[ad_1]

Finding a peaceful way to pay for retirement is one of the most pressing issues of the day. Many readers have turned to Seeking Alpha to address the challenges currently facing retirees. Retirees must understand:

- How to plan their cash flow

- How to build a stable portfolio

- What level of expectations is reasonable

It is distressing to hear retirees who "need" an annual rate of return of 14%. Even with increased risk and volatility, 14% is very unlikely. Even if an investor reached it, it would not happen on a regular basis. This is the nature of high volatility.

Many investors want to spend part of their golden age on a cruise ship. It's entirely possible.

Today, we use hypothetical situations that many readers are confronted with.

It would be easy to plan retirement with $ 10 million. Instead, let's do it less: $ 568,848. The portfolio we will highlight would have cost $ 500,000 about 18 months ago, but stock prices have risen alongside dividend rates. We will show how to increase yield without increasing volatility. If investors want to manage a similar plan for $ 500,000, they can simply reduce the size of positions or use a higher allocation of preferred shares.

Market environment

The interest rates currently available on bonds are low, but they have increased significantly. Bonds are a difficult way to generate income without a huge portfolio. Perhaps you prefer to opt for a portfolio consisting mainly of stocks?

The market had unprecedented records earlier this year. Higher valuations make it more risky to put all equities in equity.

Investing today requires caution. The investments I would choose are the big companies that have proven themselves. A retiree can still invest in an income portfolio and expect solid dividend yields. Dividend champions are unlikely to reduce their dividends, even in times of crisis. Short-term market volatility may be important, but the source of income should remain almost entirely intact.

Retirement homes

Care in a retirement home is expensive. Staying there for a long time would almost certainly lead most retirees to bankruptcy or an early grave. The costs of specialized care are far too high for most pension portfolios. If you are considering this option, please contact a financial planner. They can advise you on designing a legal structure to protect your capital in case of bankruptcy.

Social Security

Waiting to take social security has huge benefits. The retiree invests in their future cash flows and ensures a larger payment in each future period. If they are expecting to enjoy a long retirement, waiting is often logical. However, there are some important exceptions.

Here are several reasons why a retiree may choose to deposit early:

- Repay a high interest rate debt

- Health problems that make them believe that they will live until the end of the 80s.

- Doubts about the future level of benefits

- Expectations of changes in the taxation of social security benefits

For this scenario, our retiree subscribes to SS as soon as possible. When a retiree has no idea of his age or age, it may be wise to take social security sooner. Often, the payback period for social security benefits ends in the early 1980s. If we adjust the ability to accumulate interest on cash balances, it will be a little later.

For our example, the investor takes Social Security at age 64 and will receive a monthly benefit of $ 1500. That translates into $ 18,000 a year.

Challenges in retirement

Every retired person faces their own challenges. To give you a better chance at retirement, we recommend the following steps:

- Be diligent in your planning. Spend time tracking your expenses right from the start.

- Be frugal. Look to reduce some of these expenses.

- Consider ways to earn extra income. Even a small source of income can help.

- Stay attached to the plan. A plan is only useful if you follow it.

Job

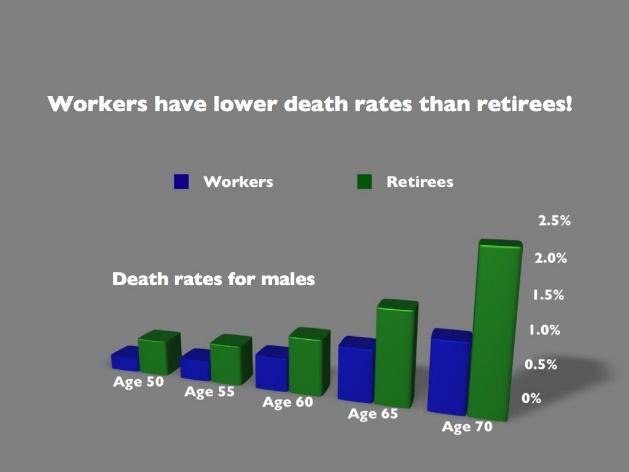

Retirees who do not work at all usually have a shorter life span:

Correlation and causation are not the same. We can see a very clear correlation, but we can not say what caused it. Were mortality rates higher because sick people had retired earlier? What about those who retire earlier to enjoy their last years? Share your ideas in the comment section.

