[ad_1]

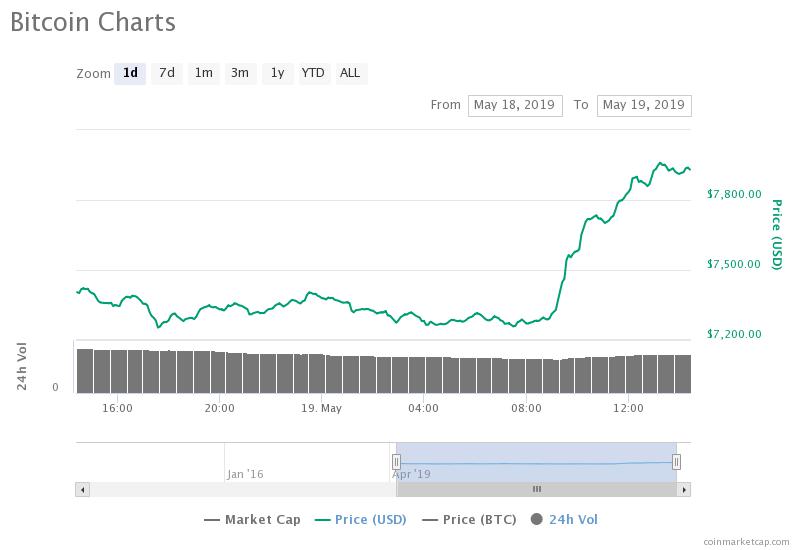

The price of bitcoin climbs 7% in less than four hours (source: coinmarketcap.com)

On May 17, as CCN reported, the price of bitcoin briefly plummeted to $ 6,400, a decline of more than 18% against the US dollar.

The market is fast eating an 18% drop in Bitcoin, a sign of a positive feeling

Analysts, including Dovey Wan, a founding partner of Primitive, said the sharp drop in Friday's bitcoin prices was likely due to manipulation by a single investor.

When the investor sold 5,000 BTC on Bitstamp, he triggered contracts on BitMEX, which relies heavily on Bitstamp, to be liquidated.

That's what happened

1. A fool makes a total sale of 5000 $ BTC on stamp

2. Shallow depth buffer + algo glitch?

3. The Bmx index is 50% on the stamp

4. Massive Bmx liq tanked the mkt

5. Still, BTC quickly rebounded to $ 7,000

This could be the best chance of BTFMD

– Dovey Wan ? ? (@DoveyWan) May 17, 2019

Since it has fallen to $ 6,400 in less than two days, the price of bitcoin has risen to $ 8,000, or more than 25% in less than 48 hours.

The immediate absorption of the $ 13 billion decline in Bitcoin's market capitalization reflects the significant improvement in sentiment in the cryptocurrency market.

Speaking to CCN on May 13, a cryptocurrency operator with an online pseudonym "Satoshi Flipper" said that bitcoin could be subject to a healthy short-term retracement from a rise of 5,000 $ to $ 8,000.

However, the trader pointed out that once the retracement was completed, the dominant cryptocurrency was on track to maintain its momentum in the medium and long term given the market momentum of recent weeks.

The merchant stated:

I have clearly spoken of a healthy return to the BTC, but I do not think it will be a radical return of 30% in the $ 4,000. Once we have a local summit, I think we will have 10% maximum, and then we will sit on the side.

It is then that we will have a real season altcoin that everyone expects. On the immediate return, the altcoins will be a little successful, but when BTC settles on the side, the altcoins will bounce a lot.

Similarly, in an exclusive interview with CCN, Su Zhu, CEO of Three Arrows Capital, said the brief fall of bitcoin to $ 6,400, which has investors wary of the short-term trend of the company. active, should not lead to a real retracement.

"It's a movement purely related to the market structure, I think the buyout will be extremely fast," Zhu said.

As suggested by some investors, the market quickly absorbed the steep drop in bitcoin prices on May 17 and, with a general increase in volumes, the asset dynamics should be maintained.

$ BTC Weekly update:

Resistance rejects, supports media.

And people say that AT does not work.

As long as 6400 will maintain, I will be a better permanent bull than Parabolic Trav.It always seems beautiful and I will not touch the red button for a long time. pic.twitter.com/hVRmD40vjJ

– DonAlt (@CryptoDonAlt) May 18, 2019

The actual volume of 10 Bitcoin, which estimates the legitimate volume of assets using the methodology created by Bitwise Asset Management, hovers around $ 1 billion. In March, the actual volume of bitcoins was $ 270 million.

What catalysts are on the horizon?

Josh Rager, Cryptocurrency Analyst, said if Bitcoin regained stability above the $ 8,200 level, the $ 9,000 region could be considered a reasonable target in the near term.

"Bitcoin certainly seems to be pumping, now above the previous resistance. The price is close to $ 8,000 and is geared towards resistance of $ 1,200 (could be consolidated before). " m said Rager.

With a halving of the expected gains in May 2020, which has always been a fundamental catalyst for bitcoin, and a depository infrastructure supporting the asset class significantly improving, the sentiment in relation to market could continue to grow in the coming weeks.

Click here for a real-time bitcoin price chart.

[ad_2]

Source link