[ad_1]

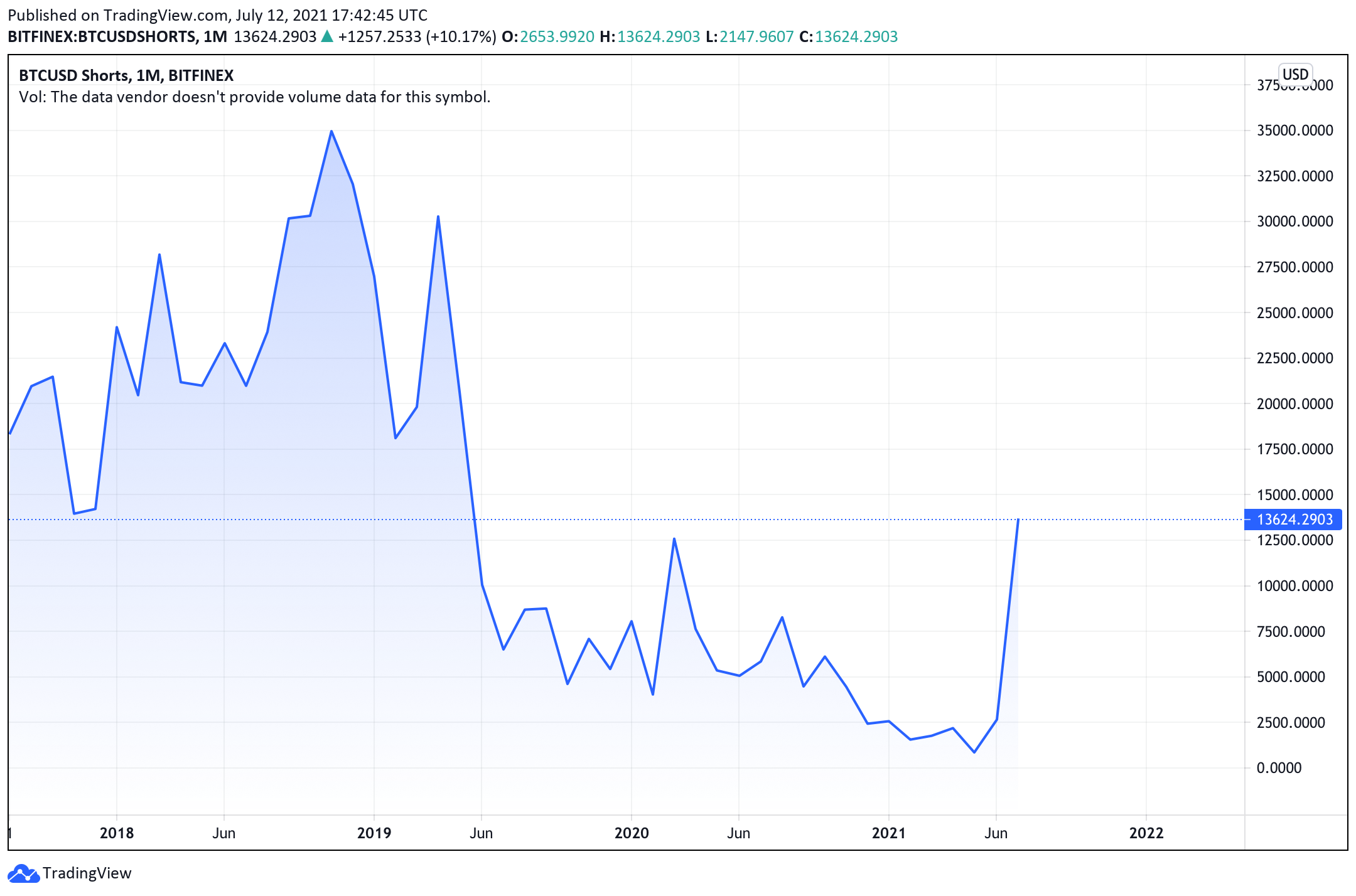

The total market cap of the 10,800 existing cryptocurrencies is down 2.8% on Monday, with bitcoin losing more than 2.4% in the past 24 hours. Meanwhile, bitcoin shorts are rising again after bitcoin shorts hit a two-year high on the Bitfinex derivatives exchange on June 25.

Bitcoin shorts climb higher

Bitcoin (BTC) and digital markets in general have seen better days as BTC hit an all-time high above the $ 64,000 handle three months ago, but is still down 48. 66% since then. About 17 days ago, on Bitfinex, the number of BTC / USD short positions skyrocketed to levels not seen since June 17, 2019.

About 20 days ago, BTC hit its lowest price in some time at $ 28,600 per coin, and today the cryptocurrency is only 13.72% up from that. low prices. Now, after the June 25 peak in short positions, things improved on June 27 and the shorts have remained low. Today, however, the short positions held on Bitfinex are starting to rise again and some onlookers believe this is a bearish signal.

