[ad_1]

(Bloomberg) – Growing investor angst over China’s real estate crackdown spilled over into markets on Monday, hitting developers in Hong Kong and adding pressure on Beijing authorities to prevent financial contagion from destabilizing the market. ‘economy.

Hong Kong’s real estate giants, including Henderson Land Development Co., have suffered the biggest liquidation in more than a year amid speculation that China will extend its real estate crackdown to the financial hub. Fears of contagion from China Evergrande Group continued to escalate, spiking everything from bank stocks to Ping An Insurance Group Co. and high yield dollar bonds.

The Hang Seng Index fell 3.9% at the lunch break, its biggest loss since late July. The sell-off spread to the Hong Kong dollar, offshore yuan and S&P 500 index futures. Holiday closings across much of Asia may have exacerbated volatility, the investors said. tradespeople.

Faced with uncertainty over the economic fallout President Xi Jinping is willing to accept as he pushes forward campaigns of market turmoil to achieve “common prosperity” and curb over-leveraged businesses, many investors are choosing to sell off first and ask questions later. Interest payment deadlines this week on several Evergrande bank bonds and loans add another layer of risk as market participants brace for what could be one of China’s biggest debt restructurings.

“Price movements in several asset classes in Asia are horrific today due to growing fears over Evergrande and a few other issues, but it could be an overreaction due to all the market closures in the region.” said Brian Quartarolo, portfolio manager at Pilgrim Partners Asia.

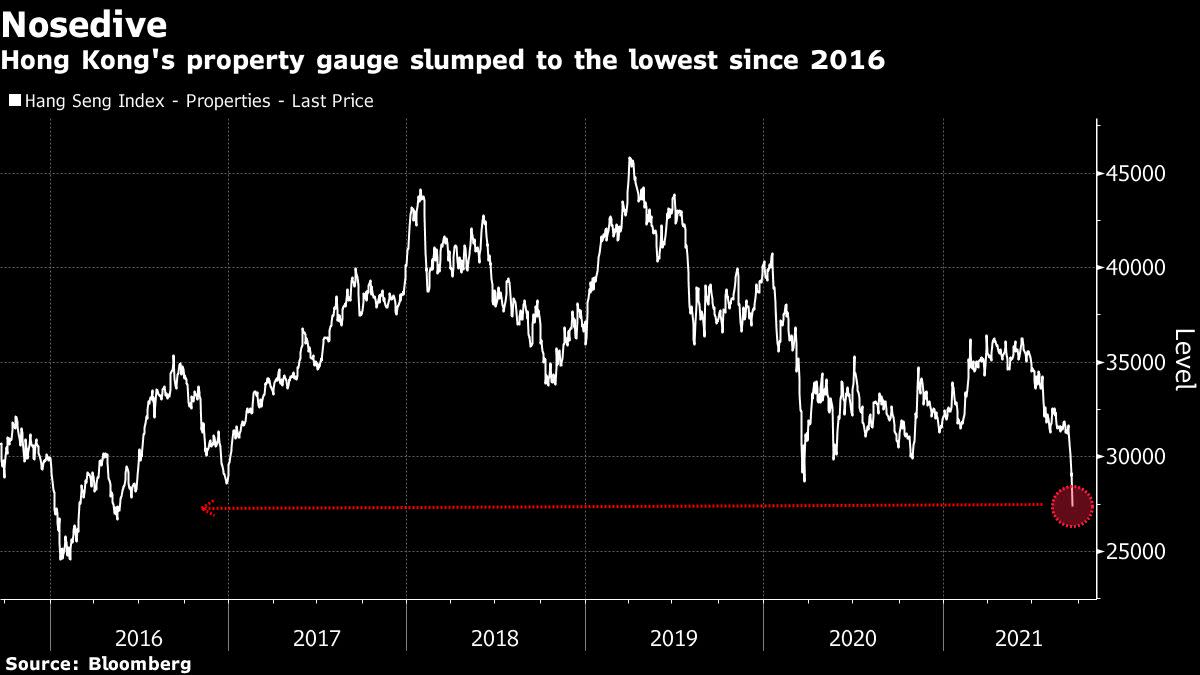

The Hang Seng real estate index fell 6.6%, the highest since May 2020. Henderson Land fell 12%. Sun Hung Kai Properties Ltd. fell 9.1%, poised for its biggest loss since 2016. CK Asset Holdings Ltd. fell 7.9%.

Chinese officials have told developers in Hong Kong that Beijing is no longer willing to tolerate what it calls monopoly behavior, Reuters reported on Friday. Officials have not set a roadmap or deadline, according to the report, citing unidentified developers.

“This is a paradigm shift,” said Hao Hong, chief strategist at Bocom International, referring to the Reuters report. “People have to watch closely. “

The Hong Kong government has long struggled to keep house prices under control amid excessive demand, limited supply and low borrowing costs. The average value of Hong Kong properties was $ 1.25 million globally in June 2020, according to CBRE Group Inc.

The feeling of risk aversion in financial markets was widespread on Monday. Chinese dollar bonds rated as garbage slipped as low as 2 cents. The Hong Kong dollar fell to its lowest level this month. The offshore yuan fell for a third day. Futures on the FTSE China A50 index slipped 3.9%. Mainland financial markets are closed for public holidays until Wednesday, when Hong Kong will be closed. Futures contracts on the S&P 500 index fell 0.9%.

“We are seeing fears of contagion from China Evergrande emerging,” said Jun Rong Yeap, market strategist at IG Asia Pte.

Evergrande is expected to pay interest on bank loans on Monday, with a one-day grace period. Although details of how much owed are not publicly available, Chinese authorities have already told major lenders not to expect a refund, people familiar with the matter said last week. Evergrande and the banks are discussing the possibility of extensions and renewals of some loans, the people said.

The developer’s stock fell as much as 19% on Monday, on track to close at its lowest ever market value.

More stories like this are available at bloomberg.com

Subscribe now to stay ahead of the game with the most trusted source of business information.

© 2021 Bloomberg LP

[ad_2]

Source link