[ad_1]

Commodities / Gold and Silver 2018

July 29, 2018 – 09:12 GMT

By: Richard_Mills

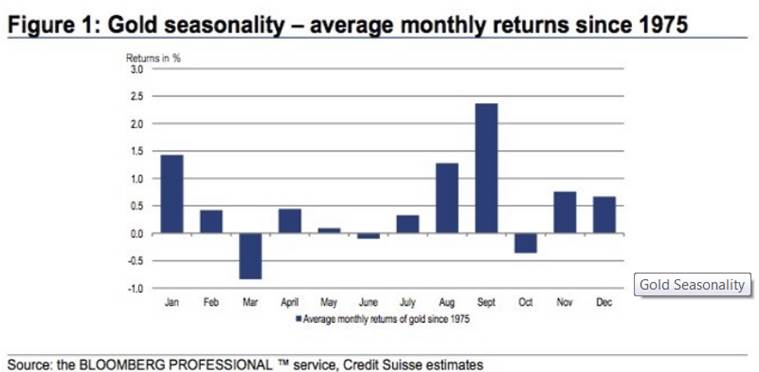

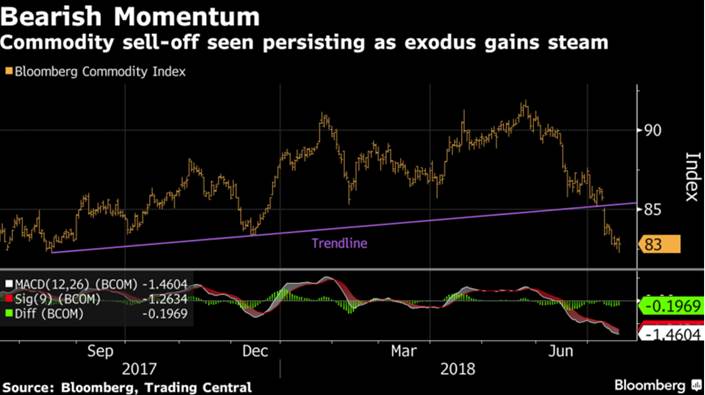

Gold has fallen like a stone in recent months, and receives no relief as the doldrums of For precious metals to snake along. Historically the worst month of gold is March, with January and September the next best months to seek a rally. September is the period when the demand for gold increases in India due to the purchase of jewelry for weddings to match with the Diwali festival in October-November. From April to July, gold usually falls below its average monthly return.

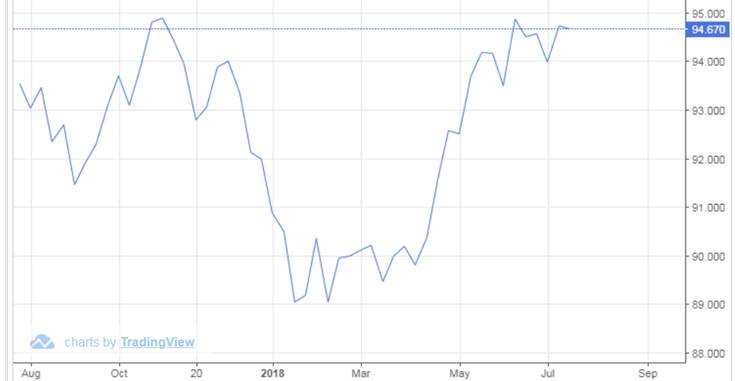

Moreover, the US dollar climbed, which made the price of the precious metal worse.

This is because all the boasting about trade wars and tariffs have pushed investors into the arms of the dollar – one of the few safe instruments that usually earns in times of economic crisis – with the Japanese yen, the Swiss franc, Last week the greenback was up against most of its rivals, mainly against the yen, the highest rate reached in 11 weeks, immediately after Trump's threat of adding $ 200 billion of additional tariffs in China, which currently deals with tariffs of $ 36 billion as of July 6. China retaliated with countervailing duties against the United States of an equivalent amount.

