[ad_1]

- Crypto holders in Singapore prefer Ethereum to Bitcoin, according to a survey by cryptocurrency exchange Gemini.

- A total of 50,000 Ethereum worth $ 165 million burned since the London hard fork made ETH more likely to become deflationary.

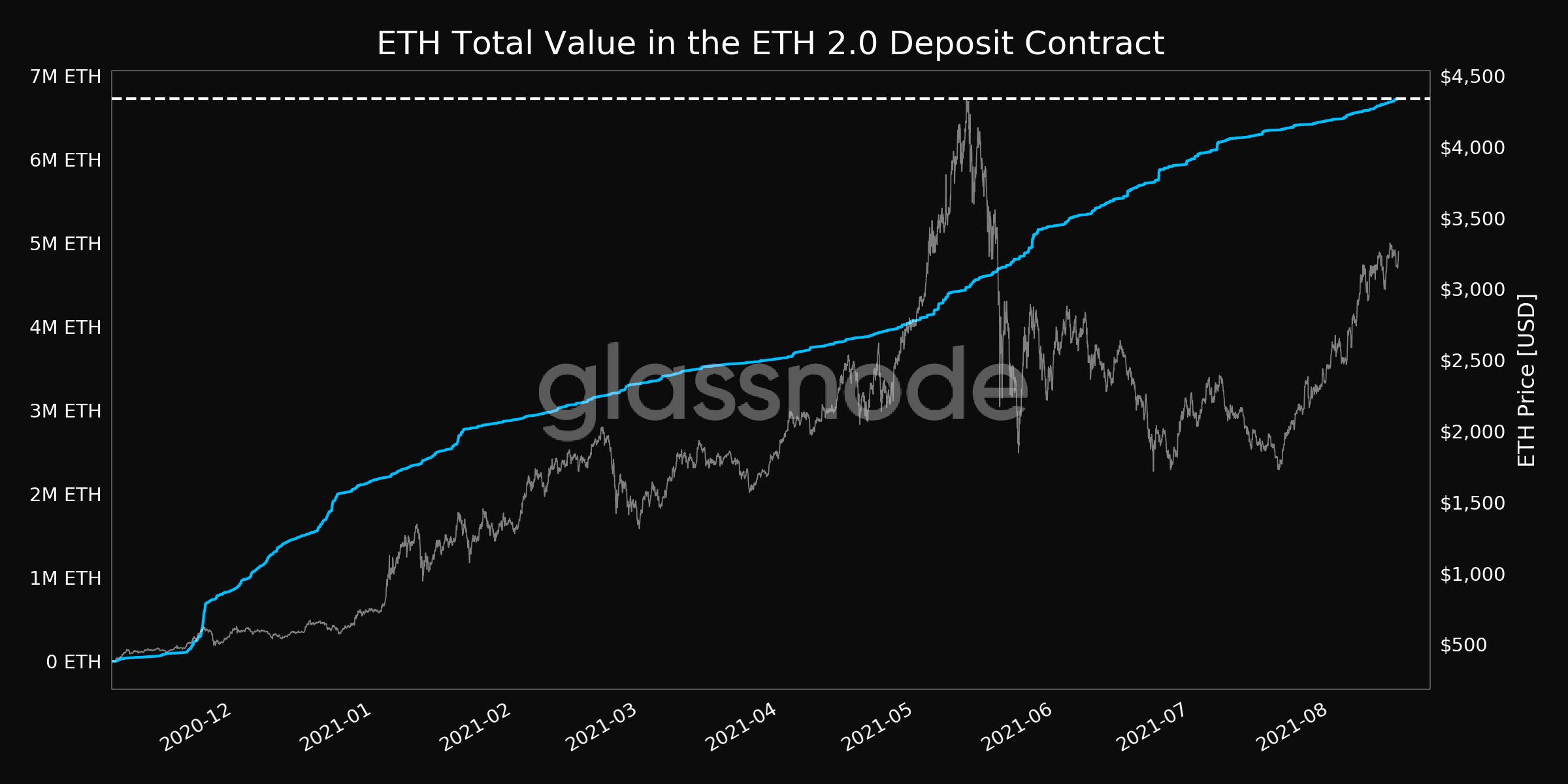

- Ethereum staked on the ETH 2.0 staking platform hits a new all-time high.

Ethereum’s future is likely to be deflationary with the higher level of ETH burned. The amount of ETH held on exchanges is constantly decreasing.

BTC popularity drops as traders prefer deflationary ETH cryptocurrency

A recent survey by the Gemini cryptocurrency exchange revealed that Ethereum is the most popular cryptocurrency in Singapore. Almost 78% of crypto investors in Singapore own Ethereum and 69% have Bitcoin.

The growing popularity of Ethereum can be attributed to the increase in the number of deflationary blocks produced since the entry into service of EIP-1559 with the London hard fork. $ 165 million worth of ETH has been burned in the past ten days.

As more Ethereum is taken out of circulation, analysts are noting an increase in the Total Locked-In Value (TVL) on DeFi and an increase in the volume of Ethereum put into play in the ETH 2 contract.

Guy, cryptocurrency analyst and YouTuber at CoinBureau, says Ethereum locked in DeFi is held in smart contracts. It is most likely used in DeFi protocols to provide cash, earn interest, or other types of yield farming tactics.

ETH representing DeFi TVL is used for a specific purpose, and investors who hold this Ethereum are less likely to sell it in the short term. At the same time, Ethereum put into play in the ETH2 contract reached a new all-time high of 6.72 million ETH. Ethereum that is locked in is out of long-term circulating supply, fueling the bullish outlook for traders.

The total value of ETH put into play in the ETH2.0 deposit agreement

Ethereum outperformed Bitcoin in terms of transaction volume, daily trade volume and return on investment, according to data from the Blockchain Center.

Additionally, as the Ethereum network moves towards ‘merger’, the upgrade that replaces the current Proof of Work (PoW) consensus mechanism with energy efficient and secure Proof of Stake (PoS), the Ether inflation is expected to drop. , resulting in deflation.

Traders expect “deflation” to positively impact the price of Ethereum, making it more attractive than Bitcoin.

According to FXStreet analysts, Ethereum’s next price target is $ 4,000, and this is an important psychological level for the price of altcoin to rise. There is an increase in Bitcoin reserves on the exchanges; however, in the case of Ethereum, the opposite is true.

[ad_2]

Source link