[ad_1]

The Walt Disney Company (NYSE: DIS) has seen an incredible 41% growth in the past 12 months, mostly thanks to the rise of streaming with Disney + subscriptions. Today we’ll see if the stock has matured its potential by estimating the company’s future cash flows and discounting them to their present value. The Discounted Cash Flow (DCF) model is the tool we will apply to do this.

We generally think of a business’s value as the present value of all the cash it will generate in the future. However, a DCF is only one evaluation measure among many, and it is not without its flaws. If you would like to know more about discounted cash flow, the rationale for this calculation can be read in detail in the Simply Wall St.

Crunch the numbers

We use a 2-step model, which just means that we have two different periods of growth rate for the cash flow of the business.

Usually the first stage is higher growth and the second stage is lower growth stage. To begin with, we need to get cash flow estimates for the next ten years. Where possible, we use analyst estimates, but when these are not available, we extrapolate the previous free cash flow (FCF) from the last estimate or stated value.

10-year free cash flow (FCF) forecast

| 2022 | 2023 | 2024 | 2025 | 2026 | 2027 | 2028 | 2029 | 2030 | 2031 | |

| Leverage FCF ($, Millions) | US $ 5.83 billion | 8.71 billion US dollars | US $ 11.8 billion | US $ 15.5 billion | US $ 18.2 billion | US $ 20.6 billion | US $ 22.7 billion | US $ 24.3 billion | US $ 25.8 billion | US $ 27.0 billion |

| Source of growth rate estimate | Analyst x13 | Analyst x11 | Analyst x5 | Analyst x3 | Est @ 17.92% | Est @ 13.13% | Est @ 9.78% | Est @ 7.43% | Est @ 5.79% | Est @ 4.64% |

| Present value (in millions of dollars) discounted at 6.7% | 5.5,000 USD | $ 7.7,000 | US $ 9.7,000 | US $ 12.0k | US $ 13.2,000 | US $ 14.0k | $ 14.4,000 | $ 14.5,000 | $ 14.4,000 | US $ 14.1k |

(“East” = FCF growth rate estimated by Simply Wall St)

Ultimately, we add up the present value of the cash flows over the next 10 years.

See our latest analysis for Walt Disney

10-year present value of cash flows (PVCF) = US $ 120 billion

It is now a matter of calculating the Terminal Value, which accounts for all future cash flows after this ten-year period.

We discount the terminal cash flows to their present value at a cost of equity of 6.7%.

Terminal value (TV) = FCF 2031 × (1 + g) ÷ (r – g) = US $ 27B × (1 + 2.0%) ÷ (6.7% – 2.0%) = US $ 585B

Present value of terminal value (PVTV) = TV / (1 + r) ten = US $ 585B ÷ (1 + 6.7%) ten = 307 billion US dollars

Our result is the total value, or the value of equity. Which then is the sum of the present value of future cash flows. For Disney, we offer a net worth of $ 426 billion today.

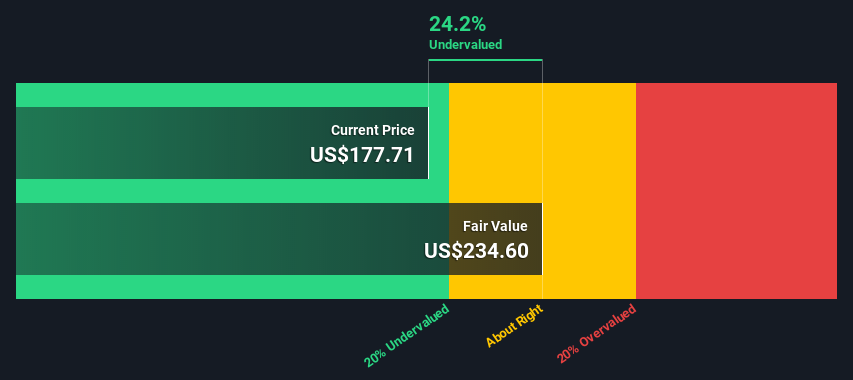

From the current share price of US $ 178, the company appears to be slightly undervalued at a 24% discount from the current share price.

The model attempts to gauge Disney’s future cash flow, while not perfect, it shows the company has a lot of potential going forward. It is now up to management to deliver on the execution and to come up with interesting ideas.

The company has yet to show the full potential of a reopening game. The main hope is that Disney will capture a significant market share in entertainment screen time, which was once dominated by cable and television companies.

Theme parks are also an asset that should be revitalized over the next few years and provide a solid foundation for future cash flows.

Key points to remember

Valuation is only one side of the coin in terms of building your investment thesis, and it shouldn’t be the only metric you look at when researching a business. It is not possible to achieve a rock-solid valuation with a DCF model. Instead, the best use of a DCF model is to test certain assumptions and theories to see if they would lead to undervaluation or overvaluation of the company.

It’s entirely possible that Disney has a lot of value to unlock, and our model suggests the stock is 23% undervalued.

The next few years will be crucial for execution and positioning against competitors in the streaming landscape. Therefore, if the value potential is there, it is linked to the management of the execution form and the emergence of a market leader among the competitors.

PS. The Simply Wall St app performs a daily discounted cash flow assessment for every NYSE share. If you want to find the calculation for other actions, just search here.

Simply Wall St analyst Goran Damchevski and Simply Wall St have no positions in any of the companies mentioned. This article is general in nature. We provide commentary based on historical data and analyst forecasts using only unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell shares and does not take into account your goals or your financial situation. Our aim is to bring you long-term, targeted analysis based on fundamental data. Note that our analysis may not take into account the latest announcements from price sensitive companies or qualitative documents.

Do you have any feedback on this item? Are you worried about the content? Contact us directly. You can also send an email to [email protected]

[ad_2]

Source link