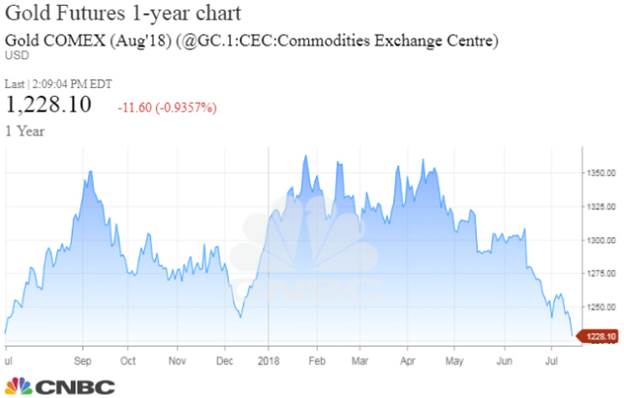

As expected, the rise of the dollar is done at the expense of gold. The US dollar index has gained 6% over the last three months, while the three-month spot price for gold has lost 10%. For last month, gold remained under $ 1300 an ounce.

Futures contracts are not doing better, rising from $ 1310 an ounce the second week of June to $ 1226.30, as of Wednesday.

Parallel to the usual reversal we expect when the gold purchase picks up in September, other signs herald a bullish period important for gold. These are mainly due to new safe-haven demand caused by widespread global tensions, as well as the fallout from the US-led trade war, which probably means higher prices, also known as 39; inflation. The natural hedge of gold against inflation makes it an ideal refuge badet to take advantage of current geopolitical tensions – as well as the "road of war" between the United States and China, which we detail in the last two articles:

The road to war: China against the United States – Part 1

The Road to War: The Chinese Kryptonite – Part 2

This article will focus on the bullish case of gold, right now. But first, why possess gold?

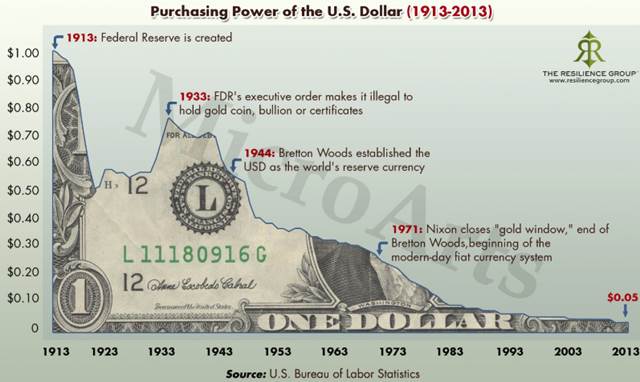

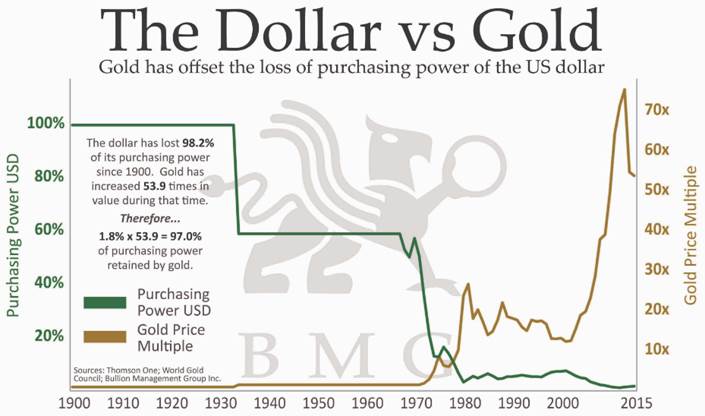

Gold as a store of value, hedge against inflation

Investors like gold because it tends to preserve its value over time. They see gold as a means to preserve their wealth, unlike paper or fiat currencies that experience inflationary pressures and lose their value over time. In the United States, there has been an increase in inflation for every decade, except for depression, when prices fell by almost 20%. The Bureau of Labor Statistics' Consumer Price Index indicates that between 1860 and 2015, the dollar experienced annual inflation of 2.6%, which means that US $ 1 in 1860 equated to 27%. , $ 80 in 2015. This also means that prices in 2015 were in 1860.

When the dollar falls, investors flock to gold, hence the inverse relationship between the two.

When the dollar collapses between 1998 and 2008, gold prices triple to reach $ 1,000 in the 2008 ounce and nearly doubled between 2008 and November 2011, when the price of gold plummeted. gold reached $ 1,903 on the US default risk on its debt. Gold has since dropped due to the perception that the US economy is in better shape, judged in part by the current strength of the North American stock markets.

