[ad_1]

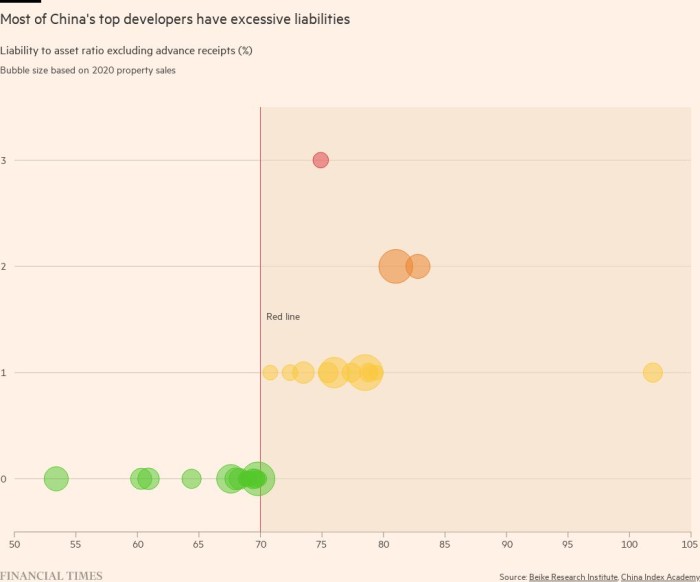

According to a Financial Times analysis of the latest data available, nearly half of China’s top 30 developers have broken at least one of Beijing’s recently introduced rules on real estate leverage.

In August of last year, the Chinese government unveiled the “three red lines”, which aim to constrain the debt of real estate developers according to three balance sheet indicators: the liability / asset ratio; net debt to equity; and from cash to short-term borrowings.

FT’s analysis, based on data from Beike Research, part of Chinese real estate group KE Holdings, showed that of the 30 developers, 14 had crossed at least one red line as of June 14. These companies represented the majority of the 30 developers. sales last year.

The results come as Chinese group Evergrande, the world’s most indebted developer, is on the verge of default after missing an interest payment last month.

Evergrande’s problems have put China’s debt policy in the spotlight and disrupted global markets. The company is the most extreme example of the high leverage that has funded Chinese real estate development for years – and supported the country’s rapid growth – and which the government is now seeking to curb.

Only a few of the 30 developers in the FT’s analysis had breached at least two red lines, but liquidity crises at these companies, including Evergrande and Guangzhou R&F, raised fears of contagion to the wider Chinese economy.

If developers break the rules, they face caps on their ability to take on new debt.

S&P Global Ratings noted that although the Chinese government has not released an official statement regarding the rules, they have been widely reported in national media since last summer.

Liability / asset ratio (excluding anticipated receipts)

The liability-to-asset ratio is the measure of leverage that surprises by far the biggest Chinese real estate developers, reflecting not only the extent of their debt but also the obligations to the companies they work with.

Country Garden Holdings, China’s largest developer by sales last year, had a liability-to-asset ratio of 78.5% in June, breaking the red line limit of 70%. The group’s shares have fallen 26% this year, but its bonds due 2024 are trading above face value, in stark contrast to many of its peers.

Of the almost Rmb2tn of Evergrande’s total liabilities, almost half are made up of trade and other debts.

Many developers also have off-balance sheet bonds which should increase their leverage if included in the metrics.

Across the industry, businesses often sell properties to homebuyers prior to completion and receive payment up front, known as advance receipts. Developers add “contractual liabilities” to their balance sheets to offset cash inflows, before finally making a profit after projects are completed.

Net gear

Guangzhou R&F, the only Chinese developer to cross the three red lines, is doing the worst in terms of net debt.

The measure subtracts a company’s cash from its debt and then measures the difference to equity. It’s a way of comparing debt with the value of a business.

Besides Evergrande, Guangzhou R&F has been one of the most watched developers. This year, it finalized the sale of a major logistics development in southern China to Blackstone, the US private equity firm. She also sold assets to Country Garden.

Its bonds have sold sharply in recent weeks, but have rebounded after shareholders injected funds, which Fitch says will be used to repay future bonds.

Short-term cash-to-debt ratio

Perhaps the simplest measure of developer vulnerability is how much money the company has to pay off debts about to fall due – and many are close to the line, putting the pressure on. on their ability to make repayments.

Evergrande, the second to violate the measure at the end of June, attempted to raise funds by getting rid of the assets, some of which were listed in an interim report in August that also warned of the risk of default.

But his liabilities eclipse the assets he has managed to sell. Evergrande’s shares are suspended along with those of its property management subsidiary, which it listed in Hong Kong late last year. On Monday, the developer said it anticipated a potential takeover offer for the unit.

Another recent sale, of part of a stake in Shengjing Bank, highlighted the creditors’ rush to recoup the faltering developer’s losses: the bank demanded that the proceeds from the sale be used to pay off debts. which are owed to him by Evergrande.

[ad_2]

Source link