[ad_1]

It goes without saying how important it is to start saving from an early age. This makes retirement planning so much easier. However, most of us do not have this wisdom between 20 and 30 years old. So many people do not think and plan retirement savings until they are 40 years old. But it does not matter, because you can still reach your goals, even if the path will be a little harder and may require more sacrifices.

For the purpose of this article, let's assume a hypothetical pair – John and Lisa, both 50 years old at present. They saved about $ 200,000 in retirement savings in addition to a portion of the equity in the home. It's not bad at all. However, in 12 years they will be 62 years old. They could retire at age 62, but they would still like to predict what awaits them when they retire at age 62 due to a forced situation. They would like to accumulate retirement assets of $ 1 million or more by age 62.

Why retire at age 62?

Frankly, it's only a number. In addition, many people continue to work beyond age 62. However, it is important in many ways. At age 62, you become eligible to receive your social security benefits even if your benefits are 25% lower than if you had to wait until the age of retirement, between 66 and 67 years of age. Plus, once you are 59 and a half, you can withdraw money from your retirement savings vehicles like IRAs and 401K without any penalty. However, please note that Medicare can not be claimed before the age of 65. Thus, for many, it may not be possible to retire before age 65, just enjoy the medical benefits. If one decides to retire at 62, he / she will have to buy their own health insurance for the interim period (from 62 to 65 years old).

There may be other good reasons for planning an early retirement even if you decide not to do so when the time comes. Many people face situations such as dismissal or forced early retirement, and find it difficult to find suitable employment. It may even be an offer of voluntary retirement from your employer that it would be too good to let it go. So you have to plan well to prepare for any eventuality.

Is $ 1 million enough to retire?

In the 1990s and up until the early 2000s, financial planners heard that one million dollars was enough to have a very comfortable retirement. However, not everyone agrees with this milestone. Obviously, $ 1 million is not the same as it was 20 years ago. Despite the low rate of inflation recorded over the past 20 years, one million dollars in 2000 would equate to $ 1.45 million in 2019 due to inflation. Of course, there would be people who would say that a million dollars would not be enough to retire in 2030. Then, without a doubt, they would be better off saving more and keeping a margin of error while setting goals. That said, a million dollars may not guarantee a very rich retirement, but with careful strategic planning, savings of one million dollars can help finance a comfortable retirement for a couple, provided we believe that others Pillars of Retirement Security like Social Security and Medicare will remain intact.

On the other side of the fence, it can be said that it is too high a goal for so many people who may have done everything for the better but who are still going through difficult times in because of layoffs, constant changes in the labor market and age. discrimination in the last years of life. This is why it is so important to have an emergency reserve corresponding to one year of living expenses.

Start saving early is essential, but it's not the final phase

Nevertheless, we believe that the most important factor that determines your future wealth will depend on how quickly you are ready to start saving and paying yourself first, in other words, start saving for retirement. The table below shows the impact that early savings can have on the quality of life of later years. Steve starts paying $ 6,000 a year ($ 500 a month) at age 30 and increases it by 3% a year to age 62. However, Mark waits 10 more years but starts saving the same amount as Steve at 40. % annual return, Steve would end up with almost double what Mark would accumulate. To match Steve, Mark will have to pay double the annual amount from age 40 up to the age of 62.

Here's how their 62-year savings overlap, assuming an annualized return of 8%:

|

Steve contributes $ 500 a month (from age 30), increases by 3% each year |

Mark contributes the same amount as Steve (from 40 years old) |

Mark contributes double (2x) the amount of Steve (from 40 years) |

|

|

At 30 |

0 |

0 |

0 |

|

At 40 |

$ 122,782 |

0 |

0 |

|

At 50 |

$ 411,289 |

$ 154,181 |

$ 308,361 |

|

At 62 |

$ 1,299,000 |

$ 632,121 |

$ 1,264,000 |

You are 50 years old and have saved $ 200,000:

