[ad_1]

President Donald Trump's aversion to Iran's rulers is evident since he announced his candidacy for the post of President of the United States. Its confrontational policy culminated in the unilateral withdrawal of the United States from the JCPOA, the Iran Nuclear Deal. In order to increase the pressure on the already ill Iranian economy, it is inflexible for Washington to cut off oil exports and thereby reduce Tehran's financial strength. However, this policy could turn against oil prices and the Middle East is a major producer and exporter.

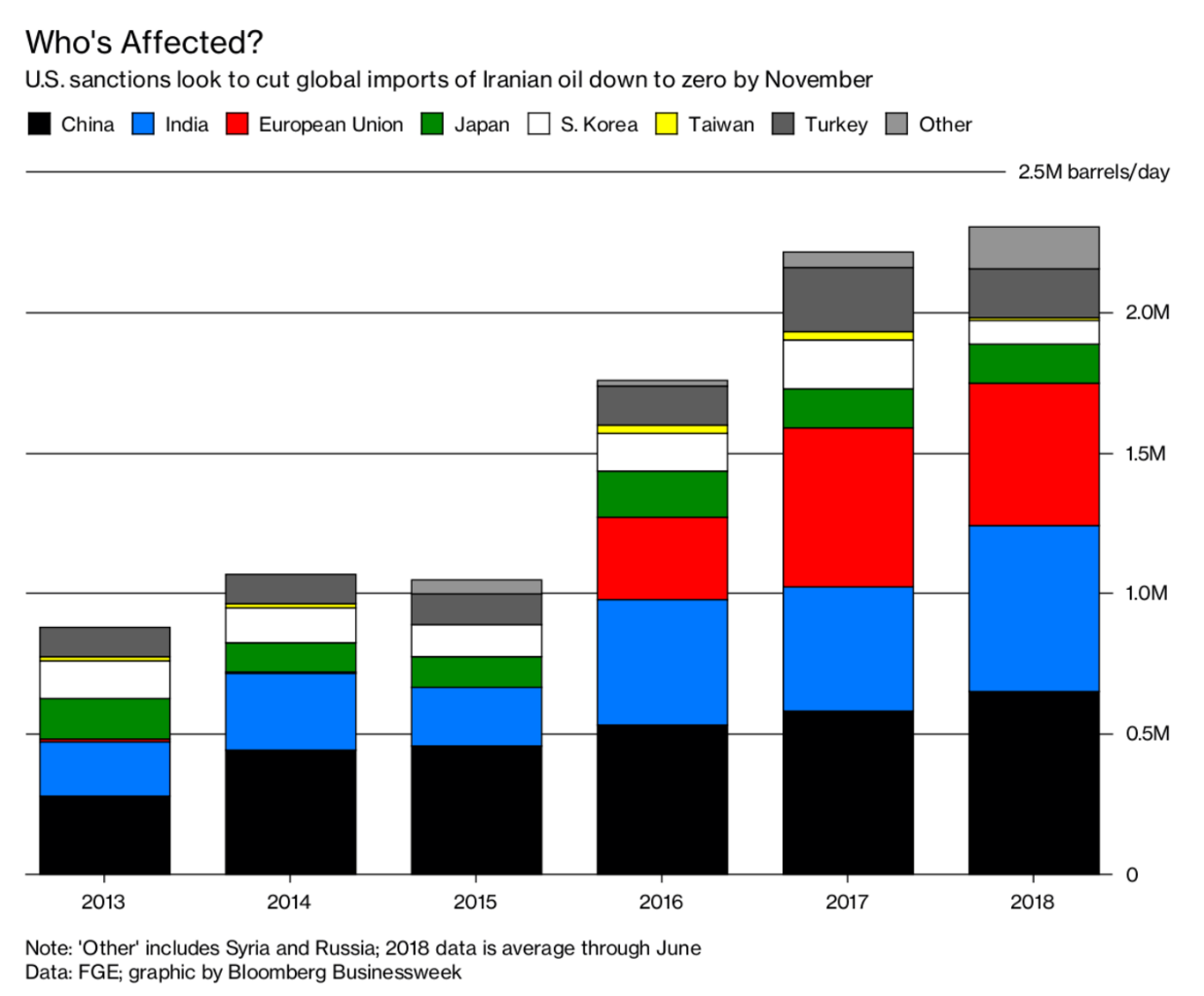

Currently, Iran is the third largest oil producer of OPEC after Saudi Arabia and Iraq with a production of 4 million barrels / day and one export 2.1 million. Oil revenues have kept the country afloat while facing a global sanctions regime and a hostile US policy throughout the region. Since the signing of the historic nuclear agreement and easing restrictions on the Iranian energy sector in 2015, exports have increased by 1.4 million barrels / day. The United States does not pursue the elimination of the only barrels added since the signing of the Deal, but the entire Iranian oil exports. However, depriving the world market of this quantity has serious consequences for economic and political reasons.