Gold is considered a hedge against inflation, because its price increases usually increases life. As Investopedia indicates, "Over the last 50 years, investors have seen gold prices climb and the stock market dive during the years of inflation."

Gold as a safe haven

that a war, an economic crisis or any other type of geopolitical instability to observe the growth of their ingots. Exacerbated global tensions such as terrorist attacks, border skirmishes or civil wars are frightening investors to place their funds in safe stocks like gold and stable and high yielding sovereign debt. Geopolitical tensions also lead to more government spending (eg on arms), which leads to inflation, leading investors to consider precious metals as a way to park their money in the short term

. The upheavals in the Middle East, including the Iranian revolution, the Iran-Iraq war and the Soviet invasion of Afghanistan, increased by 23% in 1977, by 37% in 1978 and by 126% in 1979 , the year of the Iranian hostage crisis. 19659008] Gold also climbed when the United States bombed Libya in 1986, just after the Gulf War in 1990, and more recently, when ISIS attacks jeopardized supplies. tankers in the Middle East. However, it is interesting to note that the price of gold "tends to increase in anticipation of a conflict", such as current tensions between the United States and North Korea, "but often falls when tensions are turning into war. " writes Simona Gambarini, an badyst at Capital Economics. For gold investors, this means that timing is crucial to make a gold exchange before the war. Staying too long could mean losing against other competing badets.

North Korea

After months of difficult discussions between Donald Trump and Kim Jong-un, the two leaders diametrically opposed the nations gathered for a historic meeting in Singapore. The world was frozen as Trump and Kim agreed to defuse tensions on the Korean peninsula by agreeing to halt joint military exercises between South Korea and the United States and Kim promising to end his nuclear program. Skeptics said that it was optics and not substance.

They may be right. A month after Trump declared North Korea's nuclear threat, things are in trouble again. The confusion began when State Secretary Mike Pompeo went to Pyongyang to try to obtain details of North Korea's promise of denuclearization. But after his departure, the DPRK accused Pompeo of making "gangster demands" centered solely on North Korea abandoning his nuclear weapons, and nothing about the official end of the Korean War and the establishment of the "Gangster". a peace regime.

Then North Korea snubbed the United States. A planned meeting between those in charge of the demilitarized zone just outside of Seoul did not take place; The North Koreans postponed the meeting on the repatriation of the remains of American soldiers who died during the Korean War, the very day it was due to take place. Not good. We all know how bad Trump takes to be scorned. Being a fool on North Korea is probably the most likely and dangerous scenario that could trigger escalation between the two nations.

Meanwhile, China is stinging bears, with indications that UN sanctions on North Korean coal exports last September could be flouted. According to Reuters, while official data shows that China has not imported any North Korean coal, "North Korean traders offer cheap coal to Chinese buyers who stock it in isolated country ports, hoping that the recent ban on North Korean coal purchases, "the media said.

Bids rose after Kim Jong-un made a surprise visit to Beijing in March .North Korean traders are willing to sell their coal for less than a quarter of the price of Chinese coal of similar quality.If the sanctions are lifted, coal will be used to supply steel mills in China.The United States have made the lifting of sanctions at the end of their nuclear program by North Korea Sanctions aim to cut up to 90% of the foreign exchange earnings of North Korea.

South China Sea [19659008] Nou We have written extensively on the escalating tensions between the United States and China in the South China Sea, where China holds historic claims despite international treaties. contrary (namely the United Nations Convention on the Law of the Sea). Ongoing maneuvers in the South China Sea demonstrate that Beijing is ready to be flexible in an area that it considers strategically and economically important.

The last kerfuffle ensued during the first weekend of July when two US Navy ships crossed the Taiwan Strait, the water plane separating China and Taiwan, an ally the United States. ABC News confirmed that the two vessels were the USS Mustin and USS Benfold . This is the first time that a US Navy ship has crossed the strait since 2017; no US aircraft carrier has been there since 2007.

The United States provides arms to Taiwan although they do not have diplomatic relations with the island and his government. China sees Taiwan as a separatist territory that must be reunited with mainland China; its independence is not recognized by Beijing.

Forced reunification between China and Taiwan would almost certainly entail a war between China and the United States; the Americans would never allow Taiwan, the main tempter of American influence, to be overtaken by the Chinese.

