[ad_1]

Several market movements took place between the closing of US stock markets on Wednesday and the opening on Thursday. As a result, the Dow Jones Industrial Average and the S & P 500 both hit record highs on Thursday.

Here's what investors need to know.

Delayed rates

The stock futures rose on Wednesday night after President Donald Trump announced that he would delay by 15 days the expected increase in tariffs on Chinese products, as a "gesture of goodwill. ". Tariffs are expected to increase from 25% to 30% on Chinese goods valued at approximately $ 250 billion. Treasury Secretary Steven Mnuchin told CNBC Thursday morning that the president "could reach an agreement at any time" with China, but not until "it's a good deal."

"The President has delayed it as a result of a request from the Deputy Prime Minister," added Mnuchin. He said Chinese Vice Premier Liu He had made the request because October 1 marked the 70th anniversary of the establishment of the People's Republic of China.

ECB lowers rates

On Thursday morning, the European Central Bank (ECB) announced a reduction of its deposit rates by 10 basis points to 0.5%. The ECB has also announced a major bond buying program of 20 billion euros per month as part of its quantitative easing (QE) initiative. The euro initially fell to its lowest level against the dollar in nearly two weeks, then rebounded around $ 1.104, while foreign currency investors still do not know if the ECB's policy will increase the dollar. 39, inflation successfully. In addition, bond yields in the euro area fell, as yields on 10-year German benchmark bonds fell to -0.64%.

Investors were delighted that the ECB is again attempting quantitative easing in the hope that the new program will boost the global economy.

Tamed Inflation

About an hour before the opening of US stock markets on Thursday, the Labor Department announced that consumer prices had slowed last month. The consumer price index, which is used to measure inflation, rose only slightly in August. However, the basic measure of the CPI has reached 2.4% from one year on the other – the highest level since 2008.

Controlled inflation should allow the Federal Reserve to cut interest rates next week.

Stock indexes close to all-time highs

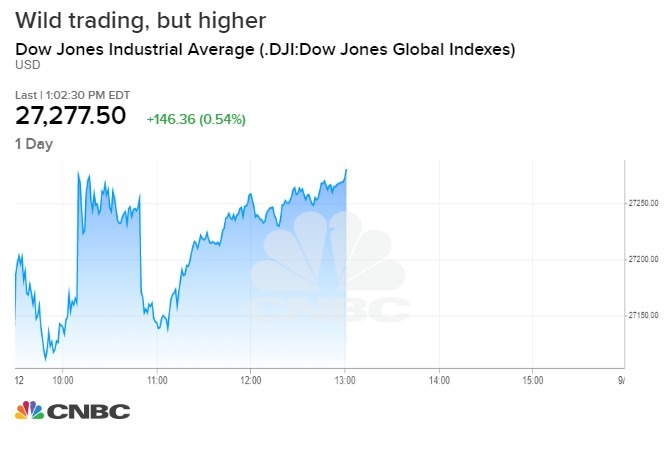

The Dow Jones and the S & P 500 both entered into trading on Thursday, less than 1% under all-time highs set in July. After Thursday's gains, the Dow and S & P 500 were at about 0.5% new records. The Dow seeks to surpass the record of 27,398.68 intra-day, while the S & P 500 is close to its previous record of 3,027.98 points.

The shares initially began trading on Thursday, with gains supported by a report that the Trump government was considering an interim trade deal with China. But the shares quickly reduced their gains after a senior White House official denied the report. The official told CNBC that the Trump administration was "absolutely not" considering a limited trade deal to delay or remove tariffs on China.

However, equities rallied again, led by Apple and Amazon.

[ad_2]

Source link