According to the Institute for Economic Policy, the national average of retirement savings among 45 to 49 year olds is $ 81,000 and $ 124,000 for 50 to 54 year olds. So being in the middle would be around $ 100,000. Since for a couple, it should be twice as high, suppose you saved $ 200,000. Obviously, it's an average, and it's not enough. If you are already 50, you should know that you can no longer delay retirement planning. Of course, you could have other urgent needs, such as saving and paying for tuition in children's colleges. If you can handle both, good for you. But saving for tuition should not be at the expense of retirement savings. If necessary, there are other ways to meet these needs, such as tuition loans, at least partially. In addition, children can work part-time to finance their own education to a certain extent. At this point, retirement savings must become priority # 1.

Let's enter our hypothetical pair: John and Lisa

As in the past, we will use our hypothetical pair – John and Lisa, to help with the illustration.

It is there that John and Lisa are today. Both are 50 years old. Their combined annual salary is modest at $ 130,000. They have $ 200,000 in their retirement accounts. John and Lisa want to at least be ready to retire at age 62. They only have 12 years left before retirement. Of course, they can work longer, but it may not always be their choice. To be able to retire in 12 years, John and Lisa realize that they will have to make sacrifices in their current lifestyle in order to be able to retire comfortably later.

John and Lisa decide to save 16% of their salary for their 401K. These savings will be deferred and will reduce their tax obligations. Until now, they saved only 6% of their income. They are fortunate to get from their employers a good match for their savings of $ 401K. On average, this equates to 80% of the top 6% of contributions. They have not had any IRA so far. They will put $ 10,000 ($ 5,000 each) for IRAs. Since they qualify for tax-deductible IRAs, they will use this option instead of the Roth IRAs. It will also help reduce their taxes. They will also open a college education fund for their child and deposit $ 5,000 a year. However, it will be after tax, but qualifying tuition withdrawals, including growth, will be tax free. Their goal is to reach $ 1 million in retirement savings, out of home.

With the above decisions and after taking into account tax savings (due to pre-tax contributions), their monthly net income will decrease by about $ 1,550, even if they will save $ 1,920. more per month.

Where can I find $ 1,550 more per month?

They can reduce their monthly budget in several ways to save that extra $ 1,600. They will look at several options and choose the ones that suit them. Some of the options they will look for are:

- They could significantly reduce their spending budget for each item of expenditure and save $ 1,600 a month. Although feasible, it may seem difficult to achieve at first glance.

- If not, sell the current house and move into a smaller but newer home. This will save a little money and reduce the need to reduce other expenses.

- Of course, there is a third way, although nothing guarantees to achieve it. They can look for new opportunities at work with additional responsibilities and increase their purchasing power. Any success here will reduce their need to reduce expenses.

With a combined income of $ 130,000, their current net income is approximately as follows:

Gross income: $ 130,000

Less SS / Medicare: – $ 9,945

Less federal taxes **: – $ 8,000

(Assuming there are no state taxes)

Deductions 401K (6%) – $ 7,800

Less other deductions: – $ 4,800

Net income at home: $ 99,455

Net monthly income: $ 8,287

** This is a rough estimate for this couple based on income and two dependents, but it can vary significantly depending on the individual situation.

First method:

Based on their monthly net income, they set the new household budget to achieve additional savings of $ 1550 per month.

|

Budget item |

Before |

After (again) |

Savings |

|

Mortgage real estate: |

1150 |

1150 |

0 |

|

Property Tax, Ins, HOA: |

850 |

850 |

0 |

|

House maint. |

250 |

150 |

100 |

|

Home Improvements |

400 |

100 |

300 |

|

Payments of car / gasoline / maint. |

1200 |

800 |

400 |

|

Grocery / Food |

1500 |

1200 |

300 |

|

College funds |

400 |

600 |

-200 |

|

Miscellaneous children |

1000 |

600 |

400 |

|

Eat outside |

400 |

200 |

200 |

|

Holidays |

600 |

300 |

300 |

|

Discretionary / Miscellaneous Spending |

750 |

500 |

250 |

|

Total |

8500 |

6450 |

2050 |

|

Emergency Fund |

0 |

500 |

-500 |

|

NET totals |

8500 |

6950 |

1550 |

Second method:

