[ad_1]

Editor's Note: Seeking Alpha is proud to welcome Renegade Investment Research as a new contributor. It's easy to become a Seeking Alpha contributor and earn money for your best investment ideas. Active contributors also have free access to the SA PRO archive. Click here to find out more "

Investment thesis

Despite the production and sale of approximately 600,000 vehicles (including 1Q19), Tesla (TSLA) has not been able to guarantee financial security. Using a relatively simple methodology, the Altman Z-score, drawn quarterly since 2010, shows how dangerous the situation in society is.

When will there be positive points?

The last 8K deliveries on April 3, for the production and delivery of 1T19, were terrible. Approximately 63,000 cars were delivered to customers worldwide, a reduction of 31% compared to deliveries of 4T19, or 27,700 cars.

Models S and X recorded a significant drop in shipments, down 15,450 units from 4Q18, a decrease of 56%. Shipments have not been as low for Model S and Model X since 4Q15. This could be a significant marker for Tesla premium vehicles. A steady or measured decline in demand would not be uncommon, but that is tantamount to a gulf of deliveries.

Model 3 shipments decreased 12,250 from 4Q18 and 4,940 from 3Q18. It would appear that much of the Model 3 stock has been shipped overseas, raising the question: what happened to US domestic demand? Have we seen a record demand from the United States for the currently available versions of Model 3? I think it's too early to find out, but it's not a bright spot less than a year after model 3 production issues were resolved and vehicles started to to get out of Fremont at a decent pace.

There was then this strange statement included in the 8-K of April 3 regarding the cash flow situation of the company:

Due to lower than expected delivery volumes and several price adjustments, we expect a negative impact on first quarter net earnings. However, we ended the quarter with enough cash.

Enough for what? After two quarters of positive earnings and positive cash flows, while current quarter shipments are declining, I expect that TSLA will generate positive operating cash flow in 1Q19, but investment and financing activities will erode and may even make it negative. Given the $ 900 million debt repayment this quarter, the drop in shipments could not have been worse. Tesla has ambitious short-term goals of building a production plant near Shanghai, China; develop the Y model for the market; and continue the development of the Tesla Semi and Roadster II (or 2). In my opinion, none of them can self-finance with existing or permanent activities, unless the company can deliver 90,000 vehicles per quarter (or more!) For the next two years while managing its cost base. A delivery rate of 90,000 vehicles is expected to generate between $ 500 and $ 700 million in free cash flow each quarter (at an approximate cost), or between $ 2.0 and $ 2.5 billion annually.

Much has been said, seen and written about (and by) TSLA President and CEO Elon Musk. He is a mercurial and polarizing figure, loved and hated and everything else between the bulls and the bears that follow TSLA. Given that the company has suffered a lot of wear and tear on executives and executives over the last 12 to 18 months, this will have caused disruptions (and not the right type invented in Silicon Valley) and the responsibilities of these people. leaders. It is well known that Elon Musk flourishes, that is, he does not devote 100% of his time to the role of CEO of TSLA. He holds management positions in other entities, including Space-X and The Boring Company. He could have a huge "engine" and be able to work 18 to 20 hours a day, but this will be at the expense of concentration. Perhaps the heavy workload also creates a distraction situation. Challenging the SEC, cavers or people who dispute his vision of TSLA or have nothing to do with TSLA does not add value to his company.

A bad quarter does not mean that's the end. We all know that TSLA has struggled a lot when it came to becoming a sustainable automaker. Given the above, I was looking for a tool, method or other measure to capture the company's history and the likelihood or potential risk of bankruptcy.

The Altman Z-score

First published in 1968 by Edward I Altman (NYU Assistant Professor of Finance), the Z-score formula can be used to predict the likelihood that a company could go bankrupt within two years.

The Z-Score formula includes five common weighted trade ratios, weighted by coefficients in a linear combination. The coefficients were estimated after identifying the companies / entities that had declared bankruptcy, then collecting a matched sample of surviving companies / entities, based on approximate size (assets) and industry.

In the initial test of 1968, it was proved that the Altman Z score was 72% accurate in predicting bankruptcy two years before the event, with a "false negative" error rate of 6%. In subsequent tests (the next 31 years, up to 1999), the prediction of bankruptcy was accurate about 80% to 90% one year before the event, with a false error rate negative "of about 15-20%.

