[ad_1]

Optimism is in the air for Tuesday, as the formal transition process for President-elect Joe Biden gets the nod from the current White House administration, and former Federal Reserve Chairman Janet Yellen drew some cheers from Wall Street as appointed Secretary to the Treasury.

Not everyone is excited about her, however: “Yellen’s long career spans from academics to economic adviser to presidents, then to Fed chief, and now to chief economic officer. for a president, hasn’t exactly straddled a concomitant period of relative American economic rise – or at least not for the majority of its population, ”Michael Every, global strategist at Rabobank, told clients in a note.

Politics aside, Wall Street’s 2021 stock forecast spills over and some paint a bullish picture, like JPMorgan’s forecast that the S&P 500 will hit 4,500 by the end of 2021, or the target of Goldman Sachs 4600 for year end – 28% above end of 3.577.

Our call of the day, from independent investment bank Stifel’s head of institutional equities strategy Barry Bannister says Wall Street may be a little too optimistic about the height of the index as the world emerges from the pandemic COVID-19.

“Short-term risks include slower growth (budget delay) and a flatter yield curve, lower EPS 2021 [earnings per share] consensus and disruptive effects in 2021 if the dollar does weaken, ”Bannister told clients in a note. A flattening of the yield curve may indicate economic uncertainty.

Bannister said the team’s S&P 500 EPS estimate was 10% lower than Wall Street’s, and if that consensus worsens, growth stocks tend to tip in favor.

“Despite enthusiasm for a value / growth cycle, the characteristics of this shift may be a case of ‘be careful what you want’ such as populism, currency degradation, a greater role for the federal government in GDP [gross domestic product] and the long march towards a geopolitical conflict is the norm, ”said the director of Stifel.

Some of the optimism on Wall Street is shrouded in a widespread rally for growth and value stocks. The latter group, unloved for years, has recently sparked the love of investors in hopes that the economy could grow.

What Bannister is waiting for is the so-called reflation swap, the idea that stronger growth and inflation will benefit these stocks or cyclical stocks, will not last. Consequently, this rotation can come to a stop in its tracks.

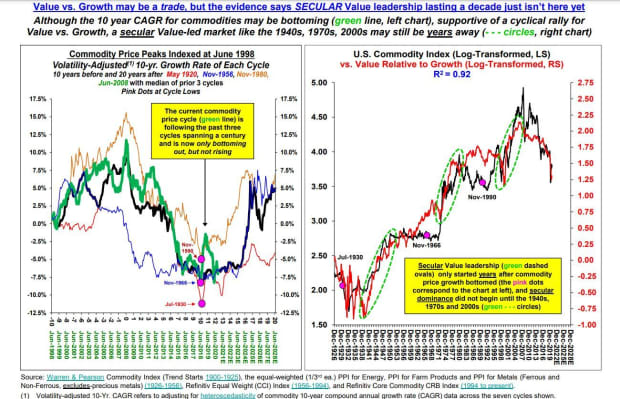

And Bannister is also pouring cold water on the idea that investors are seeing the start of a secular rotation, which tends to last a decade or more, in these valuable stocks and away from their growth rivals.

The critical point for investing in value stocks is the commodity price trough, which is just beginning to occur, the team said. Secular value leadership began in the past “years” after commodity prices bottomed out, the team noted, so investors can wait so long for another to begin, he said. declared.

Stifel

The steps

ES00 futures contracts,

NQ00,

are higher, led by those of the Dow YM00 industrialists,

European stocks are winning as well and Asian markets are strong as well. It’s like the DXY dollar,

and or GC00,

withdraw.

Table

The Russell 2000 RUT Index,

Small-cap companies continue to strengthen as investors turn to stocks that play on the economic recovery as news about the COVID-19 vaccine streams in. This decision is only just beginning, some say:

Lily: “Goldilocks” funds? Midcap ETFs may be about to have their moment

The buzz

Smucker SJM Food Group,

Rising estimates and exceeding forecasts, while shares of consumer electronics retailer Best Buy BBY,

are down even after optimistic results. Elsewhere at retailers, shares of Abercrombie ANF,

are booming on a surprise profit, Dick’s Sporting Goods DKS,

are also up on optimistic results and Dollar Tree DLTR,

stock also benefited from its results.

The revenues of Dell DELL personal computer manufacturers,

and HPQ HPQ,

are expected after the close.

Elon Musk, the head of electronic car company Tesla TSLA,

is now the second richest person in the world.

As U.S. healthcare workers and officials brace for Thanksgiving-related infections, with two million people passing through airports this past weekend, in the UK and France, plans are underway to ease the restrictions in time for Christmas.

Financial aid could help ease anti-mask attitudes, says Dr Celine Gounder, Biden’s coronavirus advisor. And the International Air Transport Association claims to have created a digital pass to provide COVID credentials at airports.

Chess is hot. A record 62 million households watched “The Queen’s Gambit” in the first 28 days, according to streaming video giant Netflix NFLX,

Case-Shiller home prices and a consumer confidence index are ahead.

Random readings

Evidence from aliens or artists in the Utah desert?

The University of Cambridge Library learns that the priceless notebooks of 19th century scientist Charles Darwin have been missing for 20 years.

[ad_2]

Source link