[ad_1]

Not all inflation hedges are created the same.

Investors have certainly flocked to Inflation-Protected Treasury Securities, or TIPS, with a yield on 10-year TIPS near a record low, at -1.08% on Monday. But according to research by index fund giant Vanguard, the unexpected inflation beta is around 1. That is, a 1% rise in unexpected inflation would produce a 1% rise in the value of TIPS.

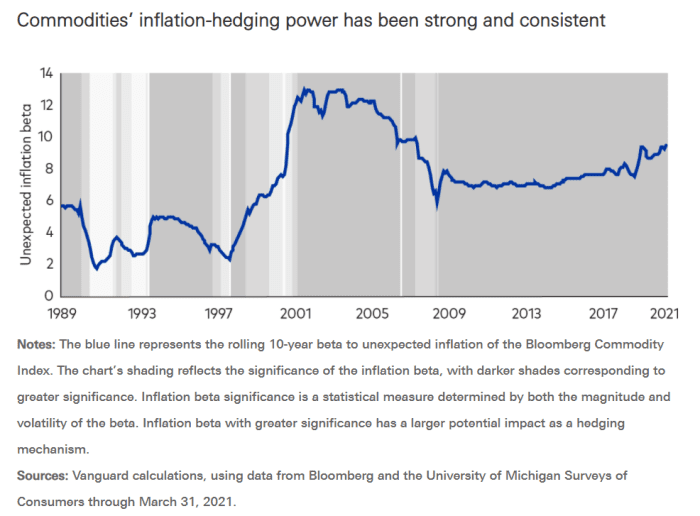

The hedging power against commodity inflation, on the other hand, is much stronger, and has been for some time. Over the past decade, the beta of commodity inflation has fluctuated between 7 and 9, which means that an unexpected 1% rise in inflation would lead to a 7-9% rise in commodities.

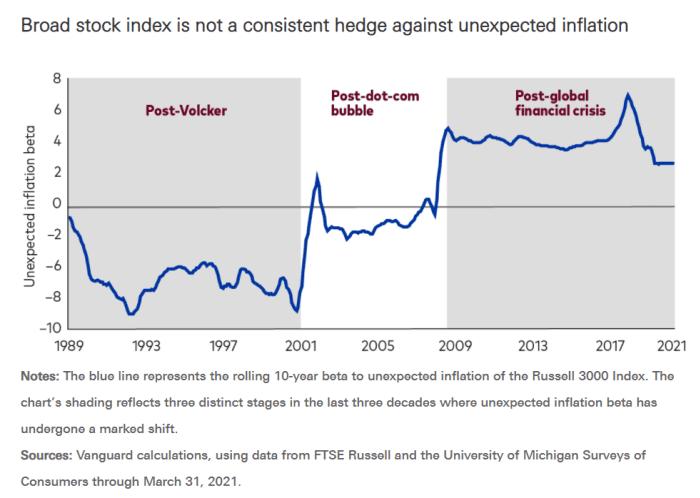

In recent times, stocks have been a better hedge against inflation, although they are still not as good as commodities. The Russell 3000’s inflation beta is now positive – unlike in the 90s – although it has declined in recent years. Vanguard research notes that commodity-related sectors such as energy and materials now account for a smaller share of the equity market than before, while tech and consumer discretionary sectors ineffective against the market. inflation are more important.

And the worst inflation hedge is bonds, as rising interest rates erode their value.

The buzzing

Retail sales data highlights a loaded list of publications and is expected to show a monthly decline for July.

Home Depot HD DIY Retailer,

reported slower-than-expected comparable store sales growth even though profits exceeded estimates, such as Walmart WMT,

both exceeded profit and sales forecasts and raised its sales forecast for the year. Walmart shares fell 1% and Home Depot fell 3% at the start of the pre-market action.

The United States should recommend booster shots of COVID-19 eight months after vaccination, according to the New York Times. New Zealand has entered a three-day national lockdown for a single case of COVID.

Quarterly deposits made by fund managers showed Berkshire Hathaway increased their bet on the Kroger KR grocery chain,

while reducing several of its investments in health, and that Scion Asset Management of Michael Burry bet against the innovation fund ARK ARKK,

directed by Cathie Wood.

Chinese internet stocks struggled, with Tencent 700,

and Alibaba 9988,

each shrinking by 4%, as China drew up rules on competition and data security.

Roblox RBLX Video Game Manufacturer,

fell 7% in after-hours trading, after sales fell behind estimates.

The market

US ES00 equity futures contracts,

NQ00,

fell, following a session in which the S&P 500 SPX,

and Dow Jones Industrial Average DJIA,

each clinched their fifth consecutive record.

The New Zealand dollar NZDUSD,

fell, as the lockdown dampened tightening expectations from the country’s central bank.

Table

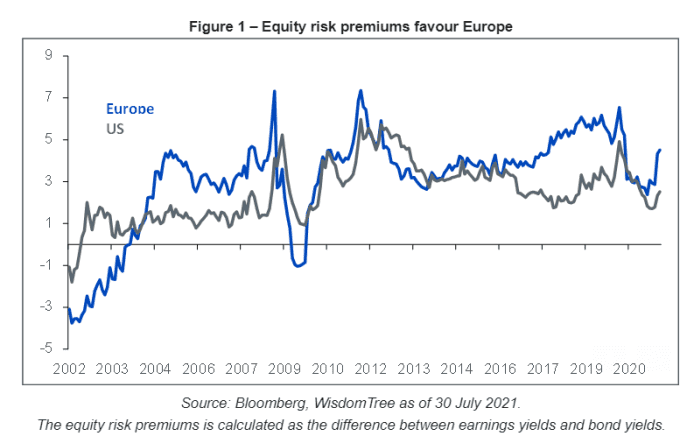

The risk premium of equities – the difference between earnings and bond yields – hit a 15-month high in Europe, thanks to strong earnings that sent analysts’ net revision ratio to the highest level since 2017, according to data compiled by the fund manager. Tree of wisdom. The Stoxx Europe 600 SXXP,

Monday ended a 10-game winning streak, its longest in 14 years, as the index climbed 18% this year.

Random readings

Magnetic strips will be phased out of Mastercard credit cards.

Pi has now been calculated to be 62.8 trillion digits.

Need to Know starts early and is updated until the opening bell, but sign up here to receive it once in your inbox. The emailed version will be sent at approximately 7:30 a.m. Eastern Time.

Want more for the day ahead? Sign up for Barron’s Daily, a morning investor briefing, featuring exclusive commentary from the editors at Barron’s and MarketWatch.

[ad_2]

Source link