[ad_1]

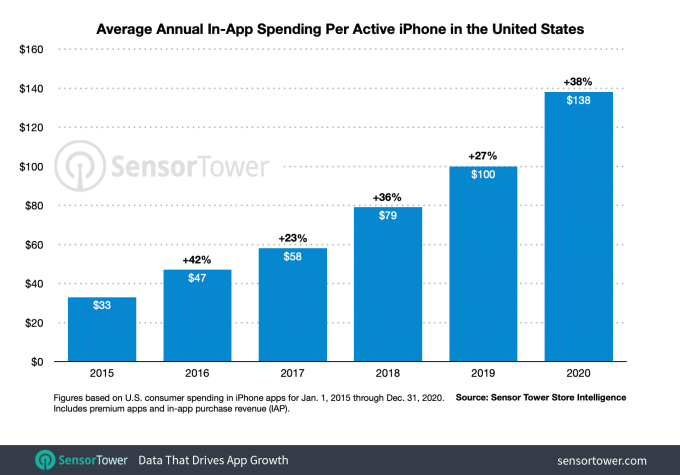

U.S. consumers spent an average of $ 138 on iPhone apps last year, a 38% year-over-year increase, largely due to the effects of the pandemic, according to new data from the company. Sensor Tower App Store information. Throughout 2020, consumers turned to iPhone apps for work, school, entertainment, shopping and more, driving spending per user to a new high and the strongest annual growth since 2016 , when they then jumped 42% year on year.

Sensor Tower tells TechCrunch that it expects the trend of increasing consumer spending to continue in 2021, when it predicts consumer spending per active iPhone in the United States will average $ 180. . This will again be linked, at least in part, to the rise caused by the pandemic – and, in particular, the rise in pandemic-fueled spending on mobile games.

Image credits: Sensor tower

Last year’s increase in spending on iPhone apps in the US mirrored global trends, which saw consumers spending a record $ 111 billion on iOS and Android apps, per sensor revolution, and $ 143 billion, by App Annie, whose analysis also included third parties. Android application stores in China.

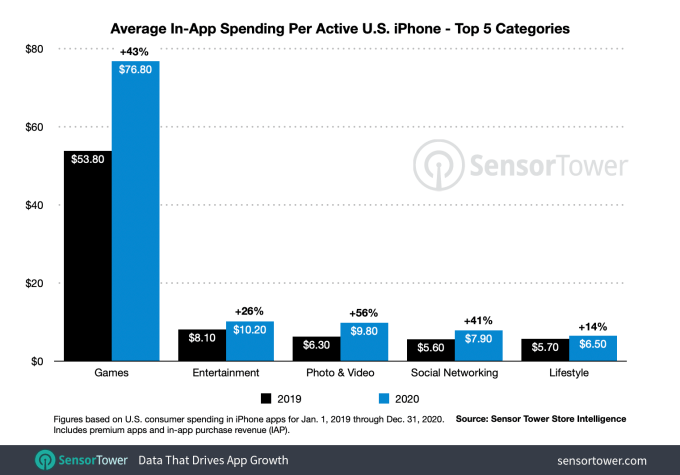

In terms of the concentration of iPhone consumer spending in the United States in 2020, the most important category was, of course, games.

In the United States, per-device spending for mobile games increased 43% year-over-year, from $ 53.80 in 2019 to $ 76.80 in 2020, more than 20 points higher than the 22% growth seen between 2018 and 2019, when in-game spending increased from $ 44 to $ 53.80.

US users spent the most money on puzzle games, like Candy Crush Saga and Gardenscapes, which may have helped distract people from the pandemic and its stress. This category averaged $ 15.50 per active iPhone, followed by casino games, which cost an average of $ 13.10, and was driven by the closing of physical casinos. Strategy games also saw an increase in spending in 2020, averaging $ 12.30 per iPhone user spend.

Image credits: Sensor tower

Entertainment is another major category of spending in apps. With theaters and concerts shutting down, consumers have turned to streaming apps in greater numbers. Disney + launched in late 2019, just months before the pandemic lockdowns, and HBO Max quickly followed in May 2020.

Average spend per device in this category was second at $ 10.20, up 26% from the $ 8.10 spent in 2019. By comparison, spend per device only increased by 1% between 2018 and 2019.

Other categories in the top five spend per device included photo and video (up 56% to $ 9.80), social media (up 41% to $ 7.90), and lifestyle ( up 14% to $ 6.50).

These increases were linked to apps like TikTok, YouTube, and Twitch. Twitch saw 680% year-over-year revenue growth in 2020 on US iPhones, in particular. TikTok, meanwhile, saw 140% growth. In the Lifestyle category, dating apps were driving growth as consumers sought to connect with others virtually during lockdowns while bars and clubs were closed.

Overall, what made 2020 unique wasn’t necessarily the apps people used, but how often they were used and the amount spent.

App Annie previously pointed out that the pandemic accelerated mobile adoption by two to three years. And Sensor Tower today tells us that the industry didn’t see the same kind of “seasonality” around spending on certain types of apps, and especially games, last year – though, before the launch. pandemic, there are usually slower times of the year. for expenses. This was not the case in 2020, when all the time was a good time to spend on apps.

[ad_2]

Source link