[ad_1]

Thursday, November 29: markets talk about five things

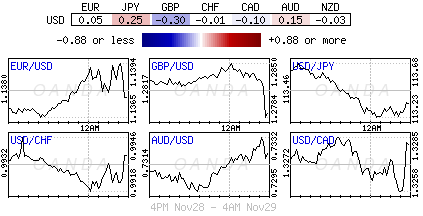

Global equities were better-rated overnight after a surprisingly "accommodating" tone from Fed Chairman Powell, who had reinforced sentiment before the weekend's G20 meeting in Argentina. The "big" dollar has slipped with US Treasury yields.

Yesterday, Powell said there was "no pre-established political path" for future interest rate increases, adding that "the bank's decisions will be shaped by new economic data."

Note: Futures prices suggest the Fed is approaching a pause and is posting market prices for just +25 basis points, the equivalent of a Fed rate hike in 2019.

The minutes of today's FOMC meeting (2:00 pm) are expected to confirm the forecast for further rate increases in December, despite Powell's dovish speech.

The market is also trying to position itself before a meeting between the United States and Chinese leaders this weekend. Many expect a calming of tensions rather than any express agreement involving major concessions from one or the other party.

Elsewhere, crude oil managed to recover some of yesterday's losses following an unexpected increase in crude oil inventories in the United States, while the price of gold rose slightly.

1. Stocks see the light

Asian equities rallied overnight, reflecting Wall Street's rise, after Fed Chairman Powell suggested they were about to end his tightening cycle. rate of three years.

Japan's Nikkei index rose + 0.4%, but concerns over the outcome of the meeting between Presidents Trump and Xi Jinping on the sidelines of the G20 summit were lower. The broader Topix also rose + 0.4%.

On the downside, Australian equities closed the night at a two-week high. Widespread gains pushed the S & P / ASX 200 index up 0.6% at trade close. Metal and mining stocks advanced + 1.3% to dominate gains. In South Korea, the Kospi closed up + 0.28%, extending its gains in a fourth session.

Note: The South Korean central bank is expected to raise rates at tomorrow's monetary policy meeting.

In China, equities lost confidence in investment ahead of the Sino-US trade talks this weekend. At closing, the Shanghai Composite Index was down -1.4%, while the benchmark CSI300 index was down -1.3%. In Hong Kong, it was a similar story. The Hang Seng index closed down -0.9%, while the China Enterprises index lost -0.5%.

In Europe, regional stock markets have higher trading levels, although they are lower than the previous ones. In the UK, bank names are trading slightly more after pbading the BoE stress test.

US stocks are about to open in the "red" (-0.2%).

Indices: Stoxx600 + 0.30% at 358.60, FTSE + 0.55% at 7,042.75, DAX + 0.38% at 11,341.42, CAC-40 + 0.58% at 5,012.16, IBEX- 35 + 0.12% to 9,114.00, FTSE MIB + 0.04% to 19,122.50, SMI +0.80% to $ 8,969.50, S & P 500 Futures -0.30%

2. Oil prices remain firm ahead of the G20, gold up

Oil prices rose slightly this morning because of investor optimism: the G20 trade talks could help the global economy and improve demand. However, gains are somewhat capped after yesterday's US crude stocks reached their highest level in 12 months.

Brent rose + 6c, + 0.1% to + $ 58.82 per barrel, after falling -2.4% yesterday. Futures contracts on US crude rebounded by + 20 cents, from + 0.4% to + $ 50.49 per barrel. Yesterday's session closed down -2.5% to + 50.29 dollars per barrel.

Nevertheless, the increase in availability limits prices. According to EIA yesterday, US crude inventories for the week ending November 23 rose 3.6 million barrels in a year, to + 450 million barrels .

OPEC members and non-OPEC members will meet in Vienna, Austria, next week (December 6) to discuss a new round of production cuts ranging from – 1 million to -1.4 million bpd and maybe more.

Before opening in the United States, gold prices strengthened overnight, as the "big" dollar weakened after comments from Fed Chairman Powell. Spot gold price up + 0.3% at + $ 1,224.13 an ounce, while US gold futures are little changed at + $ 1,223.2 ounce.

Note: Spot prices climbed about 0.6% on Wednesday, their highest percentage of gains in a day in two weeks.

3. Sovereign yields fall on Fed comments

It is not surprising that sovereign yields are under pressure after Fed Powell's "dovish" comments yesterday.

In Europe, general government borrowing costs reached their lowest level in more than two months this morning, after the fall in US Treasury yields.

Powell's comments triggered a rally in equities and pushed the 10-year US Treasury yield to + 3.01%, its lowest level since mid-September and far from this month's peak of + 3.25%.

Elsewhere, the yield on the 10-year German Bund hit a three-month low this morning at + 0.328%, down -2.5 basis points. French and Dutch government bond yields also dropped to new lows since early September, at + 0.716% and + 0.472% respectively, down about -2 basis points each over the day.

Italy's five-year bond yield plunged -4 basis points to + 2.36% and 10-year bond yield was below -1.5 basis points to + 3.25% and The difference to the Bund is +294 basis points.

4. The dollar finds traction difficult

The "big" dollar is struggling to find significant momentum, especially now that US trade is above the + 3% psychological level.

In Europe, weak growth and inflationary data have not been able to bring down the euro (€ 1,1352), but have for the moment been bridging positively.

Note: The reading of France's GDP for the 3rd quarter has been revised downwards at second reading, while Spain is missing expectations for its CPI in November and several German states have recorded lower readings compared to October .

GBP / USD (£ 1.2764) saw all its premature gains evaporate, while futures brokers reiterated their call for the next BoE rate hike here a few months in May 2020, fearing that the next Brexit vote will not be adopted by Parliament (11 December). .

Note: The BoE presented its "Brexit Scenarios" yesterday and noted that the GBP currency could fall from -15% to disruptive and -25% messy from Brexit.

Finally, a surprise contraction of Swedish GDP in the third quarter (-0.2%) prompted some dealers to anticipate a rate hike in December by the Riksbank. The EUR / SEK is up + 0.3% to € 10.30.

5. Business confidence in the euro area stabilized in November

This morning's data shows that euro zone business confidence has stabilized this month. The publication suggests that regional economies may stabilize after a prolonged slowdown of a year.

The indicator of the economic climate of the euro zone rose from 109.7 in October to 109.5 in November. By digging deeper, the decline in the measure was due to the weakening of consumer confidence. The climate in the services and construction sectors remained unchanged, while manufacturers and retailers became slightly more optimistic.

There are some special cases, the main exception being Italy, where the government's stalemate with Brussels over the proposed budget has increased corporate borrowing costs.

Elsewhere, French companies seemed not to worry about the fuel tax, while others have considered the possibility that the UK will leave the US in 2019 without a new trade agreement. .

This article is for general information only. This is not an investment advice or a solution for buying or selling securities. Opinions are the authors; not necessarily that of OANDA Corporation or its affiliates, subsidiaries, officers or directors. Leverage trading is high risk and not suitable for all. You could lose all your deposited funds.

Dean Popplewell has nearly two decades of experience in trading currencies and fixed income instruments.

He has in-depth knowledge of market fundamentals and the impact of global events on capital markets.

He is respected among professional traders for his thorough badysis and career as a global leader.

like Scotia Capital and BMO Nesbitt Burns. Since coming to OANDA in 2006, Dean

played a decisive role in raising awareness of the foreign exchange market as an emerging badet clbad

for retail investors, as well as specialized advice to a number of internal teams on how best to

serve customers and industry stakeholders.

[ad_2]

Source link