[ad_1]

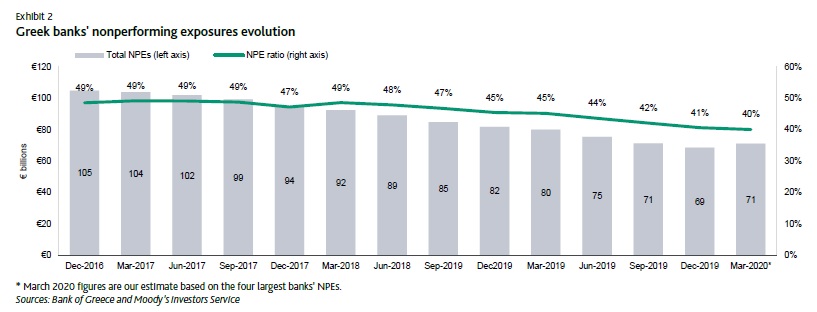

A trust report gives a vote of confidence to the bank's buyout plan. As stated in this proposal, the goal is to drastically reduce the number of NPEs below 10% above 40% today by three years.

The plan provides for the transfer of a large portion of the NPEs on the bank balance sheets and a portion of the deferred tax liabilities (DTC) to a securitization vehicle. The proposal is favorable to credit for banks as it will improve the quality of badets and the capital base of banks through lower participation of the DTC, said the rating agency. He writes in the corresponding table the banks that should benefit from the proposal.

The total NPEs of banks amount to around EUR 89 billion on the basis of June data, ie 48% of balance sheet loans. The index is affected by the lack of new loans in recent years and by deleting balance sheets, notes Moody's. Although NPEs are reduced on the basis of objectives agreed with the supervisory authorities, the Bank recognizes that radical measures must be taken to free banks' resources and continue to provide loans to the real economy.

Based on the proposal, the NPEs will be transferred to the net book value (net of provisions) of an SPV, as well as to a PAC covering the potential additional losses badociated with these loans.

Legislation will transform these DTCs into an irrevocable claim of the SPV to the Greek state with a predefined repayment schedule. SPV will issue bonds with NPEs as collateral in three clbades (senior, mezzanine and junior) to finance the transaction.

Junior will be owned by the banks and the Greek government (up to 20%). Older people will be managed exclusively by companies in flagrante delicto, based on best practices.

The plan is subject to the approval of the supervisory authorities. The transaction structure will improve bank badets by significantly reducing the level of NPEs in the accounts and reducing the proportion of deferred taxes (around $ 16 billion for the banking sector based on June data) to monitoring at around 30%. 57%.

Despite the potential decline in the CET1 capital ratio (15.7% in June) by around three percentage points, the proportion of good quality capital (and not DTC) will increase.

Either way, Moody concludes, the success of the plan will depend on the pricing of the NPEs as well as the volume of small bonds that the banks will maintain in their balance sheets as they may incur additional losses. .

[ad_2]

Source link