[ad_1]

Another sign that the zoo has gone mad. “If you don’t have your own PSPC, you are nobody.”

By Wolf Richter for WOLF STREET.

PSPC activity sets breathtaking records. A SPAC (Special Purpose Acquisition Company) is a “blank check company” with no business activity that raises funds from investors through an IPO and will then attempt to use those funds to purchase a start-up company. . For the startup, being bought out by a SPAC is an alternative to an IPO. There are fewer disclosures to be made than with a standard IPO. For Wall Street, there are huge costs to be incurred. And insiders, including those who start PSPCs, make tons of money. So all the basics are in place.

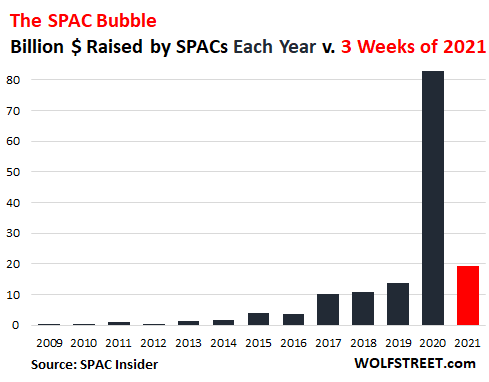

In 2020, a historic record of $ 83 billion was raised by PSPC, six times as much as in 2019 ($ 13.6 billion), according to data from PSPC Insider. That $ 83 billion was more than all the funds that PSPC had raised in all previous years combined, according to Dealogic, and it was blown by the $ 78 billion raised by standard IPOs in 2020, such as the IPO. on the Airbnb stock exchange. Everyone and their dog were starting PSPCs, from former House President Paul Ryan to former NBA star Shaquille O’Neal, chasing the hottest stories of the minute.

And in 2021, the SPAC mania accelerated even further. “If you don’t have your own PSPC, you are no one,” Peter Atwater, founder of Financial Insyghts, told The Wall Street Journal. In the first three weeks of 2021, there have already been 67 PSPCs, raising a total of $ 19 billion, more than for all of 2019:

A special blend of market exuberance, blind confidence that this exuberance will last forever, and total disdain for valuations is needed to create this kind of situation.

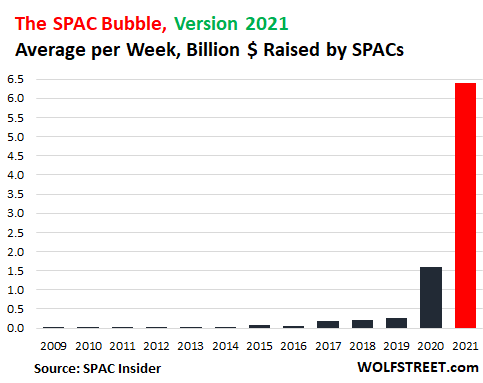

To see how much this PSPC mania has exploded this year, we can look at the dollars raised per week on average. It turns out that in 2021, $ 6.4 billion was raised per week, up from $ 1.6 billion per week in 2020. This is where we are so far:

There are currently 287 PSPCs, with roughly $ 90 billion in cash, now trying to drive out startups in the hottest industries right now, from all-EV to telehealth.

IPOs soar.

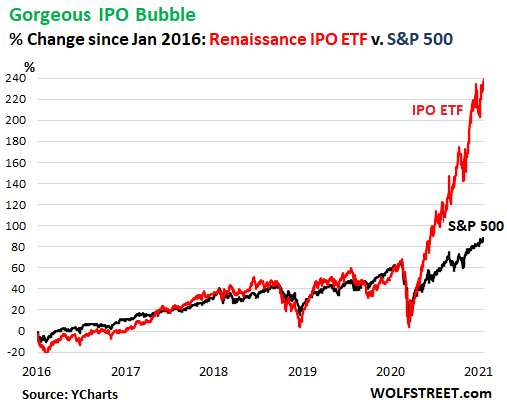

Shares after their IPO have soared from the March lows. The Renaissance IPO ETF [IPO], which tracks the Renaissance IPO Index, which includes the largest 80% of IPOs in the past two years, has climbed nearly 240% since March 18, totally blown away and leaving the S&P index in the dust 500, which is up 72% from the March low. This spike in the IPO index comes after it has spent the previous five years on roughly the same trajectory as the S&P 500 index (data via YCharts):

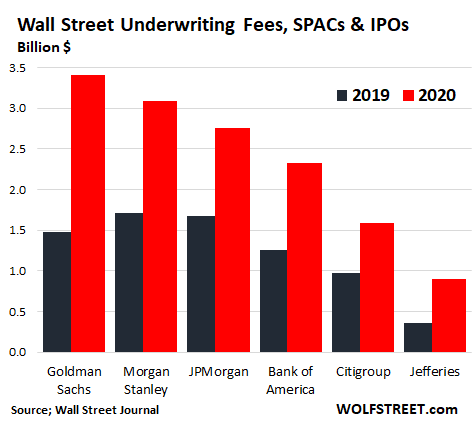

The fees for PSPCs and IPOs are a gold mine for Wall Street banks.

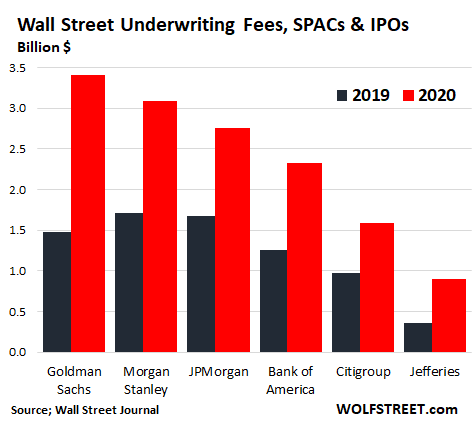

Banks have now announced their fourth quarter results, including fees collected by PSPCs and IPOs. In 2020, the top six share subscription fees – Goldman Sachs, Morgan Stanley, JPMorgan, Bank of America, Citigroup and Jefferies – collected $ 14.1 billion in fees from PSPCs and IPOs, according to the Wall. Street Journal, up 89% compared to 2019:

So everyone is getting richer from this craze in PSPCs and IPOs and having a good old time. And once everyone got rich from the mania, checked out the fees and offloaded shares and had fun, there is something else: in the earlier manias of this type, the consequences were very nasty for them. investors who had made it all possible by buying these stocks with this mixture of exuberance, blind confidence that this exuberance will last forever, and total disregard for valuations. Ah yes, this time it’s different, everyone repeats it – another sign the zoo has gone crazy.

Do you like reading WOLF STREET and want to support it? You use ad blockers – I fully understand why – but want to support the site? You can make a donation. I really appreciate it. Click on the mug of beer and iced tea to find out how:

Would you like to be notified by email when WOLF STREET publishes a new article? Register here.

![]()

[ad_2]

Source link