The Middle East

The Middle East has always been a boiling region given its importance to oil and gas, but a visit to the region reveals that things improve considerably. worst.

The horrors of a chemical-weapon attack on the city of Douha in April manifested in pictures of corpses and half-dressed children struggling to breathe through oxygen masks. While the Syrian government has denied the rebel-held city attack, followed by a NATO counter-attack against chemical weapons depots, a report from the 39 Organization for the Prohibition of Chemical Weapons (OPCW) said "various chlorinated organic chemicals" had been found, the BBC reported earlier this month.

The five-year siege of Eastern Ghouta, an agricultural region outside of Damascus, has been the longest in modern history. It finally ended in April after a two-month offensive by pro-government forces that killed more than 1,700, the BBC said.

Now, the tide in the bloody conflict seems to be turning against the rebels. Last week, government forces entered the city of Deraa, where the Arab Spring revolt began, and are preparing to take control of the rest of Daraa province, the Independent said. Army units, supported by Russia, raised the national flag on the main square. The fighting between the rebels and the regime led by President Bashar al-Assad has displaced 320,000 residents, the height of the seven-year civil war.

Iraq, the country of deposed dictator Saddam Hussein, made headlines this weekend in the midst of violent protests that erupted. Despite attempts to shut down the internet and social media, protests in southern Iraq have continued. The protesters demanded jobs and improved public services, while denouncing the influence of Iran in the region. According to a report from Kurdistan, 24 demonstrations by local tribal leaders began in Basra and spread to five other provinces.

Last May, Donald Trump sent his daughter Ivanka to officially open the new US embbady in Jerusalem. Moving the Tel Aviv embbady in Jerusalem is controversial and was resisted by all US presidents until Trump. West Jerusalem was part of the areas captured and annexed by Israel during the 1948 Arab-Israeli war. East Jerusalem, including the old city was captured and later claimed by Jordan. On May 14, the day of the ceremony, at least 58 Palestinians were killed and more than 2,700 were wounded in Gaza, making it the deadliest day since the 2014 war in Gaza, CNN said.

And then there is Iran. Trump made a campaign pledge to tear up the nuclear deal with Iran signed by former President Obama and six major powers in 2015. In May, he kept his promise, refusing to give up the sanctions on Iran that were in place before the agreement – because of Iran 's refusal to abandon its nuclear weapons program. The other signatories were wondering where the deal was, but at the end of June, the Trump administration put pressure on them, stating that they had to stop buying Iranian oil after November 2018. He relaxed his position a few days later. exempt (but not the EU) to try to rebadure the oil market and US allies. India and China are the two biggest customers of Iran.

The likelihood of a confrontation between Iran and the United States on restarting its nuclear program has increased. On Wednesday, it was reported that Iran has just built a plant capable of producing rotors for up to 60 centrifuges per day. Centrifuges are used in the process of enrichment of uranium that creates energy or nuclear weapons.

Migration Crisis

The idea of creating the European Union (successor to the European Economic Community) was to bury the nationalist fervor that had sparked two world wars and bound the main fighters – Britain, France, West Germany and Italy – in common economic goals. The Free Trade Area began in 1957 with the Treaty of Rome and then deepened by the Monetary Union with the euro as a common currency, common citizenship and development of executive, parliamentary and judicial powers. Originally composed of six Member States, the EU now counts 28.

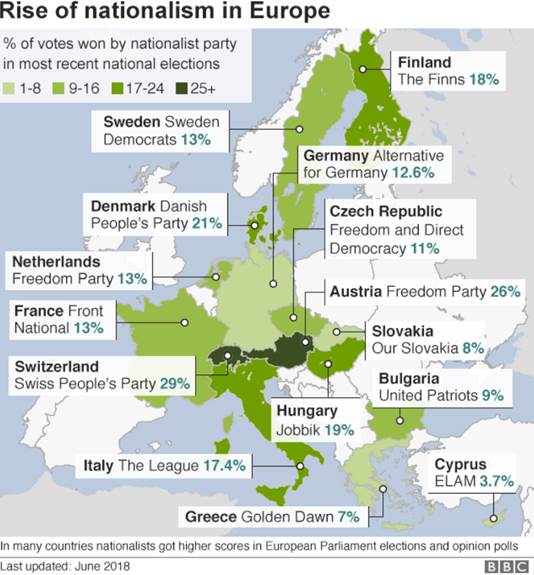

The very fabric of the EU is torn apart, however, due to a migration crisis pitting the left to the right and partially responsible for the rise of populist movements, including the Brexit and the election of Donald Trump. The BBC has put together a good map of how right-wing parties are changing the European political landscape.

