[ad_1]

The provision of 710 million euros for the social dividend includes the corresponding amendment tabled by the House of Representatives on Wednesday 28/11/2018. On Tuesday, December 4, 2018, the platform opens to allow beneficiaries to claim the dividend.

The 2018 social dividend will be awarded via electronic applications submitted to the special website www.koinonikomerisma.gr with taxisnet codes, which should be activated in the next period.

This was announced by Prime Minister Alexis Tsipras, following a decision of Parliament, on the occasion of the presentation of the corresponding amendment by the Ministry of Finance for the amount of the amount to pay to citizens.

From an badytical point of view, according to what we know today and the fact that the first two chimes will remain identical to those of last year, without excluding those who remain, they are not identical, and the 2018 dividend will be paid on December 14, as announced by the Prime Minister the step of the house.

Household Equivalence Scale:

the sum of the resulting weighting according to the composition of the beneficiary unit and the number of its members, weighing 1 unit in the first adult, 0.5 in each additional adult and 0.25 in the minor members. In the case of a beneficiary group consisting of at least one person with a disability rate of 67% or more (form codes E1: 001, 002, 005, 006 905, 906, 913 and 914), the equivalence of Benefit group is increased by 0.5 for each disabled participant. . The maximum of the equivalence scale can in no case exceed 3.

In the case of single-parent households benefiting from the single child support allowance or the special allowance for third countries / large families, the equivalence scale of a group of providers is increased by 0.25 for the first adult.

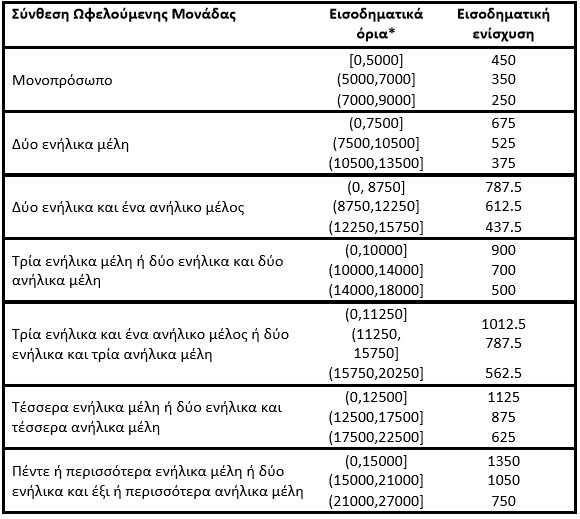

Thus, the support of low- and middle-income households should be:

Household of a person

Income 0 – 5.000 euros help 450 euros

Income 5,000 – 7,000 euros helps 350 euros

Revenue 7,000 – 9,000 euros helps 250 euros

Two adult members (for example a couple without children)

Income 0 – 7.500 euros help 675 euros

Income 7,500 – 10,500 euros help 525 euros

Income 10 500 – 13 500 euros help 375 euros

Two adults and one minor (eg Couple with child)

Income 0 – € 8 750 help € 787

Income 8 750 – 12 250 euros help 612 euros

Income 12 250 – 15 750 euros help 437 euros

Three adult members or two adults and two minor members (for example, a couple with two children)

Income 0 – 10.000 euros help 900 euros

Income 10,000 – 14,000 euros helps 700 euros

Income 14 000 – 18 000 euros support 500 euros

Three adults and one minor member or two adults and three minor members (for example, a couple with three children)

Income 0 – 11250 euros help 1012,5 euros

Income 11 250 – 15 750 EUR help 787 EUR

Income 15 750 – 20 250 euros help 562 euros

2) Property criteria. Real estate in Greece or abroad should have a total taxable value of up to € 120,000 for households consisting of only one member. The threshold of € 120,000 is increased by € 15,000 for each additional member up to € 180,000.

3) mobile property. The criterion is also the total amount of deposits of all household members in all credit institutions in the country or abroad, or the present value of shares, bonds, etc.

The exceptions. The one-time income support will exclude households whose members in the last tax returns were declared and offset:

– have pbadenger cars of more than 1 928 cubic centimeters up to 10 years, swimming pools or pleasure boats over 5 meters long

– cost of the pleasure boat crew

– Tuition fees paid to private schools

– staff remuneration costs

A prerequisite is that all adult household members have submitted income tax returns for the taxation year 2017 if they are subject to an obligation.

Examples

Family with two children and an income of 6000 euros per year will receive an aid of 900 euros. For 12 000 euros, 700 euros and for 18 000 revenues, 500 euros.

675 euros for a couple without children and income of 4,500 euros, 9,000 euros for an income of 525 euros and 13,500 euros for an aid of 375 euros.

For households of one person and incomes lower than 3,000 euros, the aid is 450 euros for an income of 6,000 350 euros and 9,000 euros for an aid of 250 euros.

Source link