[ad_1]

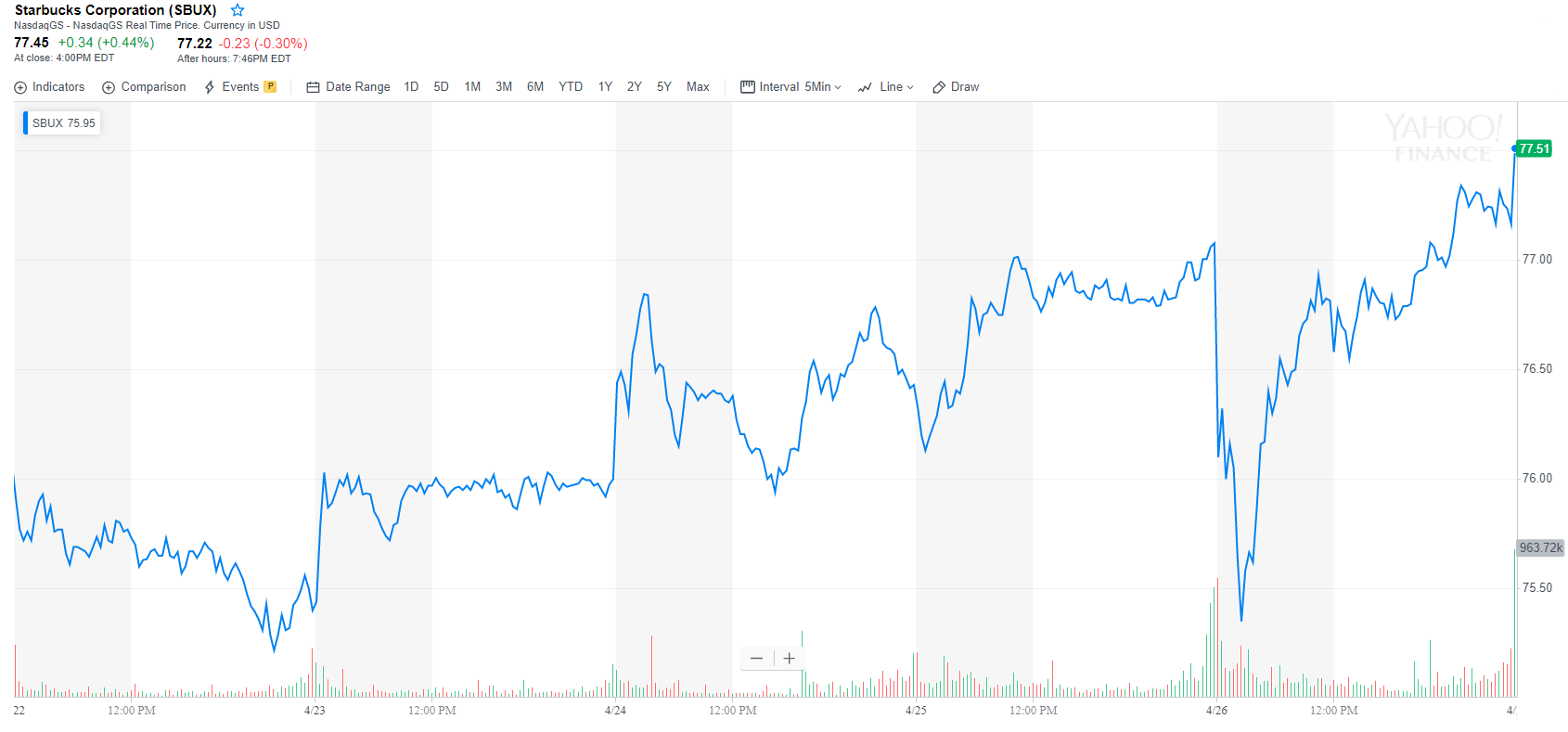

Starbucks is trading at a new high. | Source: Yahoo Finance

Long-term gains for Starbucks action

The fact that Starbucks' comparable store sales grew 4% in the United States, even after all those years, is a miracle. Note that this increase is due to pricing power and not an increase in pedestrian traffic. This is not a bad thing. This means that Starbucks is extremely loyal to its brand, and that people are willing to pay 4% more for their products, which translates into an increase in SBUX stocks in the long run.

Grismer: The main factors in the growth of sales of comp. Americas during the quarter have been improving in-store experience and strengthening the platform for beverages. $ SBUX

– Stories from Starbucks (@Starbucksnews) April 25, 2019

These increases come despite the fact that Starbucks now has 30,184 stores worldwide.

Turnover and profits up, SBUX stock up

Revenues reached $ 6.3 billion, up 5% from the previous quarter. Earnings reached $ 0.60 per share, up 13% from the previous quarter.

Mature companies such as Starbucks, which are able to generate a revealing earnings growth of 13% more than the previous year, are simply extraordinary. Most mature companies tend to become what Peter Lynch, the legendary mutual fund manager, called pillars. We expect single digit growth.

The fact that Starbucks is still generating double-digit growth is a testament to the company's outstanding central concept.

This concept is not what most people believe it is. The secret of Starbucks is not the quality of its coffee, tea or dishes. Some of them are remarkable, but the most serious coffee drinkers will insist that Starbucks coffee is not very good.

The Starbucks concept, as envisioned by Howard Schultz, was to provide people with a place to meet work and home – a place that serves as an addictive product. Before Starbucks, people had no default place to meet.

Since the creation of Starbucks, this default location now exists. Not only that, these places exist globally and are literally everywhere. SBUX's stock market performance proves that the concept works.

If two people are to meet somewhere, the easiest way is to simply say, "I'll meet you at Starbucks at the corner of this street and this street."

This partly explains why the Starbucks Rewards loyalty program has grown to 16.8 million people across the country, a 13% increase over the previous year. This also explains how the Americas were able to absorb 686 new store openings and why China has seen a dramatic increase of 998 new stores.

Johnson: China recorded 3% sales growth for the quarter, up from 1% in the first quarter, and opened 553 new net stores in the last 12 months, an annual growth rate of 17% $ SBUX

– Stories from Starbucks (@Starbucksnews) April 25, 2019

Among SBUX's other astonishingly strong figures is operating profit of $ 231.7 million, up 13% from the same quarter last year. Operating margin jumped 80 basis points to 18%, primarily due to sales leverage and cost reduction initiatives.

The insidious challenge

The only geographical area where SBUX is in difficulty is in Europe and the Middle East. Net revenues in this region fell by 9% and the region recorded an operating loss of approximately $ 3 million.

The challenge for SBUX in the European zone is that Europe had a pre-existing coffee culture. Europeans like their coffee. European coffee is exceptional. Starbucks will always have a tough battle there. Italy, for example, has only one store.

[ad_2]

Source link