[ad_1]

This Bloomberg article from September 6, published at the closing bell, is a perfect example of biased information, which, unfortunately for short films, has been too widely passed on. That said, the title captures their essence well:

Fannie-Freddie Fall's Trump plan indicates an improbable fast windfall.

Trump Plan … bargain.

The first sentence:

… hedge funds plummeting the wealth of their investments in giants.

Hedge fund.

Finally:

It may be that President Donald Trump is not re-elected in 2020 and that there is no unexpected benefit.

The reelection of Trump.

In a nutshell: the president is in cahoots, this time with the evil speculative funds, to the detriment of We The People.

Of course, nothing of this kind emerges from the plan; on the contrary. It is simply a biased and unfounded opinion. Not really this unfounded; the authors cite their source: Jim Parrott, "a former housing official under the Obama administration". Unfortunately, the same Jim Parrott is quoted on page 41 of the 5th Circuit Court of Appeals opinion and plays an important role in the decision to overturn the district court and favor the shareholders – all the shareholders, not just hedge funds – and the general public – not just President Trump or his administration. You will find the synopsis below, but this one deserves to be quoted twice:

A federal official commented in private that the third amendment was designed to prevent Fannie and Freddie of the recapitalization. (Page 12).[…] Jim Parrott, Counselor, National Economic Council, who worked with the Treasury to develop the scan of the net worth, would have written: "[W]we closed [the] possibility that [Fannie and Freddie] already[] go (pretend) again private."Similarly, when Bloomberg published a comment that"[w]What the Treasury Department seems to do here, and I think it's a very good idea, is to deprive [Fannie and Freddie] of all their capital so that [they can not go private again], "Parrott sent an email to the source:" Good comment to BloombergYou are absolutely right about the substance and the intention. E-mails confirm that the third amendment "deprives[d]"The GSE of their capital, keeping them in a state of permanent suspension, which is not allowed by the legal powers of the conservative. The pleadings in Jacobs c. Federal Housing Finance Agency208 and Perry Capital LLC c. Mnuchin209 do not seem to contain the same allegations. This factual difference distinguishes them. " (page 41)

And to start:

Net wealth transferred a fortune from Fannie and Freddie to the Treasury. When this lawsuit was filed, the GSE paid $ 195 billion in dividends on the sale of the net worth. Under the agreements more generally, Treasury had disbursed 187 billion dollars and recovered 250 billion dollars, largely thanks to the swept net worth. "(Page 13).[…] "But allocating big profits to the treasury instead of restoring GSE's capital structure is actually harm." (page 44)

So, enough of Bloomberg and Parrott. Suffice it to say that anyone reaches a conclusion without reading the Treasury Housing Reform Plan and the 5th The opinion of the Circuit Court of Appeal does so at his own risk. The plan is only 45 pages long, it's easy to read and you can find it here. As for the opinion of the Court, it is much longer and dense, with 123 pages. I have outlined below what I think are the highlights.

The bottom line is as follows. On housing reform, Senate committee chair Michael Crapo was clear: FHFA should begin reforms to move Congress through a bipartisan agreement, with the key words being: Nudge, more leverage than before the crisis and even bigger to fail that & # 39; before. Marc Calabria simply added that it was keep it at night. Add the judgment of Friday and expect the recapitalization to begin.

If Congress decides to make the guarantee explicit, as in the case of Ginnie Mae, only the valuation matters: the higher the collateral, the lower the risk, the lower the return on earnings, the lower the dilution, the higher the valuation. But The FHFA calls the bluff – they will reform, guarantee or not.

However, the reform also seeks to reduce the ecological footprint of GSEs, thanks to more competition and less "implicit guarantee subsidy gap". How does this play in evaluation is an open question, left in my opinion to long-term thinkers. I encourage you to follow Glen Bradford, SA contributor, in this saga, he has long had an excellent perspective.