Sources / references:

Altman Z-score – Wikipedia

NYU Stern – Edward Altman – Emeritus Professor of Finance

The Z-Scores TSLA Altman

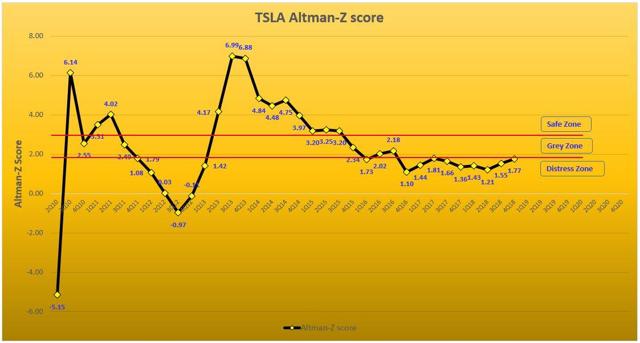

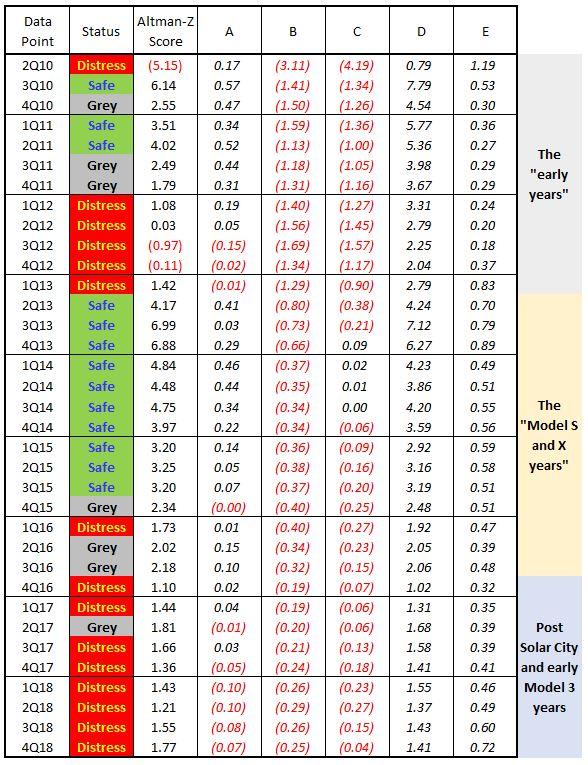

The table below shows Z Altman scores calculated as of 2Q10.

Altman Z-score – by author using Yahoo Finance's 10-Q, 10-K and TSLA rankings from TSLA SEC (historical data report)

I have broken down my observations into three distinct periods.

The "first years" – The Roadster through the beginnings of the production of Model S (1T13)

At that time, TSLA was a niche car manufacturer. The size of the company was very small (depending on market capitalization) compared to the current situation. Any significant change in the underlying data for the Altman Z-score elements had a significant impact on the calculation, which resulted in a dramatic shift in metrics, sometimes from one quarter to the next.

At the end of the first quarter of 2013:

- Total assets of the company = $ 1.14 billion

- TSLA Common Stock Price = $ 37.89

- Average number of diluted ordinary shares = 124,265,292 shares

- Market capitalization = $ 4.535 billion

The Altman Z-score during this period has fluctuated a lot. In retrospect, this period could be called start-up years.

The "model years S and X" – (2T13 to 3T16)) before the acquisition of SolarCity

TSLA introduced the S models and later the X model. By the end of this period, in 3Q16, it was starting to produce these vehicles more consistently, with monthly production reaching more than 25,000 vehicles.

The size of the company was growing in terms of market capitalization (650%). With this growth, changes to the underlying data for Altman Z-score elements did not have as much material impact on the calculation. Another way to explain this period is that Tesla has become a manufacturing company – a vehicle manufacturing company – during this period. This allows the Altman Z-score to work as expected.

