its reserves while continuing to increase production. The company's production from the Acordionero field has grown by 400% in recent years and this growth is expected to continue to increase. This shows the potential behind this field.

An important catalyst for the company is its intention to start injecting water here in the field of Acordionero. These injections could help the company significantly increase production while converting reserves of 3P and 2P into 1P. This should help the company's cash flow to increase.

Gran Tierra Energy Ayombero Field – Investor Presentation Gran Tierra Energy

Another major aspect of the company's assets is its field of Ayombero. The deposit contains approximately $ 22 million of 1P reserves and plans to expand its drilling program in the future. The company's 2019 drilling program includes 2 to 6 wells and offers significant potential on many fronts. There is a complex reservoir here, so its total value is still unknown; However, it has significant upside potential.

The company continues to focus on the valuation of the estate. However, the company predicts that the oil potential in place will reach 321 million barrels, which would provide potential resources of 64 million barrels. The Company expects that if the valuation program continues, it could increase Gran Tierra Energy's 2P reserves by 43%, which would significantly increase its value.

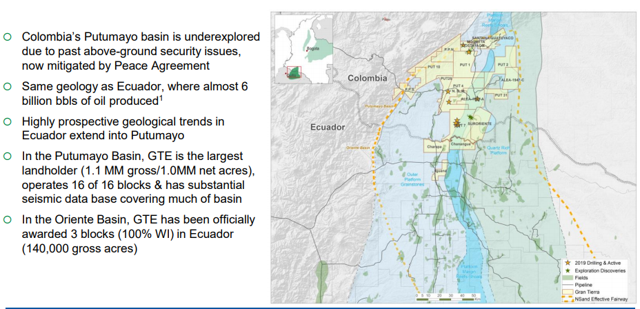

Gran Tierra Energy Field Putumayo – Investor Presentation Gran Tierra Energy

We now move on to the next major and incredibly important asset of the company. It is the basin of the company Putumayo, combined with the basin of the Oriente. It is this asset that is so valuable from a potential point of view that led Gran Tierra Energy to expand its portfolio in Ecuador to acquire additional land. This additional land should help develop the potential of this field.

The basin had not been explored before due to surface security problems by FARC rebels, and a recent peace agreement should facilitate exploration. However, this means that the basin and society are likely to end the peace agreement. This end of the peace agreement is expected to have a significant negative impact on the Gran Tierra Energy stock and also deserves attention.

The company is the largest landowner here with 1.1 million acres. Of this total, the company has about 140,000 acres in Ecuador, which we discussed recently. The deposit is huge, the average potential untapped resources represent 1.1 billion barrels, which represents 300 million barrels of risk. Even if the company collects risky resources likely to generate a profit twice its market capitalization.

What is even more impressive here is that the company got the land in Ecuador for free. The only commitment is that the company must drill 14 wells over the next 4 years. The company is currently experiencing a rapid expansion of its capital expenditure program, which should help it grow.

Gran Tierra Power Capital Program

Gran Tierra Energy has an incredibly strong asset portfolio and seeks to capitalize on it with its capital program.

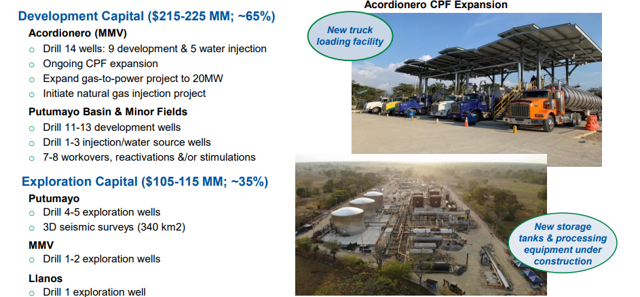

Gran Tierra Energy Capital Program – Investor Presentation Gran Tierra Energy

Gran Tierra Energy plans to spend $ 220 million in development capital, which represents 65% of its capital program. The company plans to use this program to significantly reduce costs by increasing capital expenditures. At the same time, the company expects a double-digit increase in the average of its production. This is a big improvement over the company's development program.