Portfolio investment

Let's build an example of a portfolio with strong dividend investments. Investors should choose a strategy that helps them sleep at night. Some investors like a portfolio built on a very diverse group of ETFs. Others would prefer that a few strong dividend producers create a more stable dividend payout.

We will focus on dividends to supplement income. In this scenario – simple plan. Buy and keep 20 of the best dividends on the market. These choices will be in a fast format, so we will not embark on an in-depth analysis of fundamental valuation. This article focuses on the retirement strategy, with individual stocks serving as examples for building a diversified portfolio.

Let's start!

MO and PM

My first and the second choice could frighten investors: Altria Group (MO) and Philip Morris (PM). MO and PM are two of the tobacco giants and their performance over the last calendar year has been terrible. Analysts have become much more concerned about the future of the industry. We do not agree. The growth rates of tobacco incomes are unlikely to maintain their previous levels. However, stocks are trading at low valuations. The current dividend yield is 5.74% for OM and 5.24% for MP. Their dividends are well covered and can choose to invest in new technology or use a cash surplus to buy back shares.

MO's dividend history is also relevant for PM. Both were previously part of the same company.

The Altria group has increased its dividend for almost 50 years. Each of these companies holds a huge market share. They sell an addictive market. They demonstrate their ability to switch to new products. Philip Morris tests his new technology on international markets: IQOS.

PG, MMM and JNJ

Choose from three to five:

Procter & Gamble (NYSE: PG) has 61 years of dividend increase. 3M (MMM) has 59 years of dividend increases. Johnson & Johnson (JNJ) has 55 years of increases. All these companies have another common factor: the diversity of products.

Companies are giants in their sectors. All three are selling products that are probably in your home right now. For dividend portfolios, these three companies should be at the top.

PEP and KO

Sixth and seventh:

Coke (KO) and Pepsi (PEP) combined have 100 years of dividend increases. Future growth rates are uncertain. That's always the case. Without uncertainty, investing would be very strange. Companies have delivered to increase dividends and share prices. We see a headwind for selling sweet junk food (including sodas), but companies have plenty of time to switch to healthier products. Their greatest strength is not the brands they own, it's their ability to create brands. Existing brands simply demonstrate their expertise.

BAS and HD

Eighth and ninth:

Lowe's (LOW) and Home Depot (HD) are the kings of home improvement. Shares in the residential construction sector went through a very difficult year, but today we still see higher prices in BAS and HD compared to the end of October 2017.

Both chains posted solid growth on a constant basis. We do not expect the sudden appearance of a third player to challenge this oligopoly.

O and NNN

Tenth and eleventh:

Real estate income (O) and national retail properties (NNN) are investors' favorite dividends. They have decades of dividend growth. Everyone excels in managing their property. An important aspect is to choose the right tenants. By choosing the right tenants, they can significantly reduce the risk of their tenants going bankrupt. This gives them greater certainty about their future cash flow.

T and VZ

Twelfth and thirteenth:

AT & T (T) and Verizon (VZ) are the two giants of mobile Internet access. Banks can be "too big to go bankrupt". If this designation goes to the telecommunications companies, they would be first on the list. They are trading at high dividend yields and low P / E ratios. Over the past year we have seen a dip, but VZ is up sharply.

AAPL

Fourteenth:

It's hard not to put Apple (AAPL) in a retiree portfolio. Dividend choices in the technology sector are limited. If investors want a company whose balance sheet is exceptionally strong, the list is considerably shortened. Some investors might prefer to use Microsoft (MSFT) here. In any case, technology stocks represent a very large part of the economy and it makes sense to include at least one in a growing dividend portfolio.

XOM

Fifteenth:

Exxon Mobile (XOM) is the definition of big oil. They have the political weight and size to achieve huge economies of scale. For retirees, the high dividend yield is the main attraction. The yield, about 4.16%, is quite high. This is much smaller than the high-risk players in the oil industry, but a lower return with less risk is a better fit for this portfolio.