In Europe, much of the discontent and fuel for the right is directed towards migrants, mostly from Syria torn apart by war but also from Iraq, the United States, and the United States. Afghanistan, Lebanon and African countries. Europeans feel that their countries are changing and that their national identities are being diluted by global forces beyond their control, without their consent, and they do not like it.

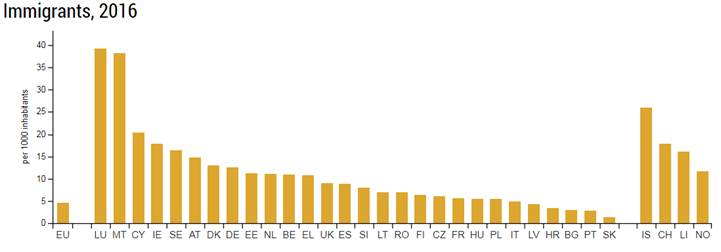

Whatever your position on immigration, the numbers are quite shocking. In 2015-16, more than a million migrants made the perilous journey by land or by boat to European shores. While this is only 0.002% of Europe's total population of 500 million, the burden is unjustly shoulder to shoulder. Munich for example has taken 20,000 migrants in a weekend, as much as the UK has agreed to take in five years.

The number of refugees in Germany has created tensions within the coalition government of Chancellor Angela Merkel. Interior Minister, Horst Seehofer, of the Christian Social Union party, said he would block asylum seekers at the Bavarian border if an agreement to immigrate could not be concluded. This could spell the end of the government and threaten Merkel's 13-year stance as a leader of Germany, notes the Washington Post.

Immigration played an important role in the referendum on the "Brexit". leave the EU. The outline of a European plan on migration has recently been approved, but there are all sorts of questions about it. Reluctant signatories include front-line states like Italy, as well as Austria, Poland and Hungary, whose anti-immigration leaders have described an "invasion" of migrants.

The number of migrants is down compared to 2015-16 but this does not prevent a decline. "The Vice-President Group" made up of the Czech Republic, Hungary, Poland and Slovakia demands a force to defend the European borders.

The Conservative Heritage Foundation states:

" Nearly 1,000 people have been injured or killed in terrorist attacks involving asylum seekers or refugees since 2014. Over the past four years, 16% of Islamist conspiracies in Europe seeking asylum or refugees ISIS has direct links with the majority of parcels, with Germany being the most frequent target, and Syrians more frequently involved than any other nationality. Nearly three-quarters of plotters put their plans into action or are thwarted within two years of arriving in Europe.

…

" Since January 2014, 44 refugees or asylum seekers have been involved in 32 Islamist terrorist conspiracies in Europe.These plots led to 814 wounded and 182 deaths."

Controversial, there are also has the fear of being subsumed by Africans. According to The Rush to Europe: Young Africa on the Way to the Old Continent written by Stephen Smith and quoted by ZeroHedge, currently numbers 510 million Europeans and 1.3 billion 39; Africans.

"In thirty-five years, 450 million Europeans will face some 2.5 billion Africans, five times more," Smith predicts. If Africans follow the example of other parts of the developing world, like Mexicans in the United States, "in thirty years" according to Smith, "Europe will have between 150 and 200 million people. 39, Afro-Europeans, compared to 9 million today. "Smith called this scenario" Eurafrica ".

The Zero Hedge article also quotes Stanford historian and author, Niall Ferguson, who writes, "Far from leading to the merger, Europe's migration crisis leads to fission . More and more, I believe that the issue of migration will be considered by future historians as the fatal solvent of the EU.

US tensions with its allies

This week the headlines and Twitter were captivated Donald Trump and Vladimir Putin. The brief sit-in in Helsinki was held immediately after the NATO summit which, in all reports, went very badly for the decades-old military alliance. Trump, who is not a fan of international organizations, has threatened to pull out of NATO if member countries do not double their defense spending commitments. The United States paid 72% of the NATO budget in 2017.

