[ad_1]

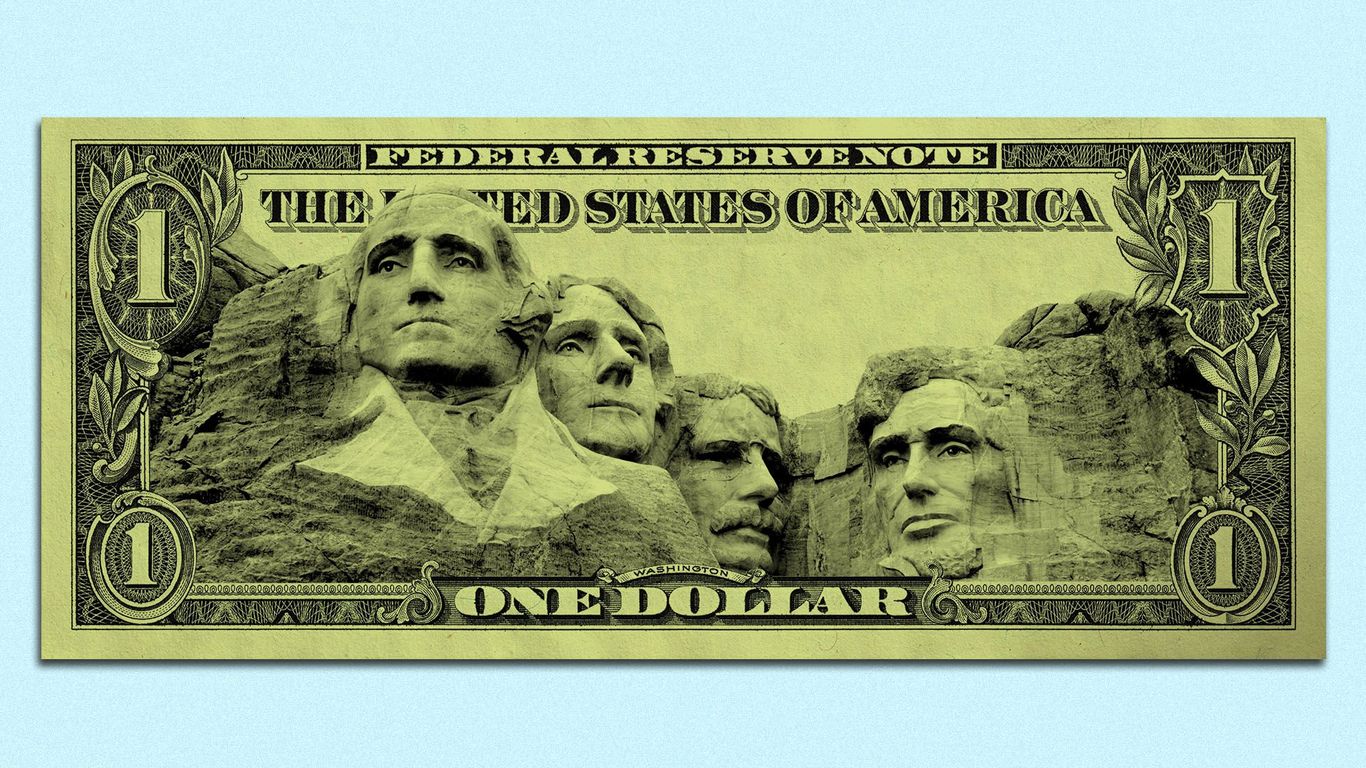

South Dakota has become the world’s first tax haven, right there with the Cayman Islands and ahead of old-fashioned places like Switzerland. This is one of the clear messages from Pandora Papers’ leak of confidential financial information about the richest people in the world.

Why is this important: The hundreds of billions of dollars sequestered in South Dakota trusts generate no tax and are effectively off-limits to anyone who might have a legitimate claim on them.

How it works: A South Dakota trust is “the most powerful force field money can buy,” in the words of Oliver Bullough of The Guardian.

- Like most tax havens, South Dakota has no income tax, no inheritance tax, and no capital gains tax. But the state went even further than that. South Dakota allows for extreme secrecy when law enforcement knocks on doors and protects assets from claims from creditors, ex-spouses, or just about anyone else.

- By creating a trust, the “settlor” – think of a billionaire who wants to keep his assets safe – gives those assets to a South Dakota trustee to look after. The trustee then invests the assets for a “beneficiary” who is often a direct relative of the settlor. Neither the grantor nor the beneficiary ever need to set foot in South Dakota, or even be able to find it on a map.

- The three parties – the settlor, the trustee and the beneficiary – can legally claim that the money does not belong to them. The settlor and the beneficiary can say they don’t have the money, it’s all in a trust managed by someone else. The trustee can say that she is only dealing with the money and not the owner of it.

How did it happen: South Dakota began carving out a place of the laxest state for financial services in 1981, when it abolished upper limits on credit card interest rates. (That’s why the credit card in your wallet was almost certainly issued in South Dakota.)

- In 1983, South Dakota became the first state to allow perpetual trusts – money that can go untouchable for centuries, without anyone ever paying estate tax.

- Since, South Dakota has continued to pass laws making its trusts more attractive to the world’s ultra-rich. It allowed trusts where the settlor and the beneficiary can be the same person. He also sealed all court documents establishing trusts, making it impossible to know – in the absence of Pandora Papers-style leaks – who might have one.

- Republican-controlled South Dakota legislature regularly approves all invoices submitted to it by the financial services industry. “No one understands any of them,” said Gene Abdallah, Republican chairman of the South Dakota Senate Judiciary Committee in 2007 – although it is widely believed that the laws help support hundreds of jobs in the South Dakota. financial services in Sioux Falls, as well as free lawmakers. -market in good faith.

The context: Since 2010, almost every country in the world has adhered to the Common Reporting Standard (CRS), whereby governments notify each other of assets held by foreigners. The United States is the only major country that has not joined CRS, which makes it much more attractive as a tax haven than countries like the Bahamas or Panama.

- Who is in: Ecuadorian President Guillermo Lasso, Chinese real estate billionaire Sun Hongbin and dozens of other top tax optimizers – foreign and American – house their assets in South Dakota.

In numbers : Ten years ago, South Dakota trust companies held $ 57 billion in assets. The current figure is around $ 360 billion – with similar trusts in other states, bringing the total for the United States to nearly $ 1,000 billion.

- United States – not only South Dakota, but also rival tax havens like Nevada and Delaware – now ranks second behind the Cayman Islands in financial secrecy.

The bottom line: “South Dakota has the best privacy and asset protection laws in the country, and possibly the world,” tax expert Harvey Bezozi told The Guardian.

[ad_2]

Source link