V and MA

Sixteenth and seventeenth:

Visa (V) and Mastercard (MA) are two actions that we should all have been buying for a long time. They dominate their sector. When Visa claims to be "everywhere," they do not joke. It is rare to find a transaction that can not be completed with Visa. Mastercard is their main competitor and both companies are expected to benefit from an increase in electronic payments worldwide.

WMT

Eighteenth:

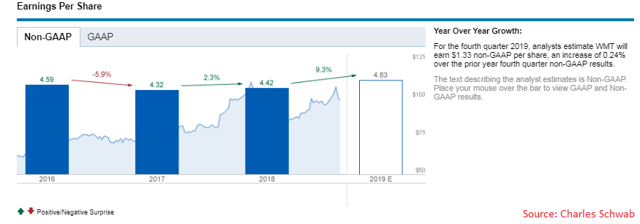

WalMart (WMT) is the king of retail. Despite the bankruptcies of retailers in the news, WalMart continues to grow:

Source: Schwab

They have made great progress in online sales.

You can not rely on Wall Street to predict that.

Back on the past a little over three years:

Source: Looking for news alerts alpha

How do you think the king of the retail trade has followed these cuts?

Most analysts are guilty of having closed the door of the stable after the horse's departure.

MCD

XIX:

McDonald's (MCD) is the king of fast food choking the arteries. McDonald's also has more than 40 years of dividend increases. The dividend history is not as impressive as some of the list, but it's not bad.

MCD could have weaker future growth with mobile order competition. We see this as a potential challenge because one of MCD's greatest strengths is its speed of order processing. A trend towards mobile orders could favor competitors that were not previously considered by the customer because of their longer wait times.

We do not expect, however, that they need to reduce the dividend.

GSP

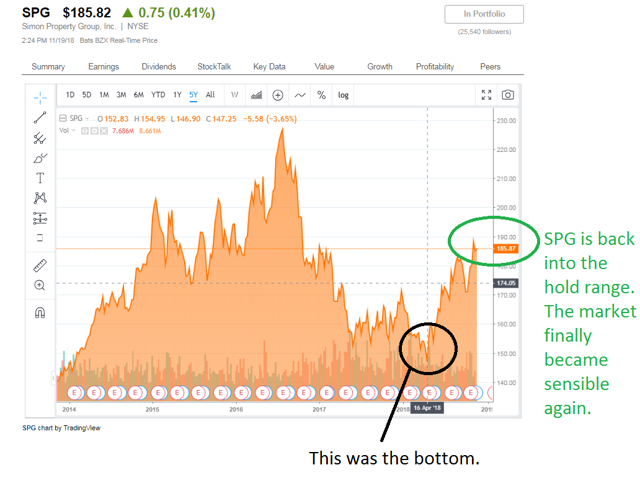

Twentieth:

Simon Property Group (SPG) is the largest of the REITs in the mall. It will continue to greatest for the coming decades. SPG has recorded solid growth year after year and the "retail death" speech has resulted in stocks up to April 2018, but since then, GSP has experienced a solid recovery.

The stores will be replaced, but an owner with good properties and a solid balance sheet should go.

Source: Looking for alpha

Wallet

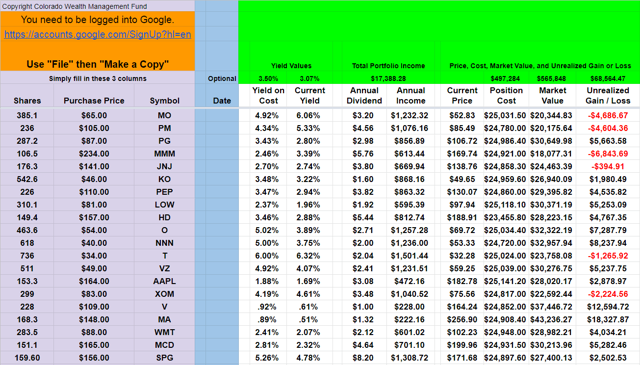

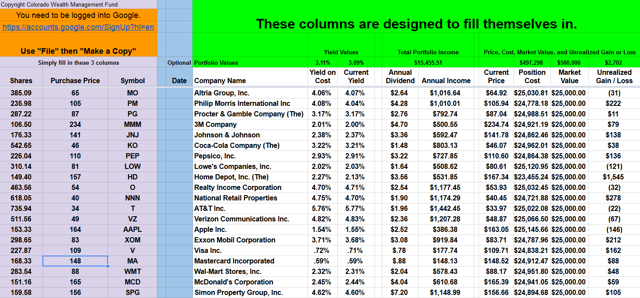

Here are all the actions listed in the follow-up of The REIT Forum's portfolio:

This portfolio would generate an annual income of $ 17,388.28 and is valued at $ 565,848.

