[ad_1]

"These reserves are meant to be used during times of stress and not to meet normal needs," Patel told the Standing Committee on Finance.

The governor's comments to the commission are important because the question of the level of reserves to be maintained was one of the critical points in the fierce battle between the central bank and the government.

This is the first time Patel has commented on the issue since

YOU broke the story

+ the stalemate between the RBI and the government.

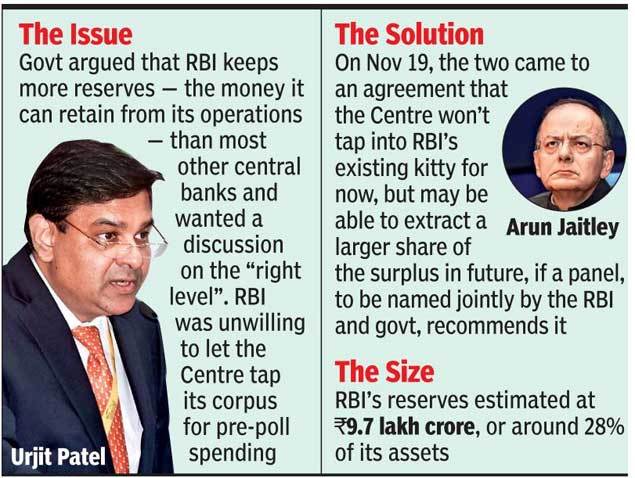

The RBI argued that a large part of the reserves – estimated at about Rs.9.7 million or about 28% of its badets – are notional and should not be disturbed.

At the RBI board meeting last week, RBI officials agreed to define the level of reserve that the central bank could set up, but the decision on a higher transfer was not made. will apply only to subsequent increases and this also if a committee recommends it.

The committee must be set up jointly by the Ministry of Finance and the RBI.

Patel's remarks reflect RBI's position that the current level of reserves is necessary to guard against shocks such as the price of oil, the depreciation of the rupee or the exit of foreign investors from the stock market.

Last week, Finance Minister Arun Jaitley said that the Center's financial situation was comfortable and that there was no need to transfer money from RBI. Even on Tuesday, Patel told the parliamentary committee that there was no stress in the economy.

"The Impact of the DeMon Transient"

At Tuesday's standing committee meeting, many questions were put to Urjit Patel by opposition members, such as the leaders of Trinamool, Saugata Roy and Dinesh Trivedi, and the Congress Digvijay Singh on "Erosion". of RBI's autonomy in light of recent tensions with the government. Patel said he would submit written answers in a few weeks.

BJP MP Nishikant Dubey sought to counter opposition MPs, saying that a council for financial stability and development had been set up by Manmohan Singh's government, showing the former prime minister among the participants.

A discussion of the level of reserves was one of the many issues addressed by the Center with RBI. The government wanted a relaxation of the Rapid Corrective Action (BCP) framework for fragile banks, which would lead to a tightening of credit, as well as specific measures to help struggling small and medium-sized enterprises and measures to help non-financial corporations. banking deal with a liquidity crisis.

The group also discussed the effects of demonetization, Mr. Patel claimed that its effects were transient. This measure was followed by an increase in digital transactions and a healthy growth of credit. Patel said that the cash-to-GDP ratio was lower than it was before, that credit flows had increased by more than 15% and that inflation was well under control around 4%. The figures published Tuesday by the RBI showed that the support of banks to the business sector amounted to 97,325 crores of rupees on November 9, an increase of 15.6% year on year.

The group's deputies sought to interrogate the RBI governor about recent discussions with the government, but it appears that Patel had stated that he would respond in writing in about two weeks. Several deputies and former ministers and Veerappa Moily, president of the Congress, attended the meeting.

Source link