[ad_1]

By Nate Parsh

Sunday, June 9 United Technologies (UTX) and Raytheon (RTN) announced that it has reached an agreement providing for a peer-to-peer merger. With a combined market capitalization of $ 155 billion, this is the largest merger in this year 's industrial sector and one of the largest of all time in the industry. aerospace and defense.

United Technologies and Raytheon both have a long history of increasing dividends. Raytheon is a Dividend realized, a group of shares with more than 10 consecutive years of dividend growth, while United Technologies is a recent addition to the Dividend Aristocrats Group, a group of 57 stocks in the S & P 500 Index with more than 25 consecutive dividend increases. You can see all 57 dividend aristocrats here.

However, after protracted rallies, United Technologies and Raytheon have raised valuations and their dividend yields have fallen to multi-year lows. The merger of these two companies will bring strategic benefits, but no action seems to be a buy today.

Business Background

The Raytheon Company was founded in 1922. In almost 100 years, the company has become the fifth largest military contractor in the world. Raytheon supplies missile, electronic, radar and communication systems to the United States and its allies. The company is made up of five reportable divisions: integrated defense systems, intelligence services and intelligence, missile systems, space and airborne systems, and Forcepoint. The company has a market capitalization of $ 49 billion and annual sales of more than $ 27 billion.

United Technologies is a commercial aerospace and defense company. On November 26, the company announced that it had finalized the acquisition of Rockwell Collins, at a cost of $ 30 billion. At the same time, United Technologies announced the split of its Otis and Climate, Controls & Security businesses. As a result of these actions, the Company will be comprised of two business segments: Pratt & Whitney and Collins Aerospace Systems. The company has a market capitalization of $ 106 billion and generates annual revenues of nearly $ 67 billion.

Details of the merger

The merged company will name Raytheon Technologies Corporation and will exclude future Otis and Carrier spinoffs from United Technologies. The merger of Raytheon and United Technologies is expected to take place as a result of these previously announced impacts in the first half of 2020.

Under the merger agreement, Raytheon shareholders will receive 2,33348 shares of the merged company. Investors holding United Technologies shares will own approximately 57% of the amalgamated company, while legacy Raytheon shareholders will own approximately 43%.

The two companies are expected to generate a business turnover of $ 74 billion in 2019 and generate synergies of more than $ 1 billion in gross annual production costs by the fourth year after closing. . The new company also plans to return US $ 18 billion to shareholders in the first three years after closing. The combined company will have $ 26 billion in net debt, with United Technologies' legacy business representing approximately $ 24 billion.

As a result of the merger, Raytheon Technologies Corporation will be one of the leading companies in the aerospace and defense industry.

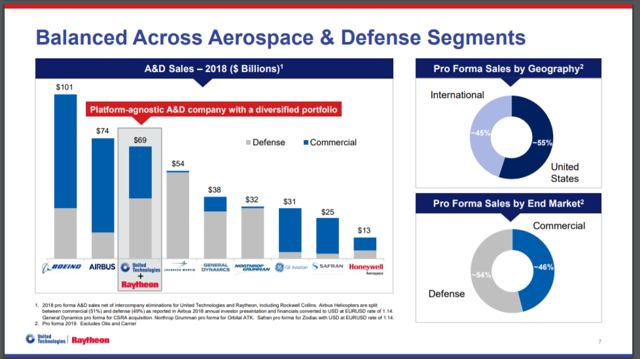

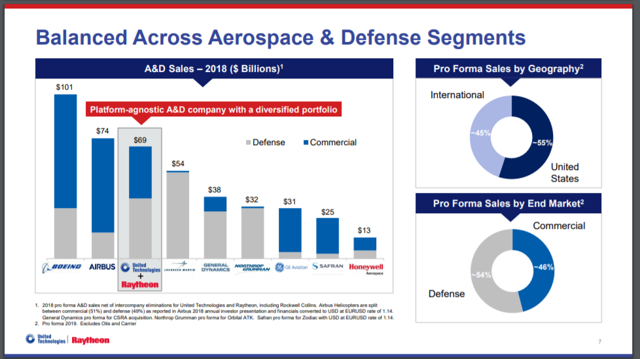

Source: Presentation of Fusion of Equals, slide 7.

Based on the combined sales, the merger will make the new company the third player in the aerospace and defense sector. The merger will also make the new company the second largest defense supplier, behind Lockheed Martin (LMT), and the third largest supplier of commercial aerospace products, behind Boeing (BA) and Airbus (OTCPK: EADSF).

Total sales will also be quite diversified, with just under half of sales coming from international markets. Defense sales will account for just over half of total sales.

The new amalgamated company will have the following business units:

- Space and Airborne Systems (former Raytheon companies)

- Integrated defense and missile systems (former Raytheon companies)

- Collins Aerospace

- Pratt & Whitney

The main question that will arise the shareholders of one or the other company is: "Is this merger good or bad for my action"? It is notoriously difficult to analyze stock-stock transactions, but some mathematical calculations can help us understand whether the price of this transaction makes sense to both parties.