At the end of 3T16:

- Total assets of the company = $ 12.592 billion

- TSLA Common Share Price = $ 204.03

- Average number of diluted common shares = 156,935,000 shares

- Market capitalization = $ 33.988 billion

The Altman Z-score during this period increased sharply and started drifting downwards, entering the gray zone at 4T15. The "D" element (market capitalization / total liabilities) was the main contributor to the rise in the Altman Z-score. The "D" element was also the main contributor to the decline, as the TSLA share price was stabilized and total liabilities started to rise.

"The acquisition of Post-SolarCity early model 3 years" – (4T16 to 4T18)

During 4Q16, TSLA acquired a related public entity, SolarCity, later renamed Tesla Energy. By the end of 2018, the company was producing its third luxury vehicle, Model 3, with a steady rate of growth.

The size of the company has further increased (due to the acquisition of Tesla Energy and Model 3). The movements in one of the elements of Altman Z-score are much more moderate considering the size of the company and its duration.

At the end of 4T18:

- Total assets of the company = $ 29.740 billion

- TSLA Common Stock Price = $ 332.80

- Average number of diluted common shares = 170,525,000 shares

- Market capitalization = $ 55.021 billion

Following the Tesla Energy acquisition (from 3Q16 to 4Q16), the Altman Z-score crater increased from 2.18 to 1.10. Total assets increased from $ 12.6 billion to $ 22.7 billion. Total liabilities increased from $ 9.9 billion to $ 16.8 billion. The acquisition generated only $ 0.2 billion in energy sales during the acquisition in 4Q16.

The Altman Z-score progressed to the early 3T18 and 4T18, where the initial impact of Model 3 was felt, with positive EBIT, solid sales and positive overall financial results , all contributing to an improvement in the score. If these were to continue in the future (positive EBIT, strong sales and positive overall financial results), it would then have a positive impact on the score (quite obvious, I know, but it must be said). Exactly the positive impact that I have never modeled or studied.

Below is a graphical representation of the table above:

Altman Z-score – by author using Yahoo Finance's 10-Q, 10-K and TSLA rankings from TSLA SEC (historical data report)

This table shows the elements that make up the Altman Z-score, where:

A = Working Capital (Current Assets Less Current Liabilities) / Total Assets: a measure of cash

B = Retained earnings / Total assets: a measure of profitability

C = Operating income before interest and taxes (EBIT) / Total assets: a measure of operational efficiency

D = market value of equity / book value of total liabilities: a public market dimension that can reflect fluctuations in security prices

E = Sales / Total Assets: a standard measure for total asset rotation

Altman Z-score and elements – by author using Yahoo Finance's 10-Q, 10-K and TSLA TSLA SEC filings (historical data report)

The main driver of the Altman Z-score is the D element: Market value of equity / book value of total liabilities. Sales growth, mainly due to the introduction of Model 3 in 2018, also has a positive impact on the score and is very important for the improvement of the score. As working capital, EBIT and retained earnings were mostly negative, they reduce the score in the calculation.

Some additional Altman Z-score charts and graphs

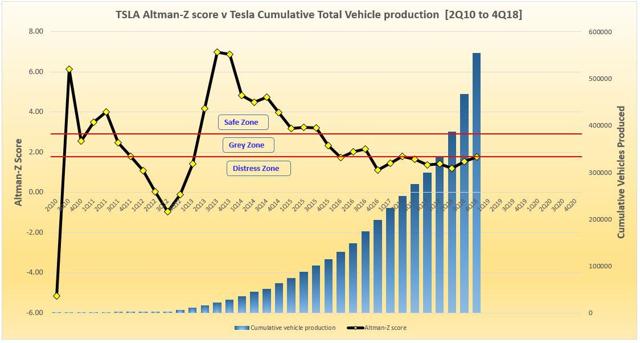

Some additional free cards (no steak knives) are shown below. Overlaying the Altman Z-score to other data points potentially highlights a context – or at least adds color to the article!

Vehicle Production Data – TSLA Deposits SEC 8-K, 10-Q, 10-K

The graph above shows the Altman Z-score in relation to the cumulative production of TSLA vehicles. The above observation shows that since the acquisition of Tesla Energy (included for the first time in 4Q16) and despite the production and sale of 350,000 additional vehicles since 4Q16, the Altman Z-score remains below the score of acquisition prior to Tesla Energy.