It is also important to note here that the entire investment budget of the company, including its exploration budget, must be covered by its free cash flow.

At the same time, the company plans to spend an additional $ 110 million in exploration capital, or 35% of its budget. This will include extensive 3D seismic surveys and drilling of about 7 wells. Especially in the Putumayo Basin, where many of these wills are going to be solicited, I recommend investors to pay close attention to news that appears. The Putumayo basin could be a major catalyst for society.

Gran Tierra Energy Financials

In addition to an impressive asset portfolio and an exciting capital development program, the company put all of this together in an impressive financial situation.

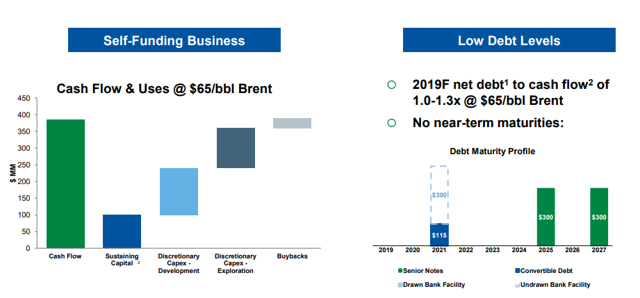

Use of Gran Tierra Energy Cash Flow – Presentation to Gran Tierra Energy Investors

The company has a self-financed business. The company buys approximately 167,500 shares daily, demonstrating its commitment to completing its buyback program. In speaking with representatives of the company, they told me that the company pledged to buy between $ 20 and $ 40 million of its shares on an annual basis (3 to 6% on an annual basis).

At the same time, the company has an incredibly strong cash flow profile. The company's cash flow at 65 Brent (about 3% above current prices despite an extremely difficult oil environment) is close to $ 400 million. At the same time, the company's sustaining capital is only $ 100 million and the company is investing an additional $ 250 billion in business development.

Despite all these investments, there is still money left for the company to buy back. I am divided on what I would like to see the company do. On the one hand, the company could suspend its unsustainable capital for a year and buy half of the company, doubling the price of its shares. At the same time, the management holds a significant stake in the company and buys shares with insider purchases. They may be waiting for the company to grow further and then buy back shares.

Another thing to consider is the company's net debt program, which subtracts cash, is still several hundred million dollars. In a low interest rate environment, the company's debt (6-7%) is quite respectable. Especially considering the potential value of the company through the growth of its business and share buybacks. The company must nevertheless take care not to borrow too much in case of a new crash.

In the future, the company expects cash flow of $ 2.1 billion over the next five years. It is a cash flow equivalent to almost three times the company's market capitalization. The Company will devote a significant portion of this amount to future development and redemptions. I hope this will generate significant rewards for shareholders.

Conclusion

Gran Tierra Energy has recently gone through a difficult period; Since the beginning of 2016, its share price has not seen its price soar. However, I think the potential of society is considerable. Its asset portfolio is incredibly exciting and spends hundreds of millions of dollars to continue to grow and explore. This ongoing investment should translate into growth in asset value.

In the future, Gran Tierra Energy continued to reward its shareholders and generate cash flow. The company plans to spend between $ 20 million and $ 40 million to buy back shares in 2019, which should help reduce the number of outstanding shares by about 5%. The lower the stock prices, the more rewarding this becomes. At the same time, the company will generate billions of dollars in cash flow over the next few years.

Invest Better – Free Trial!

Regardless of your overall investment objectives, the Energy Forum can help you generate and generate strong revenue from a portfolio of quality energy companies. Global demand for energy is growing rapidly and you can participate in this exciting trend.

The energy forum provides:

- In-depth research reports on quality investment opportunities.

- A portfolio of managed models generating a return greater than 10%.

- Macroeconomic views of the oil market as a whole.

- Technical buying and selling alerts to open positions at opportunistic prices.

If you want to know more, click here. If you have any questions, send me a PM.

Disclosure: I am / we are long GTE. I have written this article myself and it expresses my own opinions. I do not receive compensation for this (other than Seeking Alpha). I do not have any business relationship with a company whose shares are mentioned in this article.

[ad_2]

Source link