[ad_1]

After the July 4 holiday, stocks are expected to pause after a record run. The world’s largest oil cartel could have something to do with it, after it called off negotiations on an increase in supply.

One line of thinking is that if the situation does not resolve itself and oil prices continue to rise, it will increase the pressure on inflation and then on the Federal Reserve to tighten its policy.

As for stocks, our call of the day points out that they seem expensive and yes, a correction might be coming.

Led by a 15.8% gain for the S&P 500 SPX,

the first half was excellent for the markets, said Matt Maley, chief market strategist at Miller Tabak Co. But given that the S&P 500 only gained 4% from the end of April, 75% of that rally took place in the first four months of the year, he told customers in a note Monday.

Maley expects the stock market to take a very short-term ‘breath’ to digest these first-half gains, and given that stocks look overbought and a bit expensive, he said the question to ask was to know what would transform a full-fledged correction?

Look at chip stocks – an industry that has seen huge demand for reopening of trade – for answers, he suggested.

He highlighted VanEck Vectors Semiconductor’s exchange-traded fund SMH,

which hit its February and April highs in recent weeks, but not much after that. “Therefore, we will need to see more tracking on the upside to confirm that chip stocks are going to lead the stock market up,” he said.

Miller Plate + Co./Bloomberg

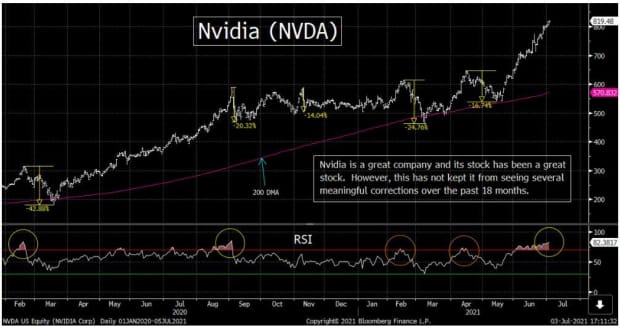

Maley also looked at the specific activity of a handful of chip stocks, such as Nvidia NVDA,

which has grown by 50% in the past seven weeks, but seems a bit too popular, he said. Its Relative Strength Index chart – a technical indicator used to determine whether a stock is overbought or oversold – rose above 82, which is close to the overbought conditions seen in late August and February 2020. The stock fell by 42 % and 20% respectively shortly thereafter, he says. In addition, another key stock, Micron Technology MU,

was hit by a “sell the news” backlash in early July.

While Nvidia is a great title, it has also undergone four major fixes in the past 18 months, he said.

Miller Plate + Co./Bloomberg

“When you combine the fact that NVDA has become somewhat vulnerable after its big run over the past seven weeks… with MU’s poor performance last week… there is reason to think the chip group might not overtake. his record. highs significantly (much like it didn’t in April). If (repeat, SI) the SMH reverses significantly in the short term, it will be difficult for the broader market to rally much more, ”Maley said.

Lily: Is the market price “maximum growth”? These charts suggest it, according to a leading strategist.

Chinese applications in difficulty and deadlock for OPEC +

ES00 futures contracts,

YM00,

NQ00,

are flat, with European stocks SXXP,

are also struggling, although airline stocks rose after Germany opened up travel to fully vaccinated British and Portuguese visitors. Larger declines were observed in Asia, where the Chinese CSI 300,000,300,

fell 1% as tech names were hit by a new regulatory review for the industry.

More info on this, as U.S. shares of Chinese app makers tumble in pre-market trading after investigations by China’s cybersecurity regulator. Actions of the carpooling group Didi Global DIDI,

are down more than 20%, with owner of truck calling apps, Full Truck Alliance, YMM,

and Kanzhun BZ,

which has an online recruiting app, also down double digits.

CL.1 crude price,

topped $ 76 a barrel, after the Organization of the Petroleum Exporting Countries and its allies failed in their third attempt to resolve a deadlock over increasing production levels. Edward Morse and a team from Citigroup said the spat could lead to Brent BRN00 crude,

(hovering at $ 77 a barrel) at $ 80 and keep it there for a while.

Data-wise, the Institute for Supply Management’s service index for June comes after the market opens.

There has been yet another Chinese crackdown on bitcoin, it seems. The BTCUSD cryptocurrency,

eased, after a report that China’s central bank has shut down a company in Beijing that provides software services for digital currency transactions.

Data from Israel’s health ministry reportedly showed vaccine efficacy against the highly contagious delta coronavirus strain fell from 94% to 64%, with 55% of new infections found among fully vaccinated people, although vaccines prevent always serious illnesses. The country uses Pfizer PFE,

0Q1N,

–BioNTech BNTX,

COVID-19 shots.

Travel to Canada for Americans could now reopen, while an increase in COVID-19 cases in Springfield, Missouri has resulted in a shortage of ventilators.

Random readings

The travel industry can be crowded, says the British man who was told it would cost his family £ 71,000 (just over $ 98,000) to stay a week in Cornwall.

The four-day working week trial in Iceland has apparently been a huge success.

Need to Know starts early and is updated until the opening bell, but sign up here to receive it once in your inbox. The emailed version will be sent at approximately 7:30 a.m. Eastern Time.

Want more for the day ahead? Sign up for Barron’s Daily, a morning investor briefing, featuring exclusive commentary from the editors at Barron’s and MarketWatch.

[ad_2]

Source link