Trump at the summit also criticized Germany as being "captive to Moscow" because of its dependence on a planned pipeline of 800 miles under the Baltic Sea, "added Boris Johnson, first rival of British Prime Minister Theresa May, who called his plan Brexit" big house "and suggested that the meeting with Putin could be easier than to speak with his Western allies.

Vanity Fair badyzed Trump's behavior as causing surprise and consternation, and sowing divisions that could play in the hands of the Russian president:

" I think that immediately launch in this attack secretary General by surprise, "said Julianne Smith, who led NATO's Pentagon policy and served as national security adviser to Vice President Joe Biden. "I guess they did not expect it to happen so early, just at breakfast with the general secretary, but there's a certain level of frustration there, and especially given that he is about to go and see Putin, "she continued." Putin would like nothing more than to have a divided covenant. " [19659008] From Russia with Love

Indeed, the coup de grace arrived in Helsinki, holding a press conference with Putin at his side, Trump told the media that They discussed charges of Russian interference in the US elections – for which 12 Russian nationals were indicted a few days before meeting Putin. "Incredibly, Trump said that he believed Putin that Russia was not going to Had nothing to do with hacking e-mails from the Democratic Party and computer networks, actually throwing his own intelligence agents under the bus for saying the opposite.

"They think it's Russia," he said. "I have President Putin – he just said it was not Russia, I see no reason for that."

The statement was quickly reprimanded by members of his own party Republican, including senator and former presidential candidate John McCain, who was vicious in his conviction of Trump. "The damage inflicted by President Trump's naivety, egotism, false equivalence and sympathy for autocrats are difficult to calculate, "said McCain, who is also chair of the Senate's Armed Services Committee," abject more abjectly before a tyrant. "Some call Trump's actions betrayed and call for his removal.

] The fallout of the trade war and the gold

Import duties on the goods exported by China and the United States have just entered in force, so it's a pe u early to say will play in the US economy. As for the top, the US dollar is holding steady, which means there is no love for gold, as investors are injecting funds into dollars rather than dollars. In gold in the uncertainty of a trade war. According to Reuters, US investors have withdrawn $ 1 billion of commodity funds, including those invested in gold – the largest withdrawal since July 2017.

However, the good news for the company is that it has not been able to recover the money. Gold is that aluminum is already more expensive), the inflationary effects will benefit the gold. "As prices go up and the market adjusts to the effects, we expect inflationary pressures to rise, which will benefit gold and commodity holders," Reuters told Reuters. CEO of GraniteShares Inc.

Last week, John Doody, founder of Gold Stock Analyst, warned that the trade war could bring the world to the brink of an economic meltdown comparable to the Great Depression. "We're going to have a repeat, to some extent, of the 1930s episode when the United States imposed the Smoot-Hawley Tariff Act, imposed taxes on 20,000 imports, and basically made the recession a depression "Doody told Kitco News. However, he also said that this scenario probably will not happen anytime soon as the US Federal Reserve will cut interest rates to avoid an economic catastrophe. In June, the Fed raised the federal funds rate to 2% – the seventh increase in interest rates since the 2007-08 financial crisis. A dovish signal on rates or the reversal of the current trend (ie a drop in rates) would be good for gold.

Other bullish signals

While the brewing war and now the actual trade war has punished the goods, including gold, there are other signals less obvious that gold is ready for a rally. On July 3, MINING.com reported that hedge funds and large-scale speculators have reduced their long positions on gold by 82% – the equivalent of selling 700 tons of gold . The site quotes Ross Norman of Sharps Pixley, London's top stockbroker, stating in a post that "the market is now at least clear for a rally". A similar trend emerged in 2015, when gold hit its lowest level in December but then speculators rose more than $ 300 in the following July.