Their house is worth about $ 350,000, thanks to rising house prices in recent years. However, they still have a mortgage balance of $ 150,000. After payment of the mortgage and commissions, they can get about 190,000 net dollars. If they install a little further in the suburbs and buy a much smaller but newer home, they could get one for $ 250,000. If all this works, they can only accept a new mortgage of about $ 100,000 over 15 years, put $ 150,000 on the house, put $ 25,000 aside as emergency funds and still have $ 15,000 . They could use this $ 15,000 to pay for one of the cars. Their monthly mortgage would be about $ 760. After adding property taxes, insurance, HOA, etc., their monthly expenses would be about $ 1,400 to $ 1,450.

They save about $ 600 a month in internal payments, and they will immediately save $ 400 in car payments. In addition, the house being new and smaller, they would save about $ 150 a month in utilities.

They would still need to reduce their other budget items and save an additional $ 500 without too much sacrifice. With budgeted savings of about $ 1,550, they can finance college savings as well as 16% pre-tax contributions at $ 401,000 and $ 5,000 each for ARIs.

Retirement Planning, Part II: Investing Successfully

The first and most important part of retirement planning is saving enough money and saving early and regularly. It's best done when it's done on autopilot. Being on autopilot means that your investment account is always paid first before you receive money on your checking account to spend essential and non-essential expenses.

The second part of retirement planning is the way you invest the money saved. This is just as important because after all, you can not become rich by sitting on money. You must protect your money against inflation. You must also deal with time. Growth and composition will work wonders for your investment capital over time.

John and Lisa decide to take charge of their investments and implement the following strategy:

Lisa's 401K:

Lisa's company provides a set of funds that she can choose. Lisa decides on the following fund combination. Once this has been put in place, the rest would really be on the autopilot. Each pay check, her contributions will be invested in the proportions chosen by her. As this portfolio is very balanced, it expects to grow about 8% a year over the next 12 years.

- 20% in the S & P 500 fund,

- 20% in the S & P 500 Equal Weight Fund,

- 20% in the Developed International Fund,

- 5% in the Emerging Markets Fund,

- 20% in bonds,

- 10% in Treasury funds.

John's 401K:

John decides to deploy a risk-adjusted strategy in order to make the most of market gains, but at the same time he will hedge the risks in the event that this bull market turns into a bear market. This strategy is discussed in the next section.

IRAs:

Since John and Lisa will fund their IRA each year for $ 5,000 each, they will manage these funds themselves.

Lisa is a fan of DGI (Dividend Growth Investing) and has decided to set up a DGI portfolio (described below).

Investment portfolios:

Lisa's DGI Portfolio for IRAs:

This is the wallet that Lisa will build for John's and his IRA. She decides to build a portfolio of about 20 to 30 prime stocks, which she could theoretically keep for the next 10 to 20 years. Obviously, things will change over time and sometimes it will have to change. All stocks will generally meet the following conditions. However, exceptions can be made sometimes:

- Market capitalization> 20 billion

- The company is either a champion of the dividend or a candidate. This means that the company has paid and increased its dividends for at least 10 years and has never reduced them.

- The yield at the time of purchase is preferably 2%, but exceptions will be made based on dividend growth. The average yield of the portfolio should be above 3%.

- 50% of positions must have experienced strong dividend growth over the past five and ten years.

- The "average" price of the portfolio is at least 10% lower than the 52-week high.

