[ad_1]

The positive hangover in Friday’s blowout jobs data could fade as investors greet the start of a new week with new concerns over the spread of COVID-19.

Goldman Sachs warns that the Chinese economy will be hit by this virus and that it does not help oil prices, which are collapsing this morning. Stock futures are mixed and gold is also drinking after a so-called “lightning crash” in Asian trading.

Our call of the day BTIG’s chief equities and derivatives strategist Julian Emanuel and equity strategy partner Michael Chu predict more drama as the pair warns of a near-term high for the S&P 500, stocks even being the possible trigger.

They are pointing the finger at a so-called ‘Money Wall’, made up of fiscal and monetary stimulus, which has helped boost stocks, commodities, houses and inflation, and in a countervailing fashion. intuitive, bonds, sending real yields to 1970s lows.

“While not unequivocally negative for equities, such low real returns have invariably resulted in high volatility over the medium term,” said Emanuel and Chu. Their basic scenario remains that the stock market rally will stop in the third quarter as volatility increases.

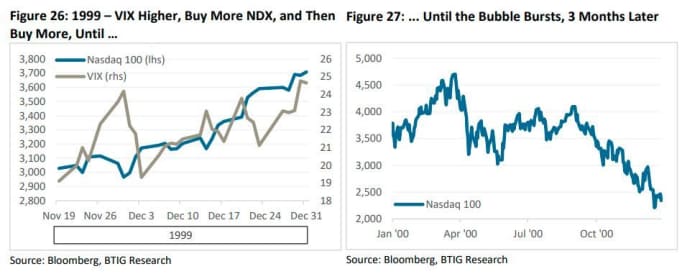

“Yet the dramatic price action of old and new ‘memes’ stocks increases the likelihood that higher volatility could result in a ‘altered reality’ exception – an exception that has only been observed in the past. late 1999, near the peak of the tech stock market bubble, ”they said. . By “altered reality” they mean negative real rates, record fiscal and monetary accommodation, record margin debt and higher core inflation.

In other words, volatility and stocks cannot continue to rise happily together, something has to give way. They are watching one level in particular on the S&P 500.

“We see a break above 4,500 capable of triggering ‘epic emotional pressure’ much like the end of 1999; it would be easy to envision another rally over 5% in the space of a week or two. After a year of targeted efforts by traders on social media, could the “same stock” dynamic become a more mesmerizing effect, “forcing” active managers and shorts to “hunt”… echoing the climatic increase of 1999-00? “

The pair also says it’s possible the market could go the other way, losing 10% if the S&P 500 breaks its 50-day moving average of 4,300, a level that held until 2021.

Grim UN climate report, Goldman sees problems in China

The $ 1,000 billion bipartisan infrastructure package was pushed back Sunday night by a coalition of Democrats and Republicans, with a final vote being held on Tuesday.

The highlight of this week’s data schedule will likely be Wednesday’s consumer price data (see preview), with jobs coming up for Monday.

DraftKings DKNG,

says he’s buying Golden Nugget Online Gaming GNOG,

in an all-stock deal valued at $ 1.56 billion. Sanderson Farms SAFM,

Shares are climbing after the chicken farmer announced a $ 4.53 billion deal to be bought by a joint venture Cargill and Continental Grain.

A damning UN report on climate change warned of a “code red for humanity,” with temperatures forecast to exceed a level of warming that world leaders were trying to prevent, in just a decade.

Goldman Sachs warns that the delta variant spread will hit the Chinese economy fairly hard in the third quarter, although a rebound is seen towards the end of the year. China has reportedly punished at least 30 officials in areas where COVID-19 has spread rapidly. as Gao Qiang, former Chinese health minister, warned that there would be no “coexistence” with the virus.

A study in Israel shows that those who received a booster of Pfizer’s PFE,

The COVID-19 vaccine experienced the same or similar effects as those who received the second dose.

Chinese company ByteDance, which owns the popular social media app TikTok, reportedly plans to go public in Hong Kong next year, despite regulatory pressure from Beijing.

Gangrene and hallucinations: the last days of Bernie Madoff, the man behind the biggest Ponzi scheme in history, according to his prison medical records. Discover the exclusive story of MarketWatch.

Table

GCZ21 Gold Price,

is down around $ 13 to $ 1,750 an ounce after falling 5% in just a few minutes on Asian trading. Prices are at their lowest level since March. SIU21 silver,

has seen an equally dramatic drop to $ 22.28 an ounce, and is down more than 1% to $ 24 an ounce. Friday proved difficult for precious metals following bullish employment data.

“Traders have been rocked by the odd behavior of gold in recent weeks when lower yields failed to raise the price, while last week’s small rally in yields triggered an immediate negative response and strong, “said Ole Hansen, head of commodities trading at Saxo Bank, on Twitter. He said Wednesday’s US inflation data could decide gold’s next round.

The steps

Equity futures are mixed, with Dow YM00 futures,

down 100 points, but those of the Nasdaq-100 NQ00,

slightly. US CL00,

and Brent BRN00 crude,

are down 4%, continuing a decline seen after Friday’s employment data and growth concerns surrounding the virus. Bitcoin BTCUSD,

holds after nearly hitting its 200-day moving average on Sunday.

Random readings

China’s rebellious elephants return home

Need to Know starts early and is updated until the opening bell, but sign up here to receive it once in your inbox. The emailed version will be sent at approximately 7:30 a.m. Eastern Time.

Want more for the day ahead? Sign up for Barron’s Daily, a morning investor briefing, featuring exclusive commentary from the editors at Barron’s and MarketWatch.

[ad_2]

Source link