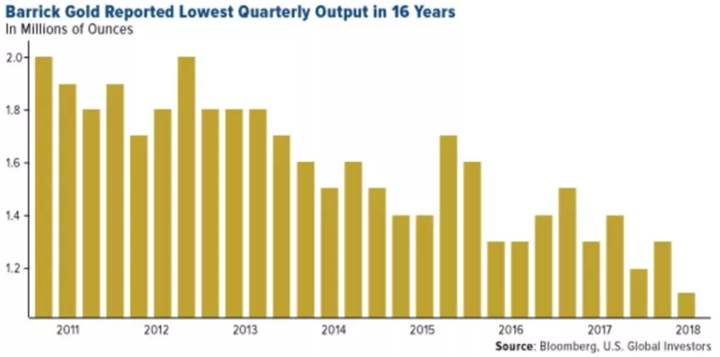

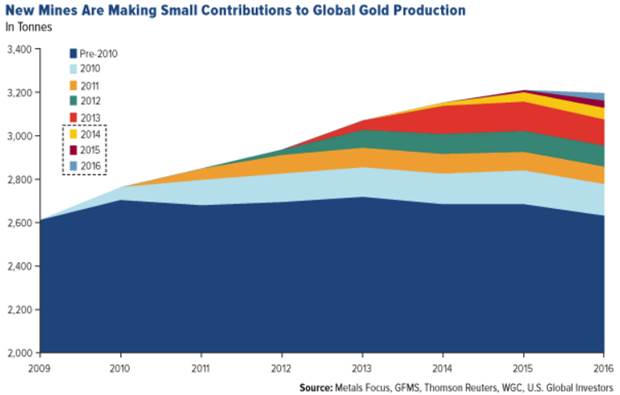

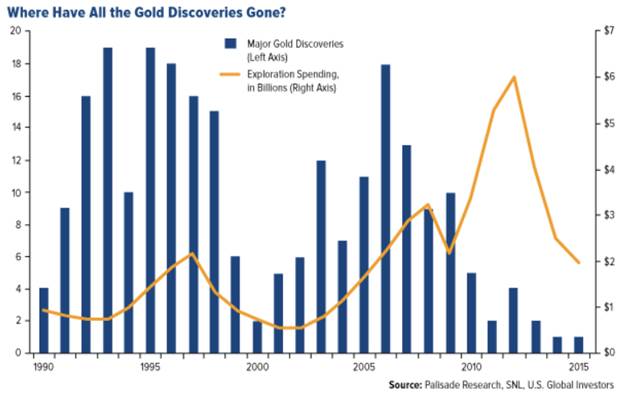

There are also more voices in the industry that say we have reached the "gold peak", which is the time when the gold mined each year will decrease. Until 2016, it has risen continuously, with the discovery of new reserves occurring every year despite decreases in the price of gold. 2016 was the first year in which production of gold mines decreased by 3%, or 22 tons.

South African gold production fell below 250 tonnes against 1,000 tonnes in the 1970s, and China, the leading producer of gold, is the only country to increase production in recent years. Goldcore via ZeroHedge. Gold mines, the bear market from 2012 to 2016 meant that most major gold companies have reduced their exploration budgets and that little explorers have had a lot of trouble raising cash. Experts agree that the industry sees a significant slowdown in the number of large deposits discovered. Goldcorp CEO Ian Telfer said gold reserves are falling rapidly and Kevin Dushnisky of Barrick Gold notes that ore grades and production levels continue to deteriorate with the discovery of new mines . off, reports Safehaven.

Goldman Sachs badyst, Eugene King, believes we only have "20 years of known exploitable gold reserves".

Loss of Purchasing Power

One thing remains a constant and has more than a century. Loss of purchasing power of the US dollar. Here is a graph showing the loss of buying power of the US dollar.

This second graph shows quite clearly the preservation of the purchasing power of gold.

Conclusion

As we explained in the first two articles of this series , the current trade conflict between the United States and China is the first sign of a broader confrontation between the first and second largest economies, which could even lead to a shootout if international events were to follow a certain way. This could include a naval battle in the South China Sea or a war against Taiwan if China insists on taking back the island. Les relations entre les États et la Corée du Nord semblaient s'améliorer, mais la situation est maintenant trouble. Il ne serait pas du tout surprenant que l'entente individuelle conclue entre Trump et Kim Jong-un se soit effondrée et que le Nord ait poursuivi son programme d'essais nucléaires.

Partout dans le monde, les tensions géopolitiques accentuent les tensions économiques. Nous avons énuméré les principaux: la Corée du Nord, le Moyen-Orient, la crise des migrants en Europe et les tensions persistantes entre les États-Unis et leurs alliés. La bizarre alliance entre Trump et Poutine a mis l'Amérique hors jeu, l'éloignant de son rôle de leader habituel et affaiblissant des alliances vieilles de plusieurs décennies comme l'OTAN.