Keeping in mind the above rules, she pre-selects the following 25 actions. The average dividend yield is about 4%, dividend growth over the last five years is 12% and, as a group, these stocks are trading at about 12% below their 52-week highs.

|

Teleprinter |

Price 04/17 |

52 weeks high |

Distance from 52High |

Div. Ans Hist |

Yield% |

RDG 5 years |

DGR 10 years |

first name |

Sector |

|

(AOS) |

55.94 |

66.21 |

-15.51% |

25 |

1.65 |

27 |

19.9 |

A. O. Smith Corp. |

Industrial |

|

(BMY) |

46.02 |

63.69 |

-27.74% |

ten |

3.44 |

2.7 |

2.6 |

Bristol-Myers Squibb Co. |

Health care |

|

(COST) |

245.34 |

247.09 |

-0.71% |

15 |

0.94 |

12.9 |

13.5 |

Costco wholesale |

Consumer Staples |

|

(RE) |

75.12 |

77.5 |

-3.07% |

16 |

4.79 |

8.2 |

7.8 |

Dominion Energy Inc. |

Utilities |

|

(IN B) |

37.11 |

37,69 |

-1.54% |

23 |

6.18 |

10.9 |

12.8 |

Enbridge Inc. |

Energy |

|

(FDX) |

197.23 |

266.67 |

-26.04% |

17 |

1.43 |

31.7 |

18.3 |

FedEx Corp. |

Industrial |

|

(HIGH DEFINITION) |

204.47 |

215.43 |

-5.09% |

ten |

2.83 |

21.4 |

16.4 |

Home Depot Inc. |

Consumer discretionary |

|

(HP) |

61.83 |

74.36 |

-16.85% |

46 |

5.11 |

16.8 |

31 |

Helmerich & Payne, Inc. |

Energy |

|

(HRL) |

40.78 |

46.26 |

-11.85% |

53 |

1.88 |

17.1 |

15 |

Hormel Foods Corp |

Consumer Staples |

|

(ITW) |

157.75 |

160.21 |

-1.54% |

44 |

2.79 |

16.4 |

11.3 |

Illinois Tool Works Inc. |

Industrial |

|

(LMT) |

310.06 |

361.99 |

-14.35% |

16 |

2.93 |

11.4 |

16.2 |

Lockheed Martin |

Industrial |

|

(MTD) |

86.15 |

100.15 |

-13.98% |

41 |

2.2 |

12.2 |

11.9 |

Medtronic PLC |

Health care |

|

(MMP) |

62.56 |

72.9 |

-14.18% |

19 |

6.58 |

12.6 |

10.8 |

Midstream Partners of Magellan |

Energy |

|

(MO) |

56.39 |

66.04 |

-14.61% |

49 |

5.57 |

9.7 |

9.5 |

Altria Group Inc |

Consumer Staples |

|

(MSFT) |

120.77 |

121.65 |

-0.72% |

17 |

1.56 |

12.1 |

14.1 |

Microsoft Corp. |

data processing |

|

(IHO) |

36.08 |

40.3 |

-10.47% |

16 |

6.92 |

7.3 |

8.3 |

Omega Healthcare Investors |

Immovable |

|

(DYNAMISM) |

122.41 |

124 |

-1.28% |

46 |

3.03 |

9.4 |

8 |

PepsiCo, Inc. |

Consumer Staples |

|

(T) |

32.25 |

35.82 |

-9.97% |

35 |

6.51 |

2.1 |

2.3 |

AT & T Inc. |

Communication Services |

|

(TROW) |

106.68 |

127.43 |

-16.28% |

33 |

3.04 |

13 |

11.3 |

T. Rowe Price Group Inc |

