[ad_1]

Jeffrey Gundlach at the SOHN 2019 conference in New York on May 6, 2019.

Adam Jeffery | CNBC

DoubleLine CEO Jeffrey Gundlach is betting on gold.

"I'm definitely a long gold," Gundlach told a web cast of investors Thursday. He added that his trade is based on the hope that the dollar will end the year down.

When the dollar weakens, gold tends to appreciate as it becomes cheaper for investors holding other currencies.

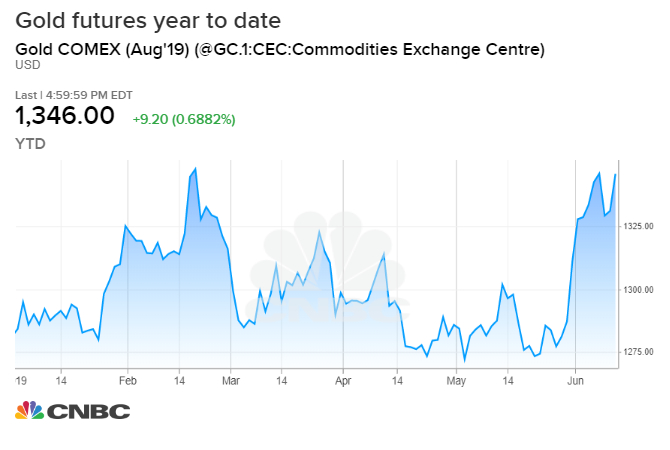

The price of gold reached its highest level in three months in June, as investors fled to bullion safe havens due to escalating trade tensions. At the same time, the dollar fell to its lowest level for 11 weeks on Wednesday, as the market bet more and more on a rate cut in the coming months.

The so-called king of bonds noted that 2019 was "the opposite of 2018" because gold, bitcoins, stocks and bonds are all profitable.

Despite the trade war, the S & P 500 is still up more than 15% this year, while the 10-year Treasury yield has fallen to its lowest level since 2017 this month. The benchmark return also fell below the 3-month note return, reversing a portion of the yield curve. The reversal of the yield curve is a reliable recession signal closely monitored by the experts and the Federal Reserve.

Gundlach now sees a recession probability of 40% to 45% over the next six months and 65% over the next year. He pointed to several indicators that are flashing, including the gap between expectations of consumer confidence and the current situation, which is almost at a low ebb.

The director also sounded the alarm about the "rising" deficit in the US, which could be "even worse in the next recession". He noted that despite low interest rates, interest on US debt as a percentage of GDP is expected to hit a record high.

Gundlach, a respected market forecaster, oversees $ 130 billion in assets under management at DoubleLine, according to its website.

A commercial call that he made in May to take advantage of the volatility of the bond market yielded more than 20%.

[ad_2]

Source link