We suggested this batch of shares about a year ago and we also showed it in portfolio tracking:

Approximately 18 months ago, this portfolio would have cost $ 500,000 and generated an annual dividend of $ 15,455.

Since then, dividend growth has been around 12.5% and price growth around 13.2%.

When investors worry about inflation, dividend growth is the answer.

The price-quality ratio shown here is without reinvestment of dividends. You can see that the number of shares remains unchanged. When we provide investment ideas, we focus on total return. This is the change in the price of the share plus the value of the dividends paid during the period.

Total retirement income

The total income of the portfolio would be $ 17,388.21. Social security benefits add an additional $ 18,000 a year. That's $ 35,388.21 a year for one person.

It's enough to live for one person, although comfort levels may vary.

It would be very difficult if the retiree were paying rent and quite impracticable if the retiree paid rent in San Francisco or New York.

However, if the retiree lives in a city where the cost of living is low, it can still work. They must own their own home and should not have the intention of driving a brand new car.

At the age of 64, this retiree still has one year before Medicare comes in. They might consider taking out a separate health insurance plan, which would require more than liquidity. They may decide not to be insured during these two years. They can also look for a part-time job with health insurance benefits. These may still be hard to find, but the health insurance aspect would be more important than the salary. The decline in the unemployment rate is forcing employers to compete more for qualified employees. These posts are not impossible to find.

How to have more income in retirement

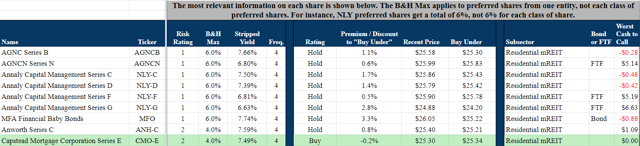

If retirees want a higher yielding portfolio, a clear way to do this would be to replace Visa and Mastercard with preferred shares. These two positions offer returns of less than 1%, but several high quality preferred shares offer returns above 7%.

Preferred shares do not offer the same dividend growth, but they offer high returns and stable values. This combination can make it an ideal complement to a retiree portfolio. This gives the investor the advantage of higher returns and lower volatilities. To manage interest rate increases, we favor the inclusion of equities with a "fixed-to-float" feature that will appear over the next decade. This gives investors automatic coverage against significantly higher short-term rates over the next decade.

Visa and Mastercard generate a combined annual income of $ 450.16, although their value exceeds $ 80,000. If we invest their value in two 7% preferred shares, we would have less volatility and we would get dividend income of $ 5,600. It's a difference of more than $ 5,000. Added $ 5,000 to the annual income of this portfolio. Total income (including social security benefits) would rise to more than $ 40,300 a year.

The combined portfolio would still provide excellent dividend growth due to other positions in the portfolio. However, the preferred shares would make the retiree much more manageable.

Never index for performance

One of the biggest mistakes that investors make is to look for high returns in high-cost index funds. For example, many investors could own the Preferred Stock ETF iShares ETF (PFF) for a return of 5.89%. They would think diversification would automatically reduce their risk, but they would be wrong. The ETF still holds individual preferred shares, but they are selected by an index rather than an industry expert.

One of our preferred shares is AGNCN (AGNCN). To show the difference between volatility and total returns over time, we have prepared a table showing the amount an investor should have invested in PFF or AGNCN on a given day since 1/1/2018 to reach the total value $ 100,000.

How can AGNCN outperform over long periods? It offers a higher return, a lower risk and does not pay a high expense ratio (like the PFF). This gives AGNCN a considerable advantage for long-term performance. It offers more potential through higher efficiency, but it is also much better in case of decline.