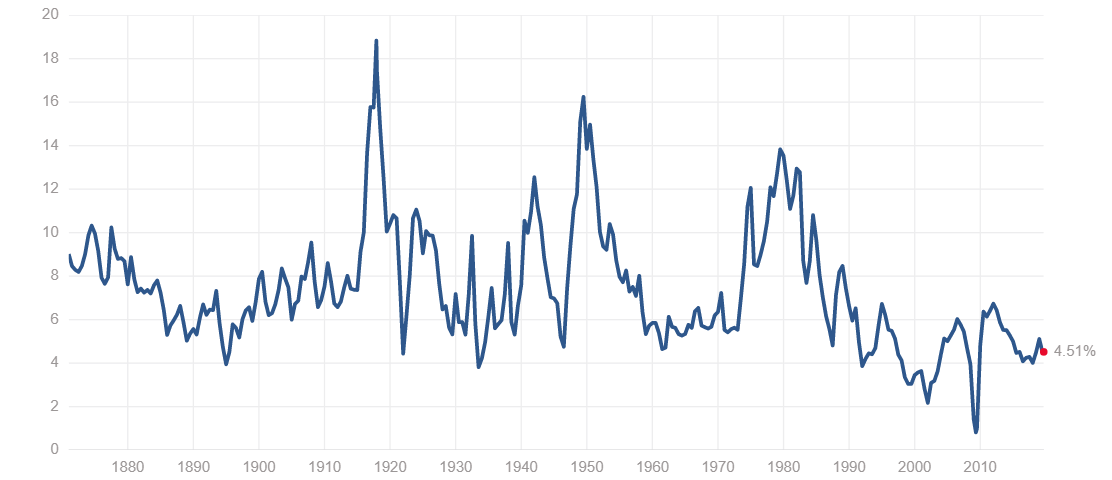

And since I will be referring to the return on income (EY), here is the S & P EY chart that you have to keep in mind:

Sources: Standard & Poor's; multpl.com.

Sources: Standard & Poor's; multpl.com.

Essentially, in the aftermath of 2008, GSE borrowed $ 185 billion from the Consolidated Revenue Fund. They paid it back, and then some. 250 billion dollars. That's what is known as net worth scanning – since 2012, every dollar that GSE earns goes to the Treasury.

What is the 5th Circuit Court is of the opinion that it is simple. You can not do this. This means that the Treasury will have to give back this surplus of money to the GSE, and thus to its shareholders – who will claim it with damages. In this analysis, I look only at Fannie Mae, whom I own.

My largest participation is the non-cumulative preference T, yield of 8.25% when issued at $ 25 in 2008 (OTCQB: FNMAT). Now sell for $ 13, for a return of 15.5%. In the end, either the choice will be called, or the yield will be reduced to …? In both cases, this one is an easy duplicate, in my opinion, which includes all the warnings you can think of …

For the FNMA common, using the latest envelope guidelines, 3% venture capital is $ 100 billion. Easy. Fannie earned $ 16 billion in 2018. Maybe we fell to $ 14 billion in 2019. That would still mean a 14% return on profits, about three times the current S & P 500 EY. Knowing that GSEs currently have an implicit guarantee from the government, and could result in an explicit guarantee, if Congress wishes, I could easily argue that a recapitalized Fannie could support a lower EY than the risk asset. global market. Add to that the Court's decision imposing on the Treasury the burden of paying the Preferred, as well as the $ 60 billion of cash accumulated in Fannie's accounts, and reducing the profitability resulting from the competition demanded by FHFA. This still leaves a lot of room for price appreciation. . My best guess at this point is a double order of magnitude. Push me, it's a triple, with 4% of EY.

To help you understand what's going on, here is the summary of the court's opinion – I have reorganized some pages so you will not need to move. Note that Mark Calabria, director of FHFA and defendant in the case, is himself cited by the Court in support of his decision:

Michael Krimminger & Marc [sic] A. Calabria, "The conservatories of Fannie Mae and Freddie Mac: the actions constitute a violation of HERA and the principles established in the matter of insolvency", Cato Institute, working paper n ° 26, 2015, quoted in the notes of bottom of page 16 and 36.

Judge Willett, who led the majority opinion, also cited it on the last page of the last sentence of the notice. "Venenum in cauda es," says Cicero, "the poison is in the [scorpio’s] tail ". In other words, the defendant FHFA pleads in favor of the plaintiff. Facilitates the application of opinion …

In case you missed it, it is important. At Tuesday's Senate hearing, one of President Crapo's opening questions focused on the need for Congress to act. In this video, Ben Carson responded at 2:29 pm that "everything we do will be considered biased, so, yes, working with Congress will be the best way to do it." The decision of the Court takes advantage of the equation and leaves the hands free to the Administration. That said, here is the "synopsis".

In 2008, the president signed HERA law to protect the national economy from further losses. HERA established FHFA as an "independent agency of the federal government" and ranked Fannie and Freddie as a "regulated right"[ies]" under FHFA. "(Page 6).