Financiers |

|

(TXN) |

116.37 |

118.48 |

-1.78% |

15 |

2.9 |

19.7 |

20.4 |

Texas Instruments |

data processing |

|

(V) |

160.23 |

161.1 |

-0.54% |

11 |

0.64 |

20.4 |

32.6 |

Visa Inc. |

data processing |

|

(VGR) |

10.78 |

19.81 |

-45.58% |

20 |

14.83 |

4.7 |

4.9 |

Vector Group Ltd. |

Consumer Staples |

|

(WBA) |

54.84 |

86.31 |

-36.46% |

43 |

2.78 |

7.3 |

15 |

Walgreens Boots Alliance |

Consumer Staples |

|

(WPC) |

77.14 |

79.75 |

-3.27% |

22 |

5.27 |

5.1 |

7.7 |

W. P. Carey Inc. |

Immovable |

|

(XOM) |

81.2 |

87.36 |

-7.05% |

36 |

4.06 |

5.6 |

7.6 |

Exxon Mobil Corporation |

Energy |

|

Average |

-12.02% |

27 |

3.99 |

12.7 |

13.17 |

John's risk hedging strategy (for 401K):

Since John is implementing this strategy in his 401K, the strategy must be simple and applicable. Most 401K accounts offer a limited number of funds to choose from. John decides to implement such a strategy, which rotates monthly.

The strategy will be invested in one of the following three titles (or equivalent funds), namely:

- Vanguard 500 Index Investor (VFINX)

- Vanguard Inv International Total Stock Index (VGTSX)

- Vanguard Total Bond Market Inv (VBMFX)

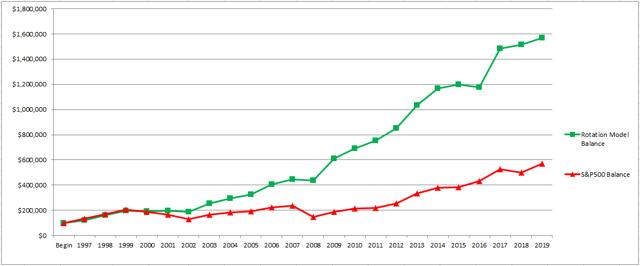

VBMFX is the hedge asset and will only be used when the other two principal securities will not perform well. By deploying this strategy, since 1997, it has generated an annualized return of 13%. In 2008, it was only -4.90% against -37% for the S & P 500. We draw your attention to the fact that the results of tests done in advance do not guarantee results similar to the future, because two periods will not be the same. even. However, the main benefit of using such a strategy would be to limit losses and decreases during recessions and corrections.

Equivalent ETFs that may be used for the above-mentioned mutual funds:

Each month, the strategy will track the performance of the three assets over the previous three months, or approximately 62 trading days, and select the best performing asset. The portfolio will be invested in the best performing asset next month. The process will be repeated every month. Below are the results of pre-tests conducted since 1997 and a comparison of performance with S & P 500. The model portfolio has accumulated nearly three times of the S & P 500 index, mainly due to fewer draws in the down markets of 2001-2003 and 2008-2009.

