[ad_1]

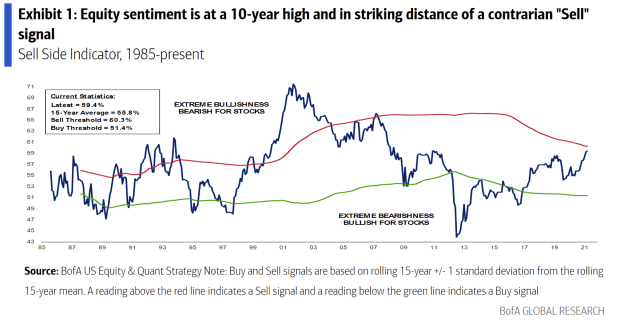

The best on Wall Street are so bullish on stocks that a contrarian sentiment gauge is about to send a sell signal.

BofA analysts led by Savita Subramanian said in a note on Thursday that the bank’s sell-side indicator, which tracks the average equity allocation recommended by Wall Street sell-side strategists, has risen. for a third consecutive month in March to reach 59.4%, against 59.2%. in February.

This puts the indicator at a 10-year high and within one point of a contrarian “sell” signal, its closest since May 2007, when the S&P 500 SPX index,

fell 7% over the next 12 months (see graph below).

BofA Global Research

Investors and analysts are paying close attention to a range of sentiment measures. Extreme bullish or bearish readings are often seen as contrarian signals that markets are due to bounce or pull back.

The S&P 500 on Thursday broke the 4000 mark for the first time, while the Dow Jones Industrial Average DJIA,

traded not far from its all-time high. U.S. stocks rebounded in the first quarter, with cyclically sensitive stocks leading the way as aggressive fiscal stimulus and rapid vaccine deployments fueled expectations of a post-COVID economic boom.

“The increasingly euphoric feeling is a key reason for our neutral perspective, because the cyclical rebound, the vaccine, the stimulus, etc. are largely integrated into the market, ”the analysts wrote. Stocks rebounded sharply after plunging into a bear market that hit a low last March as the pandemic began to set in.

Analysts noted that since last March, the recommended average allocation to stocks has risen more than three times the usual rate. It has risen 450 basis points, or 4.5 percentage points, over the past 12 months, compared to 138 basis points on average after previous bear markets.

“We found the uptrend on Wall Street to be a reliable contrarian indicator,” they wrote.

For now, the indicator remains in “neutral” territory. What does this mean for returns?

Analysts noted that when the indicator was at or below its current level, subsequent 12-month returns were positive 89% of the time. While encouraging, they observed that the indicator’s current reading is in line with 12-month returns of just 6%, well below the 12-month average forecast of 14% since the end of the crisis. Global Financial 2008, adding the standard Caution, past performance is no guarantee of future results

Analysts said investors would be better served by focusing on areas sensitive to the real economy, including cyclical and value stocks, beneficiaries of capital expenditures and small caps as President Joe Biden attempts to implement its $ 2 trillion infrastructure spending plan.

“But that’s not all blue sky. The market already appears to be planning for further stimulus and the focus is on repayment (ie higher taxes), ”they warned. “Today’s valuations are signaling anemic long-term returns and rising rates are also a headwind for income investors, who have piled up on equities amid low rates, and on margin margins. companies. “

They also see room for maneuver for a resumption of volatility in the second half of the year. That said, “staying invested is an underrated way to avoid losses,” they wrote, focusing on fundamentals rather than momentum and winning positioning factors in the long run. A focus on quality stocks, which are “cheap and overlooked” can also provide a hedge against volatility, they said.

[ad_2]

Source link