[ad_1]

Bitcoin prices continued to rise on Friday, as traders maintained their target price increases of $ 6,400, the most traded price in 2018.

The BTC / USD pair reached $ 6,337 on Coinbase, the US-based cryptocurrency exchange, to bring its net rebound up by 102%. According to market analyst Josh Rager, parity was now testing $ 6,427 as short-term resistance, while $ 6,345 was crucial support for the next potential bitcoin action.

Rager also pointed out that Bitcoin's weekly RSI newspaper had crossed the 70 mark – an overbought territory – for the first time since January 1, 2018. The analyst said that cryptocurrency requires a withdrawal, which would neutralize the feeling of the market.

$ BTC – more than $ 6,300

Daily resistance has rocked to support for the moment at $ 6153 (red arrow)

The next resistance to look for is $ 6345 and close to $ 6427 is bullish

The weekly RSI has not exceeded 70% since January 1, 2018 and is fast approaching

Withdrawal needs

But BTC has been on pic.twitter.com/Sk0nVXogT1

– Josh Rager ? (@Josh_Rager) May 10, 2019

The history of RSI withdrawals

While the price of bitcoin is close to reaching the target of $ 6,400, its potential to extend the upward momentum seems weak, at least in the medium term.

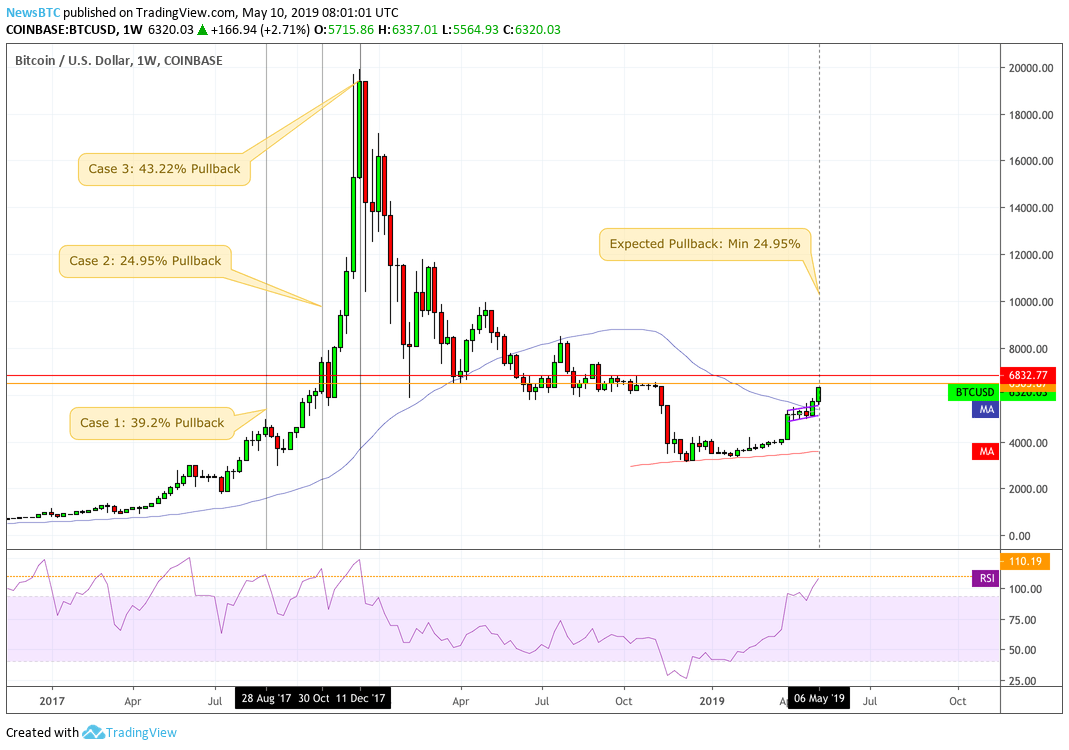

Bitcoin price dropped dramatically to neutralize its weekly overbought conditions | Image Credits: TradingView.com

The history of cryptocurrency shows extreme declines each time its momentum indicator, the RSI, is mapped in overbought territories (greater than 70) in a weekly chart. In case 1, the price of bitcoin can be corrected down to 39.2% two weeks after its RSI has risen above 70%. towards 115.