|

Year |

Rotation pattern return |

Balance model of rotation |

S & P 500 Back |

S & P 500 Balance |

|

To start |

$ 100,000 |

$ 100,000 |

||

|

1997 |

22.37% |

$ 122,370 |

33.19% |

$ 133,190 |

|

1998 |

32.58% |

$ 162,238 |

28.62% |

$ 171,309 |

|

1999 |

20.64% |

$ 195,724 |

21.07% |

$ 207,404 |

|

2000 |

-2.11% |

$ 191,594 |

-9.06% |

$ 188,613 |

|

2001 |

3.39% |

$ 198,089 |

-12.02% |

$ 165,942 |

|

2002 |

-4.91% |

$ 188,363 |

-22.15% |

$ 129,186 |

|

2003 |

35.11% |

$ 254,497 |

28.50% |

$ 166,004 |

|

2004 |

15.80% |

$ 294,708 |

10.74% |

$ 183,832 |

|

2005 |

9.90% |

$ 323,884 |

4.77% |

$ 192,601 |

|

2006 |

25.50% |

$ 406,475 |

15.64% |

$ 222,724 |

|

2007 |

9.37% |

$ 444,561 |

5.39% |

$ 234,729 |

|

2008 |

-2.17% |

$ 434,914 |

-37.02% |

$ 147,832 |

|

2009 |

40.86% |

$ 612,620 |

26.49% |

$ 186,993 |

|

2010 |

12.45% |

$ 688,892 |

14.91% |

$ 214,874 |

|

2011 |

9.19% |

$ 752,201 |

1.97% |

$ 219,107 |

|

2012 |

13.24% |

$ 851,792 |

15.82% |

$ 253,769 |

|

2013 |

21.62% |

$ 1,035,950 |

32.18% |

$ 335,432 |

|

2014 |

12.66% |

$ 1,167,101 |

13.51% |

$ 380,749 |

|

2015 |

2.83% |

$ 1,200,130 |

1.25% |

$ 385,508 |

|

2016 |

-2.10% |

$ 1,174,927 |

11.82% |

$ 431,075 |

|

2017 |

26.28% |

$ 1,483,698 |

21.67% |

$ 524,490 |

|

2018 |

2.21% |

$ 1,516,488 |

-4.52% |

$ 500,783 |

|

2019 |

3.48% |

$ 1,569,261 |

13.62% |

$ 568,989 |

Portfolio values at age 62:

