[ad_1]

Do you want to participate in a short research study? Help us shape the future of investment tools and receive a $ 20 prize!

In 2011, Larry Merlo was appointed CEO of CVS Health Corporation (NYSE: CVS).

This report will first review CEO compensation levels relative to those of other large companies.

After that, we will look at the growth of the company.

Finally, we will consider how common shareholders have behaved in recent years as a secondary measure of performance.

The purpose of all this is to examine the relevance of CEO compensation levels.

See our latest analysis for CVS Health

How does Larry Merlo's compensation compare with companies of similar size?

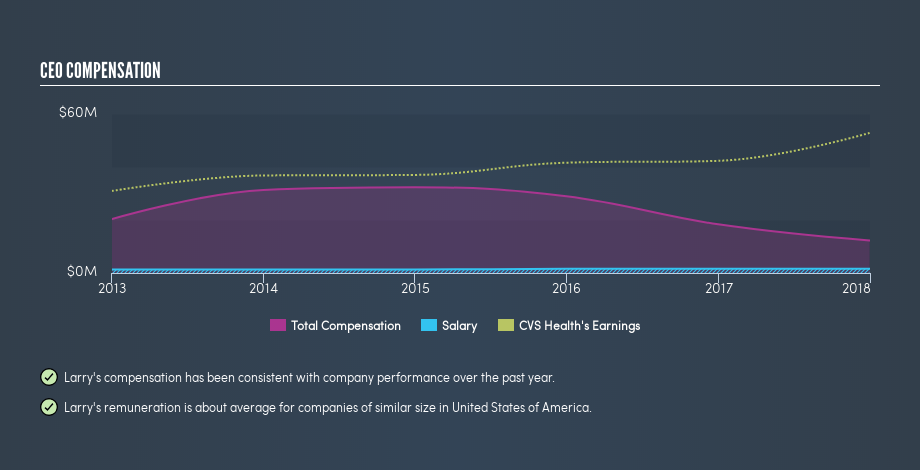

According to our data, CVS Health Corporation has a market capitalization of $ 83 billion and pays its CEO a total annual fee of $ 12 million.

(This is based on the year up to 2017).

Although this analysis focuses on total compensation, it should be noted that the salary is lower, valued at $ 1.6 million.

When we examined a group of companies with market capitalizations greater than US $ 8.0 billion, we found that their median compensation for CEOs was US $ 11 million.

Once you start looking at very large companies, you have to choose a wider range because they are simply not numerous.

This means that Larry Merlo receives a fairly typical salary for the CEO of a large company.

This fact alone does not tell us much, it becomes more relevant when compared to the performance of the company.

The chart below shows the evolution of CEO compensation at CVS Health from year to year.

Is CVS Health Corporation growing?

Over the last three years, CVS Health Corporation has reduced its earnings per share by 1.2% on average per year (measured using a line of best fit).

In the last year, its revenues increased by 3.1%.

The lack of earnings per share growth over the past three years is unimpressive.

The modest increase in sales last year is not enough to make me forget the disappointing evolution of earnings per share.

These factors suggest that the company's performance would not really justify a high salary for the CEO.

You might want to check out this free visual report on analyst forecasts for future earnings.

Has CVS Health Corporation been a good investment?

Given the 30% total loss over three years, many CVS Health Corporation shareholders are probably rather unhappy, to say the least.

So the shareholders would probably think that the company should not be too generous with the CEO's compensation.

In summary…

Larry Merlo is paid for what is normal for big business executives.

Returns have been disappointing and the company is not increasing earnings per share.

Most would consider it prudent for the company to delay any increase in the CEO's salary until performance improves.

If you think that the CEO's compensation levels are interesting, you will surely enjoy this free insider trading visualization at CVS Health.

Important note: CVS Health may not be the best stock to buy. You could find something better in this list of interesting companies with high ROE and low debt.

Our goal is to provide you with a long-term research analysis based on fundamental data. Note that our analysis may not take into account the latest price sensitive business announcements or qualitative information.

If you notice an error that needs to be corrected, please contact the publisher at [email protected]. This article from Simply Wall St is of a general nature. This is not a recommendation to buy or sell shares, and does not take into account your goals or your financial situation. Simply Wall St has no position on the actions mentioned. Thanks for the reading.

These excellent dividend stocks beat your savings account

Not only have these stocks been reliable dividend payers for 10 years, but, with a return of more than 3%, they also easily beat your savings account (not to mention the potential gains). Click here to view them for free on Simply Wall St.

[ad_2]

Source link