Case 3 tells the same story: the price of bitcoin sets its historical high at around $ 20,000, as the RSI ventures deep into its overbought territory. A week later, the price dropped 43.22%, reducing the RSI.

These cases provide ample evidence of traders' behavior when the weekly RSI exceeds 70. They can be applied to the current scenario, knowing that a decline above USD 6,400 is also high. Both technical factors could cause Bitcoin to begin at least a downward correction of 24.95%, which will bring the price down to USD 4,804 – plus or minus.

Bitcoin not bearish

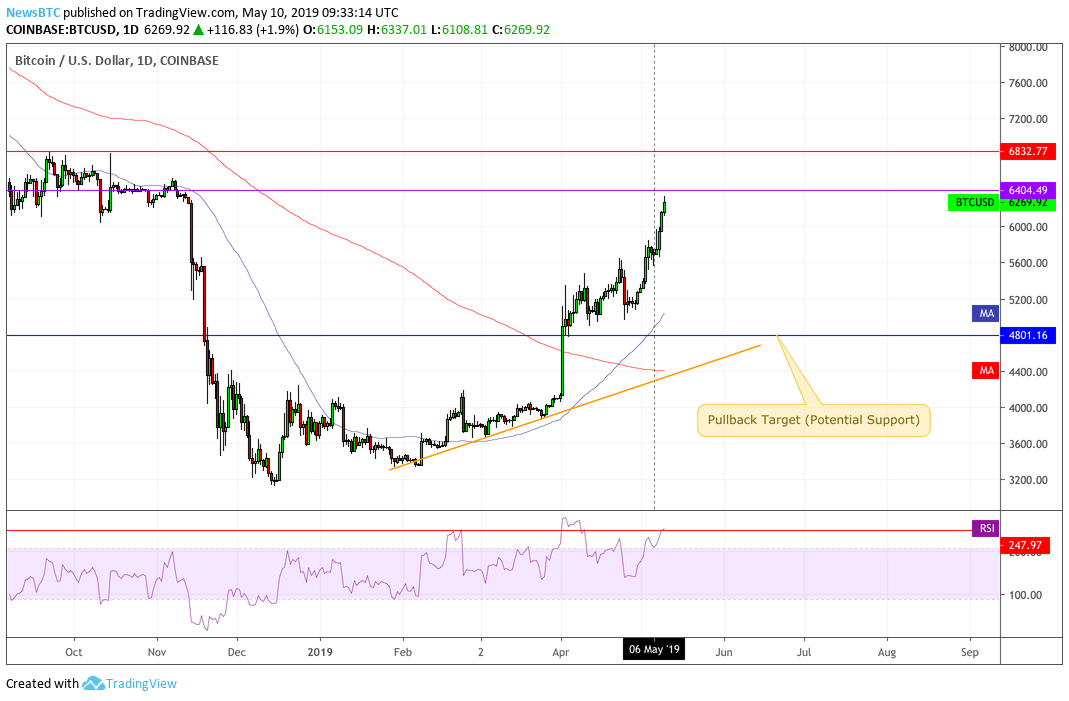

A decline, it's good for the Bitcoin market | Image Credits: TradingView.com

A brutal withdrawal will not bring bitcoin out of its strong bullish bias, mainly because of the strong fundamentals that appear on the market. Fidelity Investments, a Wall Street-friendly asset management company, has announced that it will start buying and selling bitcoins on behalf of its institutional clients. Billionaire President and CEO Abigail Johnson will also speak at the upcoming Blockchain Week NYC. Any news from Fidelity's bitcoin trading plan will play a key role in strengthening the cryptocurrency spot market sentiment.

Coupled with technical factors, such as the new Golden Cross training, the bitcoin market looks exceptionally optimistic.

Warning: The views and opinions expressed are those of the author and do not constitute investment advice. Transactions in all their forms carry risks as well as your due diligence before making a trading decision.

[ad_2]

Source link