Assumed annual growth of Lisa's 401K: 7.5%

John's annual growth of 401K: 9.5%

Presumed annual growth of ARI: 10.5%

|

Lisa's 401K |

John's 401K |

IRA |

Total |

|||||||

|

Starting capital |

Contribution |

End of capital |

Starting capital |

Contribution |

End of capital |

Starting capital |

Contribution |

End of capital |

(401K + IRA) |

|

|

% Growth |

7.50% |

9.50% |

10.50% |

|||||||

|

Year 1 |

100000 |

$ 13,520 |

$ 121,020 |

100000 |

$ 13,520 |

$ 123,020 |

0 |

10000 |

$ 11,050 |

$ 255,090 |

|

2nd year |

$ 121,020 |

$ 13,520 |

$ 143,617 |

$ 123,020 |

$ 13,520 |

$ 148,227 |

$ 11,050 |

10000 |

$ 23,260 |

$ 315,104 |

|

3rd year |

$ 143,617 |

$ 13,520 |

$ 167,908 |

$ 148,227 |

$ 13,520 |

$ 175,828 |

$ 23,260 |

10000 |

$ 36,753 |

$ 380,489 |

|

4th year |

$ 167,908 |

$ 13,520 |

$ 194,021 |

$ 175,828 |

$ 13,520 |

$ 206,052 |

$ 36,753 |

10000 |

$ 51,662 |

$ 451,735 |

|

5th year |

$ 194,021 |

$ 13,520 |

$ 222,092 |

$ 206,052 |

$ 13,520 |

$ 239,147 |

$ 51,662 |

10000 |

$ 68,136 |

$ 529,376 |

|

Year 6 |

$ 222,092 |

$ 13,520 |

$ 252,269 |

$ 239,147 |

$ 13,520 |

$ 275,386 |

$ 68,136 |

10000 |

$ 86,340 |

$ 613,996 |

|

Year 7 |

$ 252,269 |

$ 13,520 |

$ 284,710 |

$ 275,386 |

$ 13,520 |

$ 315,068 |

$ 86,340 |

10000 |

$ 106,456 |

$ 706,233 |

|

8th year |

$ 284,710 |

$ 13,520 |

$ 319,583 |

$ 315,068 |

$ 13,520 |

$ 358,519 |

$ 106,456 |

10000 |

$ 128,684 |

$ 806,786 |

|

Year 9 |

$ 319,583 |

$ 13,520 |

$ 357,071 |

$ 358,519 |

$ 13,520 |

$ 406,099 |

$ 128,684 |

10000 |

$ 153,246 |

$ 916,416 |

|

Year 10 |

$ 357,071 |

$ 13,520 |

$ 397,372 |

$ 406,099 |

$ 13,520 |

$ 458,198 |

$ 153,246 |

10000 |

$ 180,387 |

$ 1,035,956 |

|

Year 11 |

$ 397,372 |

$ 13,520 |

$ 440,695 |

$ 458,198 |

$ 13,520 |

$ 515,247 |

$ 180,387 |

10000 |

$ 210,377 |

$ 1,166,319 |

|

Year 12 |

$ 440,695 |

$ 13,520 |

$ 487,267 |

$ 515,247 |

$ 13,520 |

$ 577,715 |

$ 210,377 |

10000 |

$ 243,517 |

$ 1,308,499 |

Total savings for Lisa and John at 62:

|

Total contributions |

Growth |

Total |

|

|

Lisa 401K |

$ 262,240 |

$ 225,027 |

$ 487,267 |

|

John 401K |

$ 262,240 |

$ 315,475 |

$ 577,715 |

|

IRA |

$ 120,000 |

$ 123,517 |

$ 243517 |

|

TOTAL |

644,480 |

$ 664,019 |

$ 1,308,499 |

Conclusion:

In the model above, John and Lisa have exceeded their goals by about 30%. Even if they obtained slightly lower yields, they would still reach their target. Some may question the constant rate of return of the portfolios above. We agree that it is almost guaranteed that in some years they will get negative returns and then rise in other years. So we are waiting for them to balance them. Please note that John and Lisa diversify not only in various titles, but also in three very different strategies. We are particularly confident about the long-term performance of the DGI portfolio and the rotation portfolio using SPY / VTI / TLT.

The importance of a high savings rate is no doubt. In addition, it is important to save early. Another message is the importance of investment growth. Growth is directly proportional to the duration of these investments. Of the final total of $ 1.3 million accumulated, their own contributions amounted to about 50%, to $ 644,000, not including $ 664,000 in growth. Saving and sound investing are the two feet of the three-legged retirement stool, the third being social security.

High Income DIY Portfolios: The main objective of our market service "High Income DIY Portfolios" is high income with low risk and preservation of capital. It provides independent investors with essential information allocation strategies and portfolios / assets to create stable long-term passive income with sustainable returns. We think this is suitable for investors looking for income, including retirees or near-retirees. We offer six portfolios: two high-income portfolios, one DGI portfolio, a conservative 401K strategy, a sector rotation strategy and a high-growth portfolio. For more details or a free two week trial, please click here or on the picture below our logo above.

Disclosure: I am / we have long been ABT, ABBV, JNJ, PFE, NVS, NVO, CL, CLX, GIS, UL, NSRGY, PG, KHC, ADM, MO, PM, BUD, KO, EPP, D, DEA, DEO , ENB, MCD, BAC, UPS, WMT, WBA, CVS, BAS, AAPL, IBM, CSCO, MSFT, INTC, T, VZ, VOD, XOM, VLO, ABB, ITW, MMM, LYB, HCP, HTA, O , OHI, VTR, NNN, STAG, WPC, HAND, NLY, ARCC, DNP, GOF, PCI, PDI, PFF, RFI, RNK, STK, UTF, EVT, FFC, HQH, KYN, NMZ, NBB, JPS, JPC , JRI, TLT. I have written this article myself and it expresses my own opinions. I do not receive compensation for this (other than Seeking Alpha). I do not have any business relationship with a company whose actions are mentioned in this article.

Additional disclosure: The information presented in this article is for informational purposes only and should in no way be construed as financial advice, a recommendation to buy or sell shares. Please always do more research and do your own due diligence before investing. Every effort has been made to present data / information accurately; However, the author does not claim 100% accuracy. Any stock portfolio or strategy presented here is for demonstration purposes only.

[ad_2]

Source link