[ad_1]

Demand concerns are putting pressure on the chip industry.

In the last three months, the SMH ETF on semiconductors has fallen by more than 1%, thereby missing out on the 3% rise in the S & P 500.

The group added to losses Friday after Samsung warned that weak demand for memory chips may have reduced second-quarter profits by nearly 56 percent.

"The news from Samsung should surprise no one, smartphone sales are down, memory chips are low for a while, so you have supply and demand issues," said Mark Tepper, president of Strategic Wealth Partners, on CNBC's Trading Nation Friday.

The indiscriminate selling in the group could offer opportunities to the stock pickers, he added.

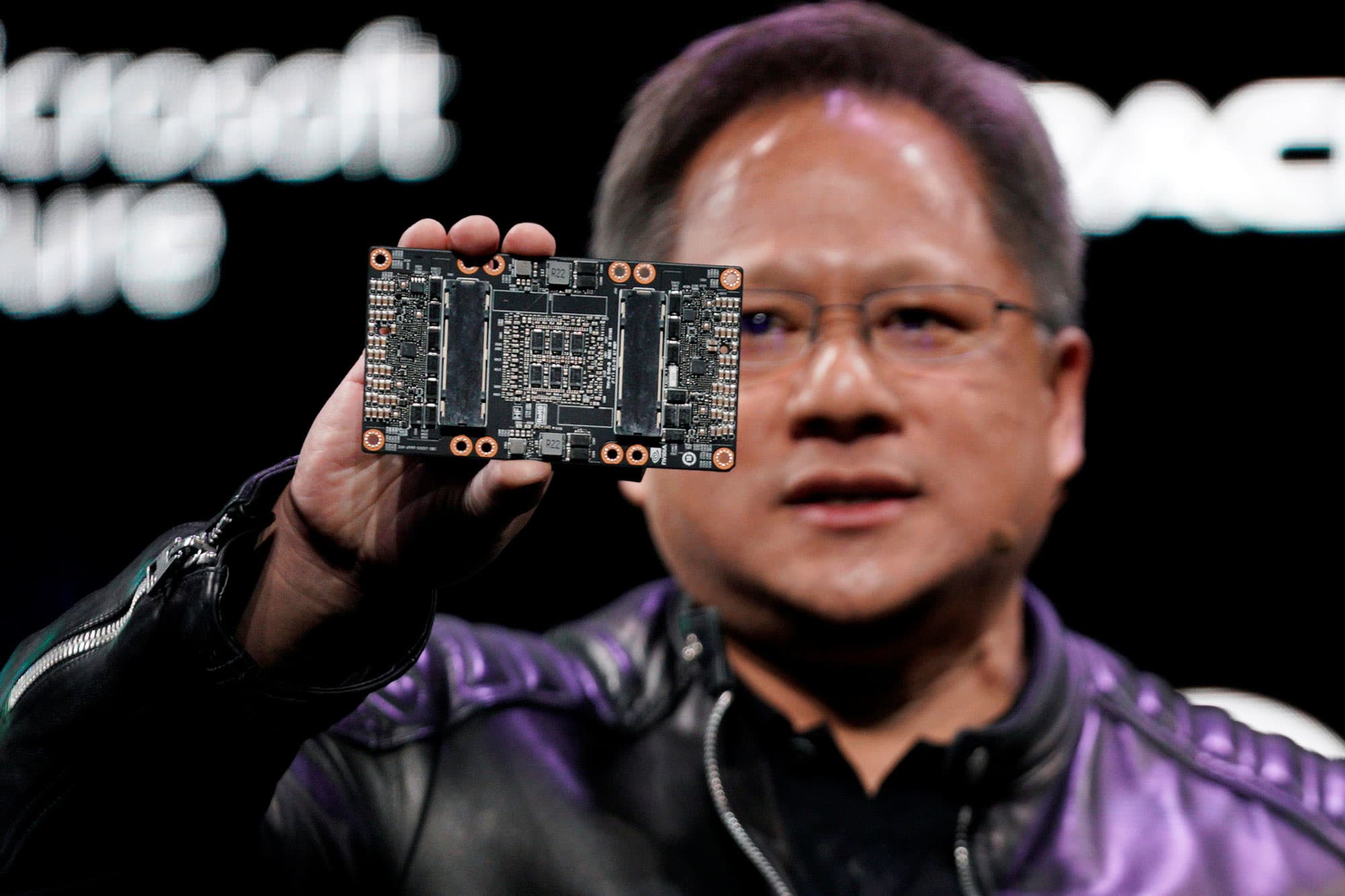

"The best way to really play this right now is to be selective," said Tepper. "Invest in companies that allow you to participate in the fastest growing end markets … like AI, autonomous vehicles, data centers and gaming." Our favorite company is Nvidia, we love Nvidia because it allows us to be exposed to all these areas. "

Nvidia is the worst performance of the SMH ETF in the last three months, down 16% since early April. He also cut his all-time record set last October by 45%.

"They had some problems last year with their crypto-exposure, but these issues are behind them, so that sounds like a good buy at this level," said Tepper.

Mark Newton, a technical analyst at Newton Advisors, said any weakness should be bought before what could be a strong short-term recovery.

"It's still just to be optimistic about semiconductors," said Newton during the same segment. "I would be a buyer of any further weakness in [this] week and thinks the group is probably carrying levels near 1570 to 1600 on the SOX Philadelphia Semiconductor index. "

A move as high as 1600 on the SOX index implies a 9% increase over current levels. It would also return to the index at its April peak of all time.

However, the long-term outlook is still uncertain, adds Newton.

"This peak we experienced last April-May is actually produced at a slower pace, so I would really be a seller in the semi-finals, but for the moment, I still think that's a good thing. It's really the right place to be, "he said.

Warning

[ad_2]

Source link