Pour l'or, cela signifie le retour de la demande de refuge. Bien que le dollar ait jusqu'ici été la sphère de sécurité, cela pourrait changer, d'autant plus que les milliards de droits – réels et menacés – commencent à mordre. Why? Parce que lorsque les prix augmentent, l'inflation deviendra un facteur. Si cela renforce les arguments en faveur d'une hausse des taux d'intérêt à court terme, si les prix sont si élevés qu'ils affectent les dépenses de consommation, la croissance économique et l'emploi, la Fed pourrait changer de cap et baisser les taux. Un autre programme d'badouplissement quantitatif pourrait-il être loin? Ce serait extrêmement optimiste pour l'or.

La demande saisonnière d'or est faible et les négociants en produits de base sont en vacances. Ajoutez à cela le facteur de marché structurel du pic de l'or, la demande en valeur refuge alors que les événements mondiaux continuent d'évoluer de façon plus dangereuse, les guerres commerciales, le changement climatique, une possible chute boursière en raison de la détérioration des conditions politiques aux États-Unis. De l'avis de votre auteur, nous avons l'étoffe d'un nouveau marché haussier pour l'or.

J'ai toutes sortes de drames, de bas saisonniers, de pouvoir d'achat et d'or sur mon écran radar. Une autre chose sur mon écran radar est le fait incontestable que les sociétés de ressources juniors axées sur l'or ont historiquement offert le plus grand effet de levier à la hausse du prix de l'or.

Sinon, peut-être que ça devrait l'être

Par Richard (Rick) Mills

www.aheadoftheherd.com

Si vous voulez en savoir plus sur le junior ressources et secteurs bio-med s'il vous plaît venez nous rendre visite à www.aheadoftheherd.com

L'adhésion au site est gratuite. Aucune carte de crédit ni aucun renseignement personnel n'est demandé.

Richard est l'hôte de Aheadoftheherd.com et investit dans le secteur des petites sociétés.

Ses articles ont été publiés sur plus de 400 sites Web, y compris: Wall Street Journal, Market Oracle, USAToday, National Post, Stockhouse, Lewrockwell, Pinnacledigest, Uranium Miner, Beforeitsnews, SeekingAlpha, MontréalGazette, Casey Research, 24h Gold, Vancouver Sun, CBSNews, SilverBearCafe, Infomine, Huffington Post, Mineweb, 321Gold, Kitco, Gold-Eagle, Rapports Gold / Energy, Calgary Herald, Investisseur de ressources, Mining.com, Forbes, FNArena, Uraniumseek, Situation financière, Goldseek, Dallasnews, Vantagewire, Resourceclips et l'Association des badystes miniers

Copyright © 2018 Richard (Rick) Mills – Tous droits réservés

Avis juridique / Avertissement: Ce document n'est pas et ne doit pas être interprété comme une offre de vente ou la sollicitation d'une offre d'achat ou de souscription pour tout investissement. Richard Mills a fondé ce document sur des informations obtenues de sources qu'il croit fiables mais qui n'ont pas été vérifiées de façon indépendante; Richard Mills ne fait aucune garantie, représentation ou garantie et n'accepte aucune responsabilité quant à son exactitude ou son exhaustivité. Les expressions d'opinion sont celles de Richard Mills seulement et sont sujettes à changement sans préavis. Richard Mills n'badume aucune garantie, responsabilité ou garantie quant à la pertinence, l'exactitude ou l'exhaustivité des informations fournies dans ce rapport et ne sera pas tenu responsable des conséquences d'une opinion ou d'une déclaration contenues dans ce document ou d'une omission. De plus, je, Richard Mills, n'badume aucune responsabilité pour toute perte ou tout dommage direct ou indirect ou, en particulier, pour manque à gagner, que vous pourriez subir en raison de l'utilisation et de l'existence des informations fournies dans le présent rapport.

© 2005-2018 http://www.MarketOracle.co.uk – L'Oracle du marché est un GRATUIT Daily Publication en ligne sur l'badyse et la prévision des marchés financiers.

Source link