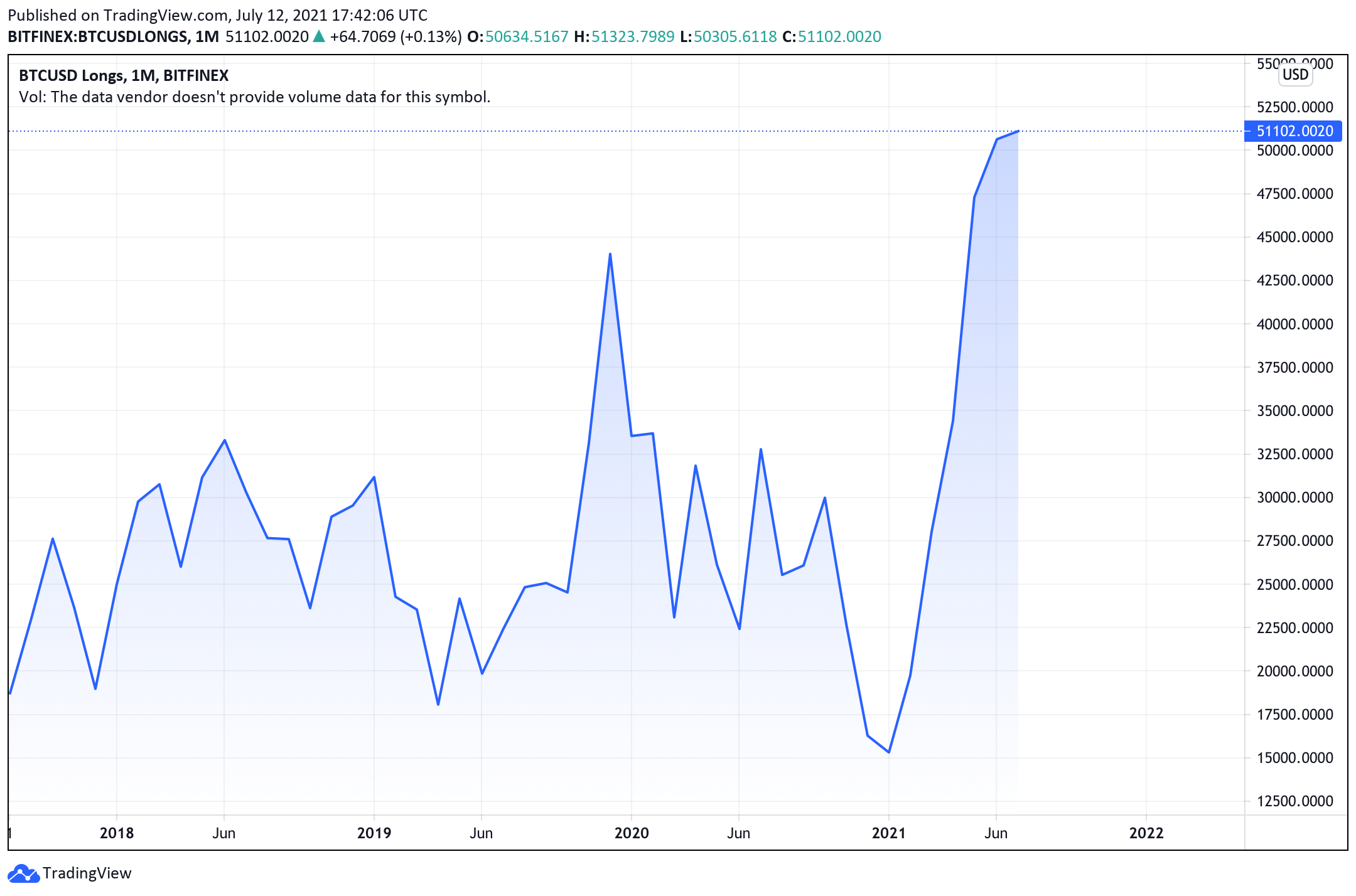

At the time of writing, the BTC / USD shorts recorded on the Bitfinex derivatives exchange have reached at least half of the high recorded on June 25. Over 13,600 BTC / USD shorts were recorded while BTC / USD long positions on Bitfinex broke all-time highs.

51,000 Bitcoin long positions hope for a quick pump

More than 51,100 long positions on the exchange have been played so far on Monday and both long and short positions continue to climb. The number of long positions doesn’t necessarily give a bullish impression either, but it does show some optimistic sentiment, one where market participants are hoping for a rise in the future.

Ethereum’s short chart pattern is a bit different from bitcoin’s, as shorts have been rising lately, but have also started falling today. ETH / USD long positions also show a different path than current BTC long records on Bitfinex, as ETH / USD long positions on the derivatives exchange are weak on Monday.

Etoro market analyst Simon Peters attributes much of the carnage in the crypto market to problems with digital currency mining in China and the regulatory climate around the world.

“Both crypto assets (BTC and ETH) have been hit by crypto crackdowns in China and regulatory changes in different jurisdictions around the world,” Peters said in a note to Bitcoin.com News on Monday.

Bitcoin’s breakout will come, but not now.

– As said yesterday, Bitcoin shorts continue to rise.

– No notable releases on the channel.

– Major levels of $ 31,000 and $ 36,000.No need to get chopped, patience pays off.

– Joseph Young (@iamjosephyoung) July 12, 2021

The number of BTC / USD shorts may also not be considered bearish as a short squeeze could be in the charts. A “short squeeze” in the BTC / USD markets is not unusual and when it does, it sets off an extremely fast pump that leaves short sellers in the dust and the land of liquidations. Usually, short cuts occur in the bitcoin trading world when an unusually high number of BTC / USD short positions are registered.

The same can happen to those who play long in what is called a “long squeeze”. Likewise, a large and sudden drop in the value of bitcoin prompts panic selling and longs are also forced to liquidate.

What do you think of the current rise in short positions and large long positions right now? Let us know what you think of this topic in the comments section below.

Image credits: Shutterstock, Pixabay, Wiki Commons, Tradingview, datamish.com, Twitter,

Warning: This article is for informational purposes only. This is not a direct offer or the solicitation of an offer to buy or sell, nor a recommendation or endorsement of any product, service or business. Bitcoin.com does not provide investment, tax, legal, or accounting advice. Neither the company nor the author is responsible, directly or indirectly, for any damage or loss caused or allegedly caused by or in connection with the use of or reliance on any content, good or service mentioned in this article.

[ad_2]

Source link