FHFA has the discretion to name itself conservative or receiver in some cases, receivership is mandatory in other critical insolvency situations. The preservation and the receivership are mutually exclusive […]"(Page 7). "In September 2008, The FHFA is named conservative for GSE. "(Page 11).

As a conservative, the agency may take the necessary "(I) measures to place the regulated entity in a market sound and solvent state; and (II) appropriate to carry on the business of the regulated entity and preserve and conserve property and property of the regulated entity. "(Page 3).

By August 2012, GSEs had raised about $ 187 billion […] But they lacked money to pay dividends of 10%. So […] The FHFA and the Treasury have adopted the Third amendment which […] replaced the quarterly dividend by 10% dividends equal to the total net value of GSE except a capital reserve. Shareholders call this arrangement the "net worth sweeping. The reserve capital reserve started at $ 3 billion. It has declined each year until reaching zero in 2018.[…] Treasury announced that the third amendment would ensure that the GSE "will be reduced and will not be allowed to hold profits, replenish capital and return to the market in their previous form. " A federal official commented in private that the third amendment was designed to prevent Fannie and Freddie of the recapitalization. (Page 12).[…] Jim Parrott, Counselor, National Economic Council, who worked with the Treasury to develop the scan of the net worth, would have written: "[W]we closed [the] possibility that [Fannie and Freddie] already[] go (pretend) again private. "Similarly, when Bloomberg published a comment that"[w]What the Treasury Department seems to do here, and I think it's a very good idea, is to deprive [Fannie and Freddie] of all their capital so that [they can not go private again], "Parrott sent an email to the source:" Good comment to BloombergYou are absolutely right about the substance and the intention. E-mails confirm that the third amendment "deprives[d]"The GSE of their capital, keeping them in a state of permanent suspension, which is not allowed by the legal powers of the conservative. The pleadings in Jacobs c. Federal Housing Finance Agency208 and Perry Capital LLC c. Mnuchin 209 do not seem to contain the same allegations. This factual difference distinguishes them. " (page 41)

The sweep of the net worth has transferred a fortune of Fannie and Freddie to the Treasury. When this lawsuit was filed, the GSE paid $ 195 billion in dividends on the sale of the net worth. Under the agreements more generally, The Treasury had disbursed $ 187 billion and recovered $ 250 billion, largely thanks to the sweeping of the net worth. "(Page 13).[…] "But Placing big profits in the treasury instead of restoring the capital structure of GSE is actually hurting."(Page 44).

Shareholders seek a statement that the net worth is scanning HERA and is arbitrary and capricious; a statement that The structure of the FHFA violates the separation of powers [Count IV]; an injunction against the Treasury to return massive dividends on net worth (or treat them as a refund of the liquidation preference); sweep of net worth; and an injunction against the further implementation of the net worth scan. " (page 14). […] "Shareholders seek, among other things, vacatur of net worth sweeping. This would repair their injury. Shareholders have standing."(Page 45).

HERA's anti-injunction restricts prosecution against the powers of the conservator or receiver of the FHFA. […] The anti-injunction provision diverts claims about how the curator used his powers, and not about the claims exceeding those granted. He distinguishes exercising unduly a power (not modifiable) to exercise a power that has never been authorized (modifiable). […] Congress borrowed much of HERA's text from the 1989 Act on Reform, Recovery and Enforcement of Financial Institutions (FIRREA).[…] If FIRREA is the parent company of HERA, FISA [1966] is a grandparent. "(Pages 16-17)[…] It follows that the anti-injunction provision prohibits the relief of counts I – III depends entirely on has the net money exceeded the legal conservation powers of the FHFA? "(Page 21). […] "By adopting the scan of net worth, the agencies have abandoned the rehabilitation in favor of the" gradual reduction "of the GSE.[…] On a textual level, the net worth of wealth has actively undermined the search for a "healthy and solvent condition" and has not "preserved and conserved" GSE assets "(page 38). […] "HERA […] did not allow a curator to "liquidate" the affairs of the room or to empty his income in perpetuity."(Page 40).

Shareholders likely claim that the third amendment exceeded the powers of the conservative FHFA by transferring the future value of Fannie and Freddie to a single shareholder, the Treasury. In Parts I – VI of this opinion, a majority of the courts on the bench believe that this demand survives the dismissal under the Federal Rule of Civil Procedure 12 (B) (6). "(Page 4).[…] Transfer almost all the capital to the Treasury, without limitation, exceeds the powers of the FHFA put the GSE in "healthy and solvent" conditions, "continue to[ir] business "and" preserve and preserve [their] assets and property. " We base this assertion on the interpretation of laws and not on commercial judgment."(Page 38).

