[ad_1]

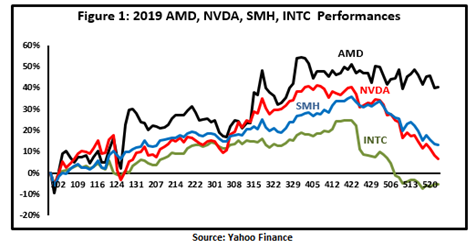

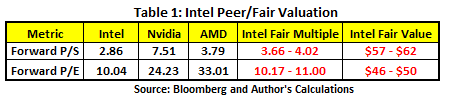

Compared to Advanced Micro Devices (AMD), Nvidia (NVDA) and other semiconductor stocks (SMH), Intel's shares (INTC) dropped disproportionately in 2019 (Figure 1). In addition to the same negative outlook for cloud spending cuts, declining gaming demand, and deadlock in trade negotiations, Intel is fed up with its own problems, including processor shortages, multiple delays 10nm chips and the impending processor market share losses to AMD. As a result, Intel's current state-of-the-art 10x processor has almost reached its lowest level in six years. In comparison, despite the consensus expectations of a decline in EPS of 19% over the fiscal year 2020, Nvidia still has a PER of 24 times. AMD's 33x PE processor is even more robust, reflecting the strong gains it has made in recent quarters in data center and PC processors. That being said, with all the information already available for a while, the question of whether the Intel stock price has correctly reflected recent information, mostly negative. It may be time to wait and review the fair valuation of Intel's shares. That's what I wanted to do in this post.

Intel's challenges

As a manufacturer of multimedia chips, Intel is never short of challenges. After a disappointing 1Q, while the short-term CPU shortage may persist, the digestion of the server-CPU inventory will also continue at 2Q. Because of its size, Intel was the most affected by IT spending cuts and price drops in corporate memory, and both negative showed no signs of easing. As a result, the industry's earlier expectations for a stronger 2H seem less likely in the face of deteriorating Chinese demand and lower data center group revenues. For the remainder of 2019, Intel's second-quarter sales are expected to decline and perhaps rebound to 2H at a figure below 10%. In the 1 st quarter, Intel's 2T and 2019 sales forecasts were 7% and 3% lower than estimates.

More important in the long run, Intel's main challenge comes from the serious threat to its market share of PC processors and AMD's CPU server market share. At the recent Computex, AMD launched the long-awaited, third-generation Ryzen 9 3900X third-generation microprocessor chip. While Ryzen 9 is based on the new 7 nm AMD Zen 2 manufacturing process, it drinks a 4.6 GHz clock with a 3.8 GHz base clock. -core i9-9920X. In addition to its lower price than Intel, the company said its new chip surpasses Intel chips by 14 percent for single-threaded Cinebench R20 benchmark tasks and 6 percent for multithreaded workloads. . The Ryzen 9 3900X also has a rated thermal power of 105 watts, compared to the 165-watt TDP of the Intel Core i9-9920X. Obviously, for the first time, Ryzen 9 ion 7nm is the first AMD attack on the Intel i9 at 14nm on costs, performance and power levels. While AMD's gain may be a loss for Intel, AMD's new product line suggests that AMD's second and third quarter sales growth will remain robust, to the detriment of Intel's market share. .

Prospective evaluation P / S

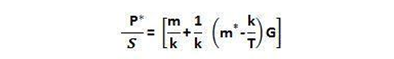

Since AMD has become a serious competitor to Intel's processor market share, the future gain should be the first concern of Intel's shareholders. As a result, I first used an income-based valuation approach, the "Sales Franchise Value Model" (SFV), to convert expected revenues to a corresponding fair value of assets:

The Sales Franchise Value (SFV) model calculates two parts of the stock value. The first part includes the market value for constant growth profitability. The second part is the excess growth of profits compared to shareholder expectations. This is a model for generating equity valuations that reflect both future income growth and changes in margin. The most sensitive factor is the annual growth rate of revenues, which is assumed to fluctuate between 3% and 5%, according to Street estimates. The discount rate has been increased from 15% to the recent level of 18%. This is due to a significant increase in Intel's risk level after Intel's first-quarter decline forecast and AMD's market share increase with Ryzen and EPYC. The less sensitive gross margin is expected to be around 60% for the year. Given the various forecasts, the SFV calculates the direct multiple P / S between 3.66 and 4.02. Based on forecast revenue over the four quarters of $ 69.89 billion, Intel's fair value is expected to be between $ 57 and $ 62. As a result, Intel's share is currently underestimated by approximately 25% -35% (Table 1).

Term Rating P / E

Unlike AMD, Intel has long since passed profitability. As a result, the market has asked the company to generate a reasonable and sustainable profit. On this front, for most of 2019, the gross margin will always be difficult. With a decline in sales in sight, growth in EPS should come from lower operating expenses. However, the expected ramp-up of 10 nm will certainly put pressure on the gross margin. Low price competition from AMD will also have an impact on costs. Intel's gross margin is expected to remain between 58% and 60%.

If investors choose to value the security with profitability, it is the sustainable long-term profits that it is important to prioritize. To this end, I used the following valuation method based on the benefits to value the shares:

![]()

When P / E * is the PE at fair term, k is the required rate of return, ROE is the return on term equity, and g is the long-term earnings growth rate. The economy of the "intrinsic PE model" is premised on the premise that the market will pay a higher multiple for the company's ability to consistently generate a return on equity that exceeds the rate of return required by shareholders. In this case and as in the previous section, the required rate of return (K) is estimated between 17% and 18%.

As noted in the previous section, Intel's sales growth in 2019, by 3%, will likely limit the gross margin to 60% maximum, which will result in an ROE of the order of 24% to 26%. According to projections, the profit growth rate pivot based on a sales growth of 3% to 5% in 2019 and an estimated gross margin between 12% and 13%. As a result, the IPE model would give the stock an equilibrium stock between 10.17 and 11, using a $ 4.55 EPS over four quarters, the fair value based on Intel's results should be between $ 46 and $ 50 (Table 1). As a result, Intel's share is slightly understated by 5% -10.

Precautions

Compared to its main competitors, AMD and Nvidia, Intel could seem to be treated unfairly by the recent market anger. Both earnings and income assessments have reached the same conclusion that the stock is undervalued. While Intel struggles to defend the growth of their revenues and their market share, the company's macro image and technology are not on their side. As a result, Intel's first-quarter unfavorable forecast and AMD's 7-nm product launches should remind shareholders that Intel's much older size advantage over AMD does not have a long life. life. The fact that the current market has focused more on the profitability of Intel's shares than on the growth of its revenues suggests an alarming possibility that Intel will lose a significant market share to AMD.

Disclosure: I am / we have been for a long time NVDA. I have written this article myself and it expresses my own opinions. I do not receive compensation for this (other than Seeking Alpha). I do not have any business relationship with a company whose shares are mentioned in this article.

[ad_2]

Source link