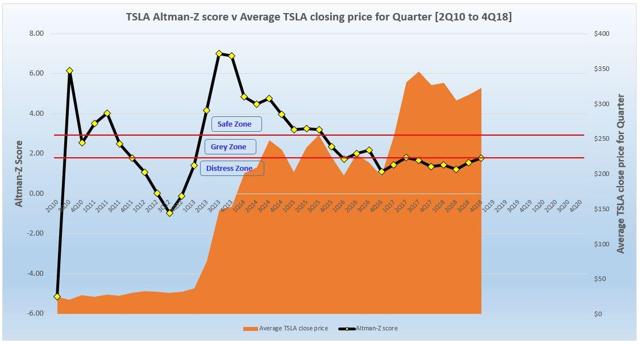

TSLA Closing Price Data – Yahoo Finance (Historical Data Report)

The graph above represents the Altman Z-score relative to the closing price of the TSLA common share for the quarter. The TSLA common stock price drove the Altman Z-score to its highest level in 2013. It remains an important engine of the Altman Z-score.

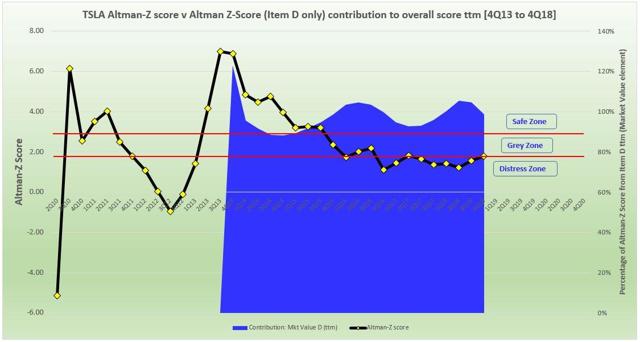

Calculation of Altman D element Z-score – by author using the 10-Q, 10-K and Yahoo Finance deposits of TSLA SEC (historical data report)

The above chart represents the Z Altman score based on the contribution impact of the D element – Market value of equity / book value of the total liabilities (shown as a percentage of the total score ). You can see that this element of market value contributes 80 to 100% of the overall Altman Z-score. The contribution of the element E, the calculation sales / total assets, "sponge" and covers the other effects (usually) negative on the score of the remaining elements (A, B and C).

Is TSLA immune to the Altman Z-score?

To date, despite what the Altman Z-score results tell us, TSLA does not seem to be about to seek bankruptcy protection. As discussed above, the method is accurate between 70% and 90%, with an error rate of 6-20% (that is, false negative). We know it's just an indicator and it's not foolproof, and the fact that TSLA has survived so long with a distress score proves it's in the range of 10-30 %.

Some might argue that TSLA can not be measured with the help of a metric created in the late 1960s, that it is about a technology society and not from a manufacturer, and that this does not apply. Its vehicles contain technology, some of which goes beyond what other manufacturers have designed and built to date. But that does not stand up to logic. Ferrari (RACE) developed the first gearbox with paddles driving in 1989, used in its Formula 1 cars – which led to its initial introduction in a road car, the F355, in 1997, followed by BMW (OTCPK: BMWYY) and Alfa Romeo and later just about every other car manufacturer. Yet, they did not suggest that they were technology companies. The nature of this activity is the development by technology for use in vehicles.

Another argument that could be used against Altman Z-score results is the argument "The future is so promising, I have to wear sunglasses" (apology to Timbuk 3). This is a popular positive theme among TSLA bulls. This argument encompasses many things. Demand for EV / BEV is only going to increase exponentially, and TSLA is leading the charge years ahead of the competition. The kimono was recently unveiled to unveil the Y model, the TSLA version of an SUV. There is the Semi Tesla, one of which has recently been sighting which was delivering its customers shares by the end of March, which could change the road transport sector in the United States and later (possibly) in the world. There is also the Roadster II (or 2), the very first "real update" of any of the TSLA vehicles. China Gigafactory, which would have been built at a breathtaking pace, will allow the company to increase its production to satisfy the ever increasing demand. If half of these elements succeed, TSLA will probably survive and, most likely, prosper.

