[ad_1]

JPMorgan stocks (JPM – Get Report) jumped Friday and closed up 4.6% to $ 111.21 after beating profit and revenue forecasts.

A positive reaction from PNC Financial (PNC – Get Report) helps, as the duo gives a boost to bank stocks. Although Wells Fargo (WFC – Get Report) beat earnings and earnings forecasts, the stock fell about 3% in Friday trading at noon.

Will it be enough to allow JPMorgan's action to pull itself together? Over the last year, the bank (and the sector in general) experienced a series of twists and turns despite the fact that the market as a whole was doing relatively well. After a profit of $ 2.65 per JPMorgan share, it was 30 cents higher than estimates, and revenues $ 29.85 billion, $ 1.8 billion. billion ahead of expectations, one might think that there is a time for a continuous rally, it is now.

JPMorgan and Goldman Sachs are stakes in Jim Cramer Action Alerts PLUS club member.

The team said: In the following view, management pointed out that stock subscription fees are expected to rebound in the second quarter due to the large number of IPOs in the US. Do not forget that big banks such as JPMorgan and Goldman Sachs are one of the ways to play among the many major IPOs this year.

Do you want to be alerted before Jim Cramer buys or sells JPM or GS? Learn more now

JPMorgan shares

Until now, JPMorgan shares have been pressuring higher on Friday, which is a big deal because many bank stocks tend to have higher earnings before giving up their earnings throughout the session (see Wells Fargo).

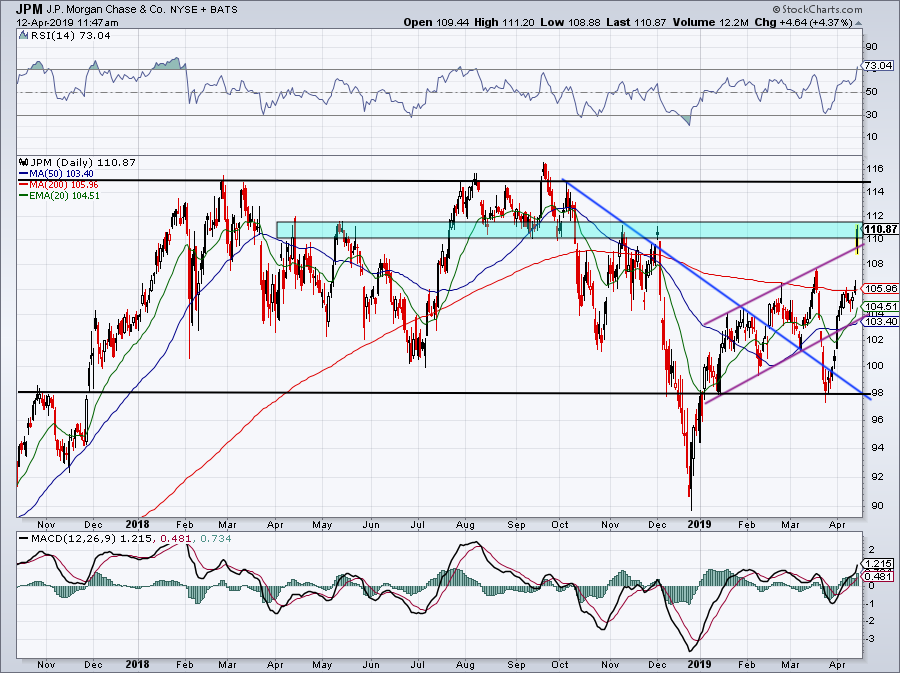

The actions of JPMorgan, Goldman Sachs, Bank of America and other creatures broke out in mid-March, but dispelled this concern over concerns over reversal. of the yield curve. These concerns were short-lived and we got a rebound of those stocks. For JPMorgan, this has reduced the stock to a recent resistance, close to $ 106, just before the profits.

Now, going up, JPMorgan's shares have opened near the resistance channel (purple line) and have rapidly increased in the area from 110 to 112 dollars. This has been a zone of resistance over the last year and it will be interesting to see if the JPM can now pass. If possible, the $ 115 to $ 116 zone will be on deck.

If JPMorgan's stock does not manage to cross this area, I would very much like to see the support of the upside resistance followed as support. If that fails, it would be encouraging to see JPMorgan's shares stay at $ 108. Although the decline in the moving average of $ 106 per area / average over 200 days makes JPMorgan's action technically acceptable, it would be very discouraging to give up all of its gains after earnings.

The bottom line? Let's see how JPMorgan shares trade between $ 111 and $ 112. The best configuration from here would be resistance up to $ 115 and a pullback to the current area that serves as support.

[ad_2]

Source link