For buy-and-hold investors, it's a great share because of the low risk. For traders, the lower risk is particularly attractive after a strong market recovery. When we hold a preferred stock with a risk rating and we are seeing a market dive, we can have a 2% loss to buy another stock that has just dipped 8%. If the market does not dive, we just continue to collect our strong performance.

Investors who are uncomfortable with this can simply stay in the stock.

Our portfolio

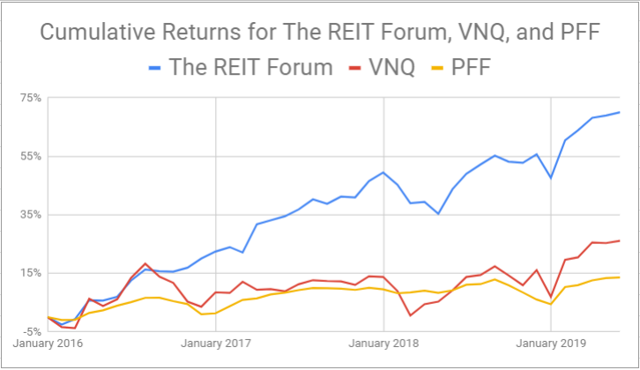

My portfolio is not as diversified as I would suggest for retirees. Quite simply, no analyst can specialize in so many areas. As a result, we are taking more concentrated positions and trading a bit more actively to capitalize on "relative valuations".

The technique worked very well. This allowed us to significantly outperform the Vanguard Real Estate ETF (VNQ) and PFF:

As no analyst can be competent in so many sectors, what should an investor do? If they want to use ETFs, they can use ETFs to target an essential part of their lower yielding portfolio. This is a very viable way to introduce diversification into the portfolio. In the meantime, they could focus their efforts on selecting individual stocks in some of the high yield investments, such as REITs and preferred shares.

Alternatively, the investor could look for some analysts to follow in different sectors. This could be more expensive because professional analysts always keep their best searches for subscribers. All our main research is published on the FPI's forum. You will find articles such as Preferred Shares, week 151, in which we provide an overview of the preferred shares of the mortgage REIT and highlight those that are most attractive in the last few classes.

Link option

If investors want a small bond allocation, I would propose the Schwab U.S. Aggregate Bond ETF (SCHZ). The portfolio consists mainly of high quality bonds with a relatively short duration. This can reduce the total volatility of the portfolio. It will not pay much, but the return is better than the one investors will get on their savings account.

Conclusion

Many strong companies have been excluded. The companies we have listed are strong enough to be considered viable sources of income for any investor. We will not apply the ratings in this article because the focus is on retirement planning and the actions are highlighted as examples of sustainable income.

Retirement planning has two main aspects. Neither is glamorous. Planning should rarely be glamorous.

The first aspect concerns the planning of expenses. By reducing expenses, the retiree has fewer obstacles to gain for his income. Many retirees do not consider this an option until it is too late. Reducing expenses early is much more effective than trying to do it later.

The second aspect is cash flow planning. Some investors will choose to sell shares on occasion to free up capital and spend a portion of the principal. There is nothing wrong with this strategy as long as the retiree is comfortable to use it. For retirees who prefer to keep their investments, it makes sense to focus on creating a revenue portfolio.

One way to significantly improve the expected income without increasing risk and volatility is to incorporate certain preferred shares. Carefully selected preferred shares can offer a high return while reducing the total risk of the portfolio. They do not offer as much potential during an extended bull market, but they significantly reduce risk while increasing revenues. We like to focus on finding defensive investments, so they suit us very well.

The REIT Forum provides a secure income portfolio for investors looking for simple, low-risk REIT opportunities. This is a simple format designed to make it easier for investors.

You will also get all our most usable reports. This includes our regular preferred share series, industry updates, earnings updates, and buy / sell alerts when we find great opportunities.

Click here to start your free trial. You can use your existing Seeking Alpha account to avoid the need to create or remember a new user name or password. Upon joining, you will have access to REIT's best searches on Seeking Alpha.

Disclosure: I am / we have long been AGNCN, MO, PM, SPG, WMT. I have written this article myself and it expresses my own opinions. I do not receive compensation for this (other than Seeking Alpha). I do not have any business relationship with a company whose shares are mentioned in this article.

[ad_2]

Source link