In Parts VII to VIII of this opinion, a majority of the bench judges believe that the Protection of the director against expulsion [of the FHFA] is unconstitutionall. "(Page 4).

Count I, insofar as he has merit, is a direct claim. Shareholders have actually suffered harm: they have been excluded from GSE profits."(Page 24). […] "We are now considering the substantive allegation of Count I that the net worth would have exceeded the powers of the FHFA curator." (Page 27).

Chiefs II and III, however, are do not in the area of interest of the laws claimed. "(Page 26).

Shareholders are entitled to a judgment on Count IV."(Page 46).

We reverse the judgment dismissing Count 1 and leave this application pending. […]The court quashes the judgment on count IV and upholds the statement of the record that the limitation of deportation "for cause" in 12 USC Section 4512 (B) (2) is unconstitutional. " (page 4) (NOTE: Notwithstanding Haynes J.'s Notice 9 to 7, shareholders can only obtain a statement that the structure of FHFA is unconstitutional, which means that it damages the entire FHFA).

The majority opinion, presided over by Judge Willett, ends on page 53. The divergent opinions begin on page 54 and, while very interesting to read, I did not want a TMI. Pretty much as it is. Moreover, they are not relevant for the purposes of this article. For example, one view is that FHFA has always been under the control of the President and the Treasury, regardless of the "for good cause" withdrawal restriction. As such, the FHFA could not be declared unconstitutional and neither the sweep of the net worth nor all of the preferred share purchase contracts could be invalidated. Instead, the deletion restriction should simply be deleted as if it had never existed (page 60).

Another, by two of the judges who acceded to the majority decision in holding the FHFA unconstitutional, concludes that the remedy is not to cancel the sweeping of the net value, but also to remove the restriction of deletion (pages 61 to 63). ).

Two other judges having adhered to the majority decision develop the unconstitutionality of the FHFA (pages 64 to 91).

And a minority opinion of six judges concluded that the FHFA had not abused its legal powers by adopting the Net Worth Sweep (pages 92 to 96).

Finally, four judges consider that the FHFA is constitutionally well structured … (pages 97 to 117).

In conclusion, the same judge by majority, Willett, with six other judges, concludes that the appropriate recourse against the unconstitutionality of the FHFA is not a possible recourse, but the simple holiday period, that is to say say canceling the scan of the net value (pages 118 to 123). This is particularly important, as Willett J. refers the District Court:

The third amendment is the smallest independent agreement that caused the shareholders harm, so that is it necessary to cancel. When a contract is terminated, the refund is generally receivable and the applicant may also need to return the benefits that he has received. I recognize that the district court has the power, in remand, to decide on the rights and duties of the parties to restore their legitimate position. […] In light of recent developments, I would refer Chief IV to the District Court for record of a judgment in accordance with that notice."(Page 123).

Recent developments to which the judge refers are noted in no. 32:

The new director of the FHFA has publicly announced that he plans to renegotiate the agreements of the FHFA with the Treasury. Andrew Ackerman and Ben Eisen, Continuing the Fannie review, Freddie pushes mortgage costs, WALL STREET J. (June 25, 2019).

With that, I leave you with a thought. The pendulum swings. Taxpayers and investors lent money to GSEs when they needed them. It is time for the GSEs to repay them. With interest. This concerns the decision of the court of appeal.

As for the plan, it's good for just about everyone – shareholders, the general public and the financial community in general. Increased competition, risk of too big to fail, mortgage rates lower. It will be hard to be partisan on this one. Unless you are "a former housing official under the Obama administration …" BTW, footnote: While Senator Chris Dodd was the main recipient of Fannie Mae's donations to the 2008 cycle, Senator Obama was close second … And if you still think it has nothing to do with politics, that was the situation in 2018.

Disclosure: I am / we have been for a long time FNMA, FNMAT. I have written this article myself and it expresses my own opinions. I do not receive compensation for this (other than Seeking Alpha). I do not have any business relationship with a company whose shares are mentioned in this article.

Editor's Note: This article describes one or more securities that are not traded in a major US market. Please be aware of the risks associated with these stocks.

[ad_2]

Source link