[ad_1]

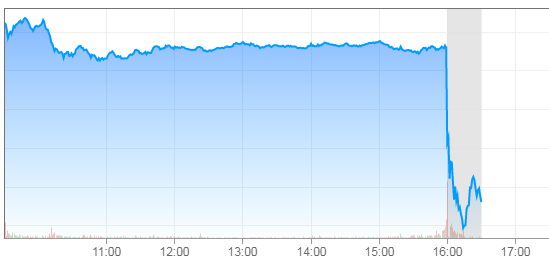

One of the biggest winners of the street in recent months is the Intel chips giant (INTC). Although the company released a weak report in January, investors expressed hope that space in the semiconductor sector would improve over the course of the year. Unfortunately, the rally stopped abruptly on Thursday afternoon, as the company published forecasts well below expectations.

(Source: cnbc.com)

For the first quarter, revenues of $ 16.06 billion were slightly ahead of estimates, although they were in free fall compared to the same period last year. Unfortunately, the name has seen gross margins shrink by 400 basis points and, combined with a higher tax rate, GAAP EPS was down 6 cents. In non-GAAP terms, the company was $ 0.89, two cents lower than estimates, but the smallest in over two years.

The Client Computing Group's business figure, the company's largest activity, generated a better result. as well as revenues from the IoT sector. Unfortunately, the group of data centers exceeded expectations, registering a drop of 6%, on which investors are really focused on the future. Intel knows that it will lose a share of the data center market to the benefit of Advanced Micro Devices (AMD). It will be interesting to see the report of the first quarter of AMD.

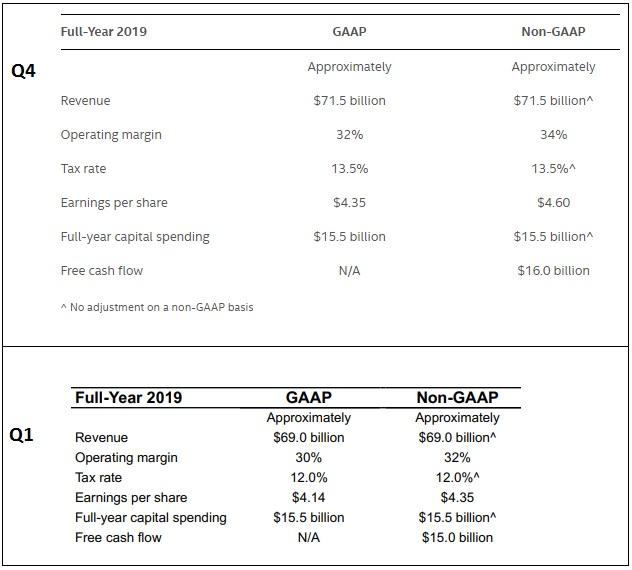

Intel's main problem with this report was the instructions, the same problem that occurred in January. For the second quarter, the company generated revenues of approximately $ 15.6 billion, against estimates of $ 16.85 billion. Analysts were looking for a decline of 0.7%, but these forecasts suggest a decline of 8.0%. The street also expected a three-cent decline in non-GAAP EPS of $ 1.01, but management is only asking for $ 0.89 for the period. We also found that the company was reducing its guidance for the full year, as shown below, hoping for improvement in the second half but adopting a more cautious view of the year.

(Source: publication of Q1 2019 results (link above and Q4 release here)

Investors will be very curious to see the plan of management to resume growth in the coming quarters. Recently, the company decided to abandon its plans to launch a 5G modem in the space of smartphones, after the technology giant Apple (AAPL) and the chip giant, Qualcomm ( QCOM), ended their long legal battle. The launch of an iPhone 5G was considered the next chance for Apple to have a supercycle of upgrades, but that seems to be the victory of Qualcomm and a big potential loss for Intel. According to one analyst, the loss could amount to $ 2.6 billion by 2021. This has no major impact on the total of society. It is therefore a psychological loss for investors looking for Intel to play a major role in the future of smartphones.

In addition, the company also accelerated its redemptions during the period. At $ 2.53 billion, share buybacks exceeded the previous year by more than $ 600 million. Due to the reduction in the number of shares, total dividend payments increased only 1% from one year to the next. Do not forget that I already explained how the 5% dividend increase was a bit disappointing, which helps the case. An annualized dividend of $ 5.6 billion seems a little light, but management has chosen to give priority to buybacks at the moment. Intel will also seek to reduce its debt a little after some major acquisitions in the last two years.

In the end, Intel's shares lost about 7% during the session after regular working hours, which is not really a surprise. Q1 revenues barely exceeded estimates, and the end result was the weakest for some time. With forecasts for the second quarter lower than estimates and forecasts for the full year reduced, the increase in equities will not last. The question that investors must now ask themselves is whether this revaluation of expectations will prompt the stock to go back later in the year, or whether Intel has lost some of its chip dominance and that this is an early sign. garde.

Disclosure: I / we have / we have no position in the actions mentioned, and do not plan to initiate a position within the next 72 hours. I have written this article myself and it expresses my own opinions. I do not receive compensation for this (other than Seeking Alpha). I do not have any business relationship with a company whose actions are mentioned in this article.

Additional disclosure: Additional Information from the Author: Investors are always reminded that before making an investment, you must exercise your own due diligence for any name directly or indirectly mentioned in this article. Investors should also consider seeking the advice of a broker or financial advisor before making any investment decisions. Any element of this article should be considered as general information and not as a formal investment recommendation.

[ad_2]

Source link