(Click to enlarge)

The world economy is running at full speed. All major economic regions from North America to Europe and East Asia are experiencing significant economic activity and growth. Even the imminent trade war of the United States with several other countries has fortunately not yet had any negative effects. Global growth has positively influenced demand for oil and petroleum products. In 2017 alone, consumption increased by 1.5 million barrels per day, increasing by 1.6%, double the annual global growth rate in a decade.

Rising oil prices have been a welcome development for producers. The bullish sentiment in the oil markets is a direct result of the agreement between OPEC and Russia to limit production by 1.8 million barrels a day to reduce the global oil glut. Inventories have fallen and prices have risen, improving the financial health of the oil states. The agreement recently reached to partially cancel the previous agreement, can be seen in the light of much tighter oil markets and the fall of Iranian exports. Adding an additional one million barrels a day should offset the drop in production elsewhere.

With the midterm elections later this year, President Trump fears that this will harm his constituency and thus Republican support in the House. Trump's efforts on Twitter were aimed precisely at this goal. The US president has gone on social networks to increase pressure on OPEC and production. Related: The Next Biggest Major Oil Move

Although OPEC and Russia agreed to add a million barrels a day to global markets, the fear remains that this is not enough to offset the increase in demand and production risks around the world. Trump acknowledged this risk in a recent tweet where he hints that Saudi Arabia is capable and eager to further increase production to 2 million barrels. However, badysts strongly doubt that Riyadh can increase the production of this amount.

Riyadh did not, however, confirm Trump's claim but baderted the Kingdom's ability to prudently use its unused capacity in the markets. The White House for its part, retreated on Trump's statement in a statement. Saudi Arabia's vague badertion of being able to increase output with 2 million barrels a day should be seen as an indirect endorsement of Washington's relentless quest to confront the world's worst. 39; Iran. However, this strategy is risky, at least because of other events that are not directly related to the United States. dissatisfaction with Tehran's growing role in the region. Related: Asian buyers seek to replace Iranian oil amid US sanctions

Ongoing conflict and instability in Libya and Venezuela have significantly reduced oil production in the United States. those countries. The end is not yet in sight, which means that production can further decline and increase the price of oil which currently stands at 74 dollars. Although prices have declined slightly due to an unexpected increase in US domestic stocks, the long-term situation is not so bright.

Assuming that the United States achieves its political objective of convincing Iranian oil buyers to stop their activities in the Middle East. country, another dangerous economic situation could be created. Assuming that Saudi Arabia is able to offset the loss of production from Iran, the risk remains to cover other potential developments.

One of the reasons for being OPEC is the stabilization of oil markets in the interest of both producers and consumers. . In the absence of unused capacity, growing demand and political instability around the world, prices could escalate and hurt global economic growth. This is not in the interest of producers or consumers. However, this could be another legacy of President Trump, as the consequences of his decisions could far exceed the length of his administration.

By Vanand Meliksetian for Oilprice.com

More Oilprice.com Top Rulings: [19659016] !! (F, b, e, v, n, t, s) {if (f.fbq) returns; n = f.fbq = function () {n.callMethod?

n.callMethod.apply (n, arguments): n.queue.push (arguments)}; if (! f._fbq) f._fbq = n;

n.push = n; n.loaded =! 0; n.version = 2.0 & # 39 ;; n.queue = []; t = b.createElement (e); t.async =! 0;

t.src = v; s = b.getElementsByTagName (e) [0]; s.parentNode.insertBefore (t, s)} (window,

document, "script", https: //connect.facebook.net/en_US/fbevents.js');

fbq (& # 39 ;, & # 39; 287597818242477 & # 39;);

fbq (& # 39; track & # 39 ;, "PageView");

[ad_2]

Source link