[ad_1]

The plan will have a long-term impact on the future of the aviation industry.

The share-purchase in India's biggest full-service private carrier needs the backing of Tata Sons' board and its controlling shareholder, Tata Trusts. The move clearly indicates the airline's interest in Jet, and would be its third investment in the country's aviation sector since the 2013 launch of Air Asia India, a budget carrier, and Vistara, a full-service airline.

TOI broke the story about the Tatas

significant stake in Jet in its October 18 edition.

+

People with knowledge of the subject said that after his initial resistance, Jet Airways chairman Naresh Goyal is coming around to the idea of ceding management control, though he is likely to insist on retaining a stake in the company. founded 25 years ago. Abu Dhabi's Etihad Airways, which owns 24% in Jet, is yet to reveal its plans for the exit of the consolidation deal with Vistara. This e-mail is sent to the editor.

The broader plan could include combining Jet Airways and Vistara, in which Tata Sons holds 51% and its foreign partner Singapore Airlines the balance 49%. This is a new way of doing business in the future. Buyout investor TPG remains in the fray for Jet though discussions with Tatas are reliably learned to have progressed significantly.

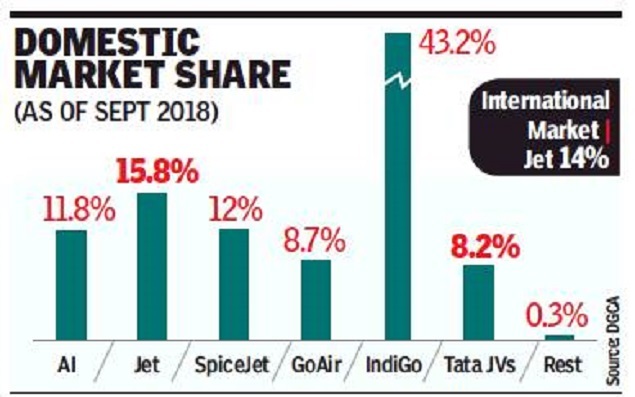

The Jet deal would give the House of Tata a combined market share of 24% in the country. Jet, with a fleet of 124 aircraft, has a domestic market share of 16% and around 14% on international routes. Air Asia India and the 22-fleet Vistara have market shares of 4% each in the country; une route internationale. The transaction would also give the Tatas a wide network of busy airports around the world.

Tata Sounds' plan is to have a majority control in Jet, which has a market valuation of Rs 2.928 crore. Goyal holds 51% in the airline, which has a debt of Rs 8,600 crore. An acquisition of 25% in Tata Sons would need to make an additional 26% to public shareholders.

For Jet, the transaction with Tata Sons would

ease its dire financial situation

+ which has caused delays in the payments of employees and payments to aircraft leasing companies. There's plenty of interest in the Jet Airways brand, the company's CFO Amit Agarwal said recently, without commenting on Tata Sons' interest in buying a stake in the carrier.

Interestingly, Tatas and Jet Airways have been reported to have been reported by the United States of America in the United States. new carriers – Air Asia India and Vistara – in 2016.

The Tata-Jet deal is expected to dwarf Jet's acquisition of Air Sahara in April 2007 for Rs 1,450 crore, and Kingfisher's purchase of 26% in Air Deccan in June 2007 – followed by an open offer – at a valuation of Rs 2,200 crore.

Read this story in Marathi

Source link