[ad_1]

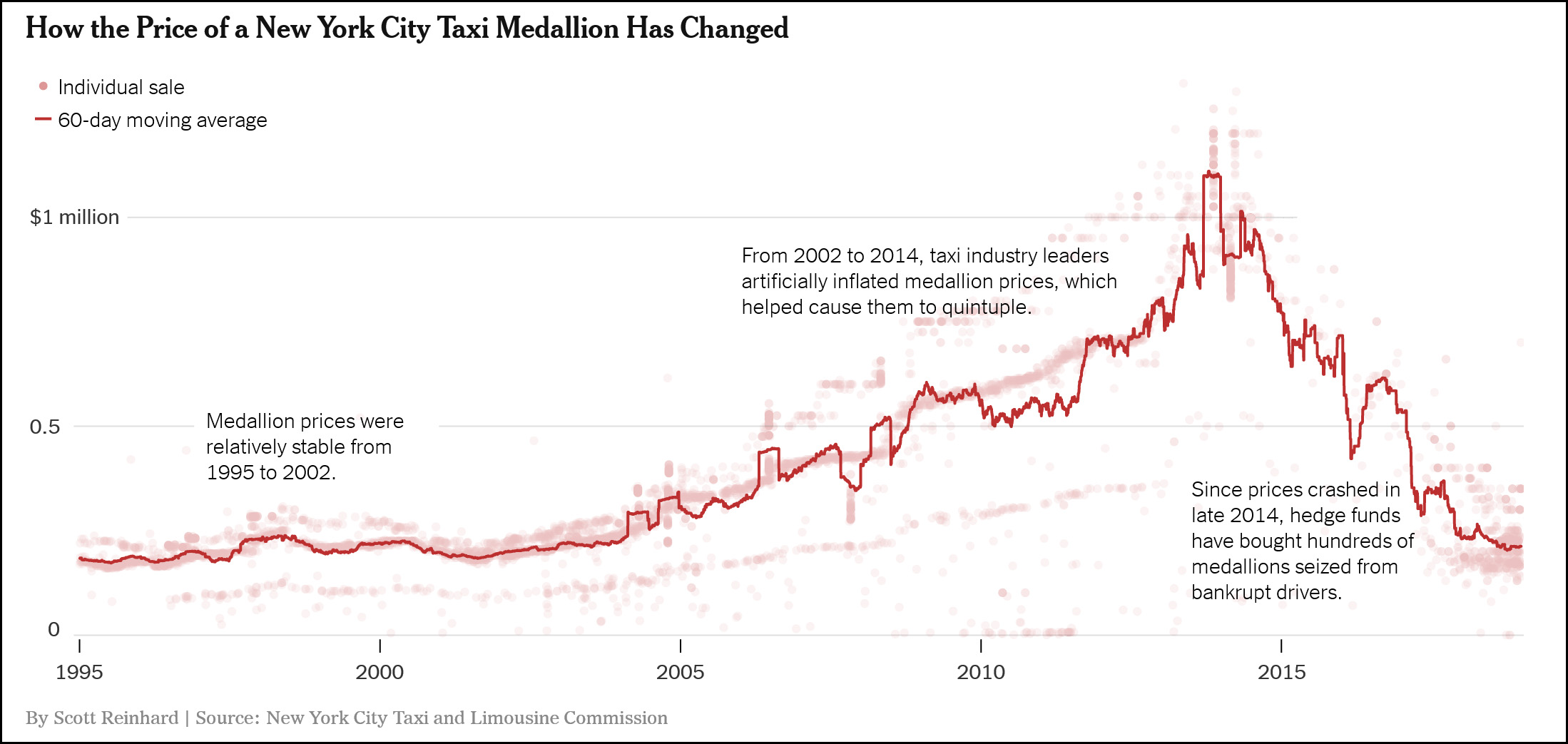

the New York Times has a good article today on the price of taxi medallions, which act as an authorization to drive a yellow cab in the city. Here are what prices look like over the last few decades:

The collapse of 2014 is almost universally described as "the Uber effect" and it is only logical that the growth of Uber will lower the value of a yellow taxi. But if you take a closer look, the real question is different: why did the medallion prices rise in the first place? Between 2002 and 2014, the population of New York City did not increase much; the number of medals has not changed significantly; and the average income from driving a taxi has not increased. So why the price of a fivefold medallion? According to Time, the answer is corruption: ¹

Much of the devastation can be attributed to a handful of powerful industry leaders who regularly and artificially pushed up the price of taxi medallions, creating a bubble that eventually burst. For more than a decade, they channeled thousands of drivers to indiscriminate loans and extracted hundreds of millions of dollars before the market collapsed.

… The practices were surprisingly similar to those that motivated the housing market crash that led to the global economic crisis of 2008: Banks and poorly regulated private lenders have taken out risky loans and encouraged frequent refinancing; the drivers borrowed a debt that they could not afford, on terms that they often did not understand … The temperature found.

… .As in the housing accident, Government officials ignored warning signs and exempted lenders from regulation. The City Taxi and the Limousine Commission went as far as possible, turning into a cheerleader for the sale of medallions. His job was to regulate the sector, but when prices skyrocketed, he sold new medallions and began to declare himself "better than the stock market" …At the height of the market, medallion buyers earned about $ 5,000 a month and paid about $ 4,500 on their loans, according to an analysis of The temperature city data and loan documents.

The victims of this scam were largely low-income people, of course, as well as immigrants. They were sold on medallions as an entry into the middle class: hard work, certainly, but it would bear fruit. After all, the value of the medallions has always increased.

But it was never true, something that had nothing to do with Uber. It is true that after Uber and Lyft entered the New York market, the average income of taxi drivers declined. Around 10%. That's a lot for a low-income immigrant family, but obviously not enough to justify a drop in medallion prices from $ 1 million to $ 200,000. This is largely due to the fact that lenders and fleet owners have created a massive and never lasting artificial bubble.

In the end, then, we have an old story: it's essentially a Ponzi scheme that saves a lot of money and a lack of regulation on the part of the people who should have protected the victims. The story of Uber and Lyft is only a fairy tale invented to hide what has actually happened.

¹ Corruption comes in all its forms and sizes. This scam was small and local, but otherwise it looked a lot like the housing bubble that ravaged the global economy in 2008. That's why it's important to get rid of it no matter where it happens. If you would like to donate to our corruption project, click here.

[ad_2]

Source link