[ad_1]

27/11/18 • 22:35 | UPD 27/11/18 • 22:37

Press room eleftherostypos.gr

<! –

->

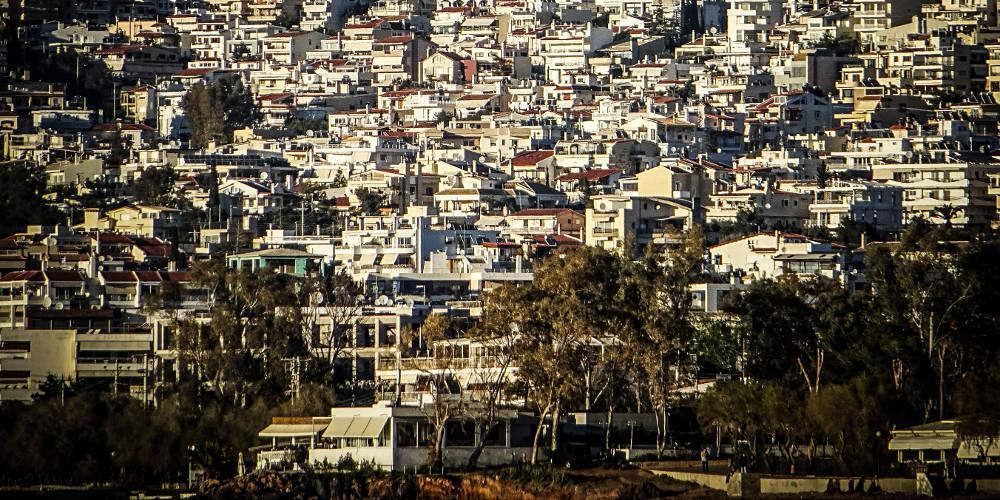

The ENFIA amendment provides that for 2019, the amount of the final tax payable by each owner who owns property with a maximum total objective value of EUR 60,000 is reduced by 30%.

In the afternoon of Tuesday, the provisions relating to the reduction of ENFIA and the corporate tax rate were tabled in the House.

The ENFIA amendment provides that for 2019, the amount of the final tax payable by each owner who owns property with a maximum total objective value of EUR 60,000 is reduced by 30%. The amount of the tax reduction is limited to EUR 0.7 per EUR 1,000 of capital gain.

The provisions of the same amendment exclude, for 2019, parcels of natural persons in the calculation of the additional tax. A provision in another amendment provides for a progressive reduction in the tax rate of profits from commercial activities acquired by corporations and corporations from 29% today to 25% for income in the taxation year 2022 and following.

In detail, for the corporate income tax:

29% of income for the 2019 taxation year,

28% for revenue in 2019

27% for Income 2020

26% for income in 2021

25% for year 2022 tax gains and subsequent years.

As pointed out in the GLA report, it should be noted that "the above financial result depends on the implementation of paragraph 1 of Article 58 of Law 4172/2013 in its current version. , subject to the non-derogation from the medium-term program 2018-2021 budgetary objectives ".

According to the amendment to ENFIA: "For the year 2019 (also applicable for the years 2016-17-18), the total value of the property rights for the calculation of the ENFIA supplement is not included in the value of the rights on land outside the town plan or settlement.In particular for the year 2019, when the total value of the real estate is less than 60 000 euros, the l 39; INPHIA resulting is reduced by 30 %.When the total value of the above mentioned real estate exceeds the amount of 60 000 EUR for the excess amount, the amount of the reduction of 30% is reduced by 0.7 EUR per 1000 EUR of real estate and can not exceed 100 EUR & # 39 ;.

The revenue loss resulting from the promoted ENFIA agreements is estimated at 260 million euros for 2019

See right here the amendment on the business tax

See right here the amendment on ENFIA

Source link