First, assume that both companies will roughly achieve their 2019 earnings forecasts, which include the following:

- Raytheon: $ 3.2 billion in net income

- United Technologies: net income of $ 6.8 billion

Note: Each company actually provides guidance on earnings per share and not on net earnings. These estimates were therefore calculated by multiplying EPS forecasts by the current or projected number of actions.

Adding these numbers, the pro forma company Raytheon Technologies is expected to generate an annualized net profit of about $ 10 billion. Based on the ownership ratio of 57/43 described in yesterday's press release, the net income attributable to each group of shareholders will be as follows:

- Legacy Raytheon shareholders: $ 4.3 billion

- Shareholders of Legacy United Technologies: $ 5.7 billion

On this basis, it appears that Raytheon shareholders will benefit enormously from this transaction, while shareholders of United Technologies will actually see the value of their shares decline after taking into account the dilution associated with the transaction.

Some big activist investors have expressed their opposition to the proposed merger. Bill Ackman of Pershing Square Capital Management and Dan Loeb of Third Point due to the dilutive issue of large amounts of United Technologies shares to complete the merger. Pershing Square owns 0.67% of United Technologies, while Third Point owns 0.8%.

If this merger takes place, the companies involved and the aerospace and defense sector as a whole will be transformed, but does that mean that the shares can be bought at current prices?

Expected total results

Raytheon increased earnings per share by 7.6% per year from 2009 to 2018. Much of this growth, however, occurred between 2017 and 2018 (earnings per share increased by 46%). We expect earnings per share to grow by 6% per year until 2024, which is slightly below the long-term average to help explain this anomaly.

Raytheon expects to earn $ 11.50 per share in 2019. Using the current share price of $ 172, the current price-earnings ratio is 15. This is in line with our 2024 price-earnings ratio target. therefore, we do not expect valuation to play a role in total returns over this period.

Raytheon has increased its dividend over the past 15 years. The company has increased its dividend:

- By a CAGR of 5.1% in the last three years

- CAGR of 7% in the last five years

- By a CAGR of 10.6% in the last 10 years

More recently, Raytheon increased its dividend by 8.7% on May 9th.th, Payment 2019. The company is expected to pay $ 3.47 per share in dividends this year, which would equate to a payout ratio of only 30% of expected earnings per share for the year. The title currently yields 2%, which is slightly higher than the average yield of 1.9% of the S & P 500.

The total returns for Raytheon would be as follows:

- Earnings per share growth of 6%.

- Dividend yield of 2.0%.

Together, we expect Raytheon's stock to deliver a total annual return of 8% over the next five years. We reserve purchase recommendations for stocks whose expected return is at least equal to 10% per annum. As a result, Raytheon receives a sustain note from Sure Dividend for the moment.

United Technologies has seen its earnings per share grow by 6.3% a year over the last decade. Part of this growth can be explained by the fact that earnings per share reached a floor in 2019. We estimate that a growth rate of 3% is more appropriate for the stock.

The company expects to earn $ 7.90 per share this year. Trading at $ 123 now, the stock has a price / earnings ratio of 15.6. This figure is slightly higher than the long-term average multiple of the stock, which is 15.3 times earnings. If equities resume this valuation by 2024, it would have a negative impact of 0.4% on total annual returns during this period.

United Technologies, which has recorded 25 consecutive years of dividend growth, is one of the newest dividend aristocrats. The company has increased its dividend:

- With a CAGR of 2.2% in the last three years

- With a CAGR of 3.5% in the last five years

- CAGR of 6.2% in the last 10 years

United Technologies has increased its dividend by 5% for the payment made on December 10thth, 2018. It is expected that the company will pay $ 2.94 per share in 2019. Using the expected earnings per share for the year, the dividend payout ratio of 37% is expected. The stock offers a dividend yield of 2.4%

The total returns for United Technologies would be as follows:

- 3% growth in earnings per share.

- Dividend yield of 2.4%.

- 0.4% multiple reversion.

We expect United Technologies shares to be able to offer a total annual return of 5% by 2024. Stocks with expected returns of 5% or less are assigned to sales quotations. Due to the low projected yields, we believe that United Technologies is a current price sale.

Last thoughts

The merger of Raytheon and United Technologies will disrupt the aerospace and defense sector. The combined companies will become one of the largest in the industry and should be able to remove a significant amount of costs a few years after the merger ends.

Both companies have also increased their dividends for long periods and offer returns at least slightly above those of the market index.

That being said, we believe that current Raytheon shareholders will likely benefit much more from the merger than those who own United Technologies. We also believe that neither company can be considered a purchase at this time, based on our expectation of total returns for the next five years.

We are maintaining our rating on Raytheon and reaffirming our sales note on United Technologies.

Disclosure: I am / we are long BA, LMT. I have written this article myself and it expresses my own opinions. I do not receive compensation for this (other than Seeking Alpha). I do not have any business relationship with a company whose shares are mentioned in this article.

[ad_2]

Source link