Last thoughts

The two-year Alt-Z data presented above do not give an optimistic view of TSLA. That said, it seems like a unique venture. There are true believers – fanboys and bulls – on one side and on the other a lot of bears, some more fervent than others. TSLA's common shares also seem insensitive to traditional methods of financial valuation. Speculators could argue that TSLA is synonymous with engineering, radical change, exponential growth and environmental protection, and that the company has years ahead of other electric vehicle manufacturers. Bearers might argue that this is just noise when looking at liquidity, debt, demand, SEC, imperfect production quality, ashlar, Tesla Energy, and so on.

One thing I believe is that the TSLA's stock price has perfected the art of levitation which has kept it significantly higher than any of the bear's arguments would have been priced . And if we must believe that the Altman Z-score is an indicator or one of the measures of a potential bankruptcy, this levitation is painfully important for this score to remain positive.

I've lived (and worked) around data for a long time. Individual data points and / or limited time series do not tend to influence me. Trends over a reasonable period of time, using consistent data points and inputs, tend to guide my decision making. The Altman Z-score series suggests to me that TSLA has made a catastrophic mistake in acquiring Tesla Energy and has squandered sales of approximately 400,000 vehicles since 4Q16 for the benefit of water, which has not brought him closer to the security of his future. TSLA did not need to acquire Tesla Energy. The idea of acquiring was truly a moment Keyser Soze (excuses to The usual suspects), who collectively resemble Michael McManus, Dean Keaton, Fred Fenster and Todd Hockney.

My belief is that at some point the reality actually occurs by a collapse of the gateway, and that a bankruptcy of the TSLA is a likely event. But what does it really mean? The city's own funds will already be protected and will either be out or having debts to share the future shares of a new, cleaner and more debt-free entity. The average holder of common shares still holding or retaining rights on the door hinge or on those who are not connected will eventually get decimated. This will take place like all the other major bankruptcies and reorganizations of the last 10 to 20 years. It's like that.

Good luck,

The renegade

For more details, here is the list of essential elements of the Altman Z-score formula and data sources for the tables and charts listed above.

Annexes

1. The Altman Z-score formula

The formula is:

Z = 1.2[A] + 1.4[B] + 3,3[C] + 0.6[D] + 1.0[E]

Or:

A = Working Capital (Current Assets Less Current Liabilities) / Total Assets: a measure of cash

B = Retained earnings / Total assets: a measure of profitability

C = Operating income before interest and taxes (EBIT) / Total assets: a measure of operational efficiency

D = market value of equity / book value of total liabilities: a public market dimension that can reflect fluctuations in security prices

E = Sales / Total Assets: a standard measure for total asset rotation

Each calculated element is weighted, that is, the element A is multiplied by 1.2, the element B is multiplied by 1.4, and so on. The five elements combined are equal to the Altman Z score and are compared to the following evaluation bands:

<1.81 = the "distress zone" – a score in this range indicates that the company will likely go bankrupt in the future

> 1.81 to <2.99 = the "gray area" – a score in this range indicates that the company is likely to declare bankruptcy

> 2.99 = "Security Zone" – a score in this range indicates that the company will not declare bankruptcy

Source / references:

Altman Z-Score

Z-Score Formula | The value | Example | Explanation of the calculation

2. Data used to calculate Altman Z score

The data that was used to calculate the Altman Z score is derived from the TSLA 10-Q and 10-K reports and the daily price of the TSLA common shares of Yahoo Finance's historical data table.

The balance sheet data are extracted directly from each quarterly and end-of-year balance sheet included in the 10-Q and 10-K reports. The income statement (EBIT and sales) consists of data from the last twelve days (TTM) combining quarterly data (in 10-Q) or annual data (in 10-K). For the calculation of the Market Value Element (Element D), I used the average closing price of the TSLA Common Shares for each quarter.

Disclosure: I / we have / we have no position in the actions mentioned, and we do not intend to initiate a position within the next 72 hours. I have written this article myself and it expresses my own opinions. I do not receive compensation for this (other than Seeking Alpha). I do not have any business relationship with a company whose actions are mentioned in this article.

Additional disclosure: Additional Information from the Author: Investors are always reminded that before making an investment, you must exercise your own due diligence for any name directly or indirectly mentioned in this article. Investors should also consider seeking the advice of a broker or financial advisor before making any investment decisions. Any element of this article should be considered as general information and not as a formal investment recommendation.

[ad_2]

Source link