[ad_1]

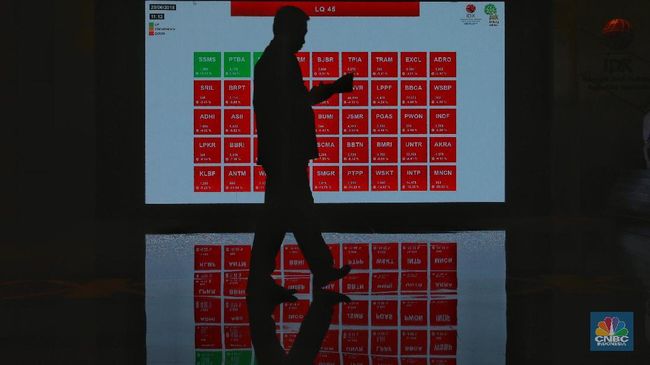

Jakarta, CNBC Indonesia – The current exchanges on the country's stock market look like a roller coaster. Starting the day with a weakening of 0.34% at 6,002.39, the compound stock index (IHSG) was punctuated several times in the green and red zones, before closing a slight rise of 0 , 03% at the end of session 1 until 6,024, 49

When entering session 2, the story is always the same. JCI seems confused in determining the direction of its movement. It was not until 3:00 pm WIB that JCI was comfortable in the red zone and finally closed down 0.15% to reach the level of 6,013.59.

The value of the transaction was recorded at 9.3 billion rupees for a volume of 10.9 billion share units. The frequency of transactions is 446,890 times.

The fate of JCI was consistent with major Asian stock markets, which were also trading in the red zone: the Shanghai index had lost 0.04%, the Hang Seng index had lost 0.17% and the Straits Times index had lost 0.17%.

The heat of the trade war between the United States and China managed to kneel the stock market of the Yellow Continent. The President of the United States, Donald Trump, said that he would likely execute a plan to increase import duties for products from China worth US $ 200 billion. .

Previously, these items, worth 200 billion US dollars, were subject to a 10% import duty, valid from September. The Trump Administration has indeed declared that import duties would increase to 25% on 1 January 2019.

Trump also said that he was preparing to impose a new import duty on an additional $ 267 billion of Chinese products if the meeting with Chinese President Xi Jingping on the sidelines of the G-20 summit at the end of the month had not resulted in an agreement, cited by Bloomberg. launched the Wall Street Journal publication. According to Trump, the amount of import duties can be 10% or 25%.

Unfortunately, at the same time, market players are increasingly convinced that the Federal Reserve will lift the key rate at the end of the year.

Citing the official website of the CME Group, which is the world's leading derivatives market manager, based on the Fed Fund's November 26, 2018 futures contract price, the possibility that the Fed will raise its key rate by 25 percent. base points in December was 79.2%, or 23 November position of 75.8%.

The emergence of these perceptions was accompanied by strong sales forecasts for Black Friday and Cyber Monday. According to the US National Retail Federation, this year's Black Friday is expected to generate more than $ 6 billion in transactions, an increase of 23% over the same period of the previous year. While the total season of purchases from November to December this year should collect $ 720.89 billion in transactions.

Then, according to the research institute Plbadytics, 75 million customers will buy their purchases on Cyber Monday. The value of the transaction is estimated at 7.8 billion US dollars.

Given that consumption accounts for more than half of the US economy, the economic growth of Uncle Sam's country appears to be still pretty good in the fourth quarter of 2018; the Fed must raise its key rate.

On the one hand, the rise in the benchmark interest rate confirmed the rapid pace of the US economy. On the other hand, the US economy could be severely affected if it was accompanied by an endless trade war.

When the US economy is hit back, the global economy will feel the effects. (ank / ank)

Source link