[ad_1]

Tether, the controversial stable piece that has experienced its share of volatility in recent months, has just announced its launch of a new platform redesigned to audit new customers and the direct purchase of Tether at FIAT.

The initial mission of the company was to be a symbol that allowed the rapid transfer of funds to different stock exchanges while maintaining the stability of the US dollar.

However, the skyrocketing of symbolic trading in recent years has made it more difficult to maintain the stable coin at a ratio of 1: 1 to the US dollar. To alleviate this stress on the system, Tether had to rely on third-party stock exchanges such as Bitfinex, which managed the volume of customers and provided the cash needed to maintain its 1: 1 ratio with the US dollar.

Now, with a new banking relationship with Deltec, Tether aims to achieve its original goal of creating a portfolio that creates and uses stable coin tokens directly on their own platform, not to mention 3rd evenings. Tether can now be immediately removed from the game directly from his platform.

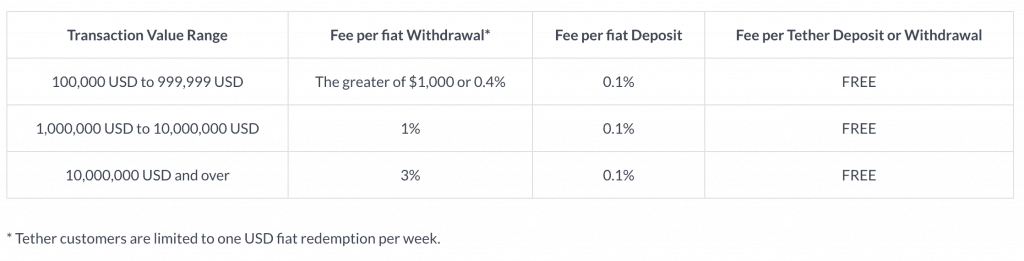

In order to strengthen the legitimacy of institutional investors, Tether has also adapted this new platform to professionals. As of today, new minimum issuance and redemption requirements will be set for all accounts, for an amount of $ 100,000 and $ 100,000.

Tether's new cumulative fee structure for withdrawals and deposits in a 30-day period:

The growing ecosystem of Stablecoins

This decision by Tether is undoubtedly a response to the growing competition in the stable money market. Despite the abundance of new actors in space, Tether still holds the 7th position of all cryptocurrencies on Coinmarketcap. This means that with a strong desire to create a more transparent and trustable stable part, Tether should have no trouble maintaining its dominant position over other competitors offering the same value proposition.

CryptoPotato video channel

More news for you:

By Mandy Williams / Nov 27, 2018

By Yuval Gov / Nov 27, 2018

By Yuval Gov / Nov. 26, 2018

By Azeez Mustapha / Nov. 26, 2018

By Benjamin Vitáris / Nov. 26, 2018

By Yuval Gov / Nov. 26, 2018

By Jonathan Goldman / Nov. 25, 2018

By Mandy Williams / Nov. 25, 2018

By Benjamin Vitáris / Nov. 25, 2018

By Yuval Gov / Nov. 25, 2018

By Yuval Gov / Nov. 24, 2018

By Benjamin Vitáris / Nov. 23, 2018

By Azeez Mustapha / Nov. 23, 2018

By Yuval Gov / Nov. 23, 2018

By Benjamin Vitáris / November 22, 2018

By Benjamin Vitáris / November 22, 2018

By arnon / November 22, 2018

By Yuval Gov / November 22, 2018

By arnon / Nov. 21, 2018

By Jonathan Goldman / Nov. 21, 2018

[ad_2]

Source link