[ad_1]

I am bullish on AbbVie (ABBV). It remains one of my largest stocks of pharmaceuticals, and I am ready to add, if the opportunity arose. And I think that has now been done and could even improve.

In this article, we will take a fresh look at the proposed acquisition of Allergan (AGN) and explain why such a merger would create a stronger company and, more importantly, a stronger AbbVie, less dependent on current products. .

Even with a potential increase in debt, I think AbbVie at this price represents a compelling valuation and opportunity – and I've increased my position.

A merger and potential acquisition to solve some problems of AbbVie.

So, in my original article entitled "AbbVie: not a swan, but a robbery at its current price", I argued that one should only invest in the company if one's understood the risks involved. As a spin-off less than 10 years old, it has convincing advantages, but also presents significant risks.

The biggest problem / risk with AbbVie is its over-reliance on Humira. You can not run a successful business with about 70% of the profits of a drugs should lose their exclusivity in 2023 and become a SWAN / safe investment. This is still the case, especially since the sale of the company is not very international compared to other pharmaceutical companies.

Prior to the proposal, AbbVie had a good debt ratio, about 2.15 times the EBITDA. Mergers and acquisitions are not unusual for AbbVie either – the company bought Pharmacyclics, Stemcentrx and others. As I wrote in my previous article, AbbVie has achieved good and bad mergers.

Today, the company has never had mergers and acquisitions of this size. The proposal would imply a huge amount of 63 billion euros. The amount at the time of the proposed merger was approximately 45% of the share price. As a result of this, the course of action AbbVie took a decisive blow, which partly explains the reason why I write this article: evaluate whether this reaction is right or not.

Proposal

For those interested in AbbVie databases, I refer you to my last article. These basic pre-proposal principles have not changed so much. Here we will focus on the transmission potential.

(Source: Slideshow AbbVie – Looking for alpha)

First of all, this movement can certainly be described as defensive. Although the company wants us to focus on opportunities and growth potential, I will focus on the risk reduction noted in this potential deal that would reduce the overall impact of Humira's sales. The question is whether this risk reduction will be bought at an attractive price.

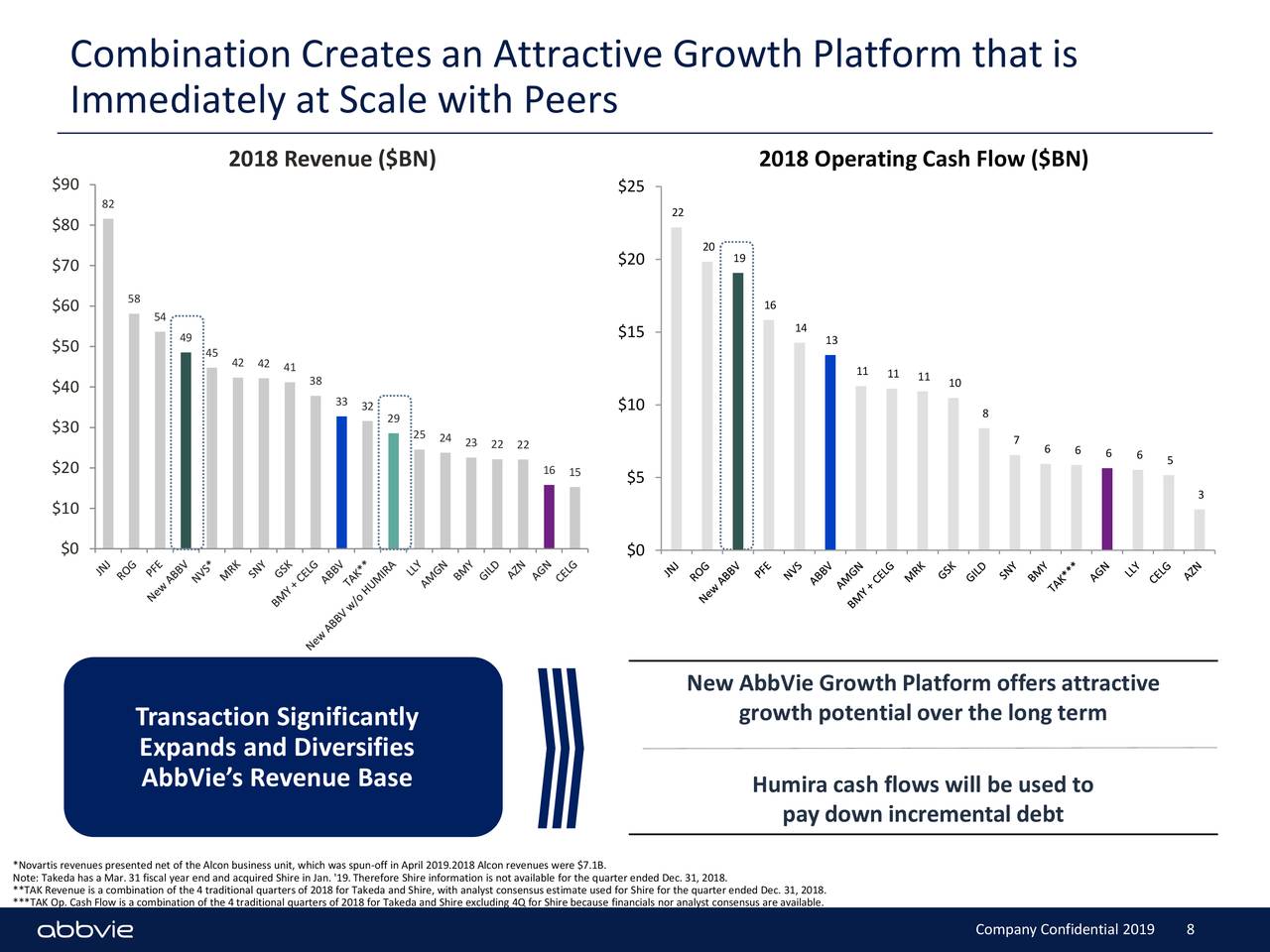

(Source: Slideshow AbbVie – Looking for alpha)

There is no doubt that the new company would represent a very powerful player in the pharmaceutical market, behind the largest companies in the global market.

AbbVie expects the potential new company to account for less than 40% of Humira's sales. It's still a bit; the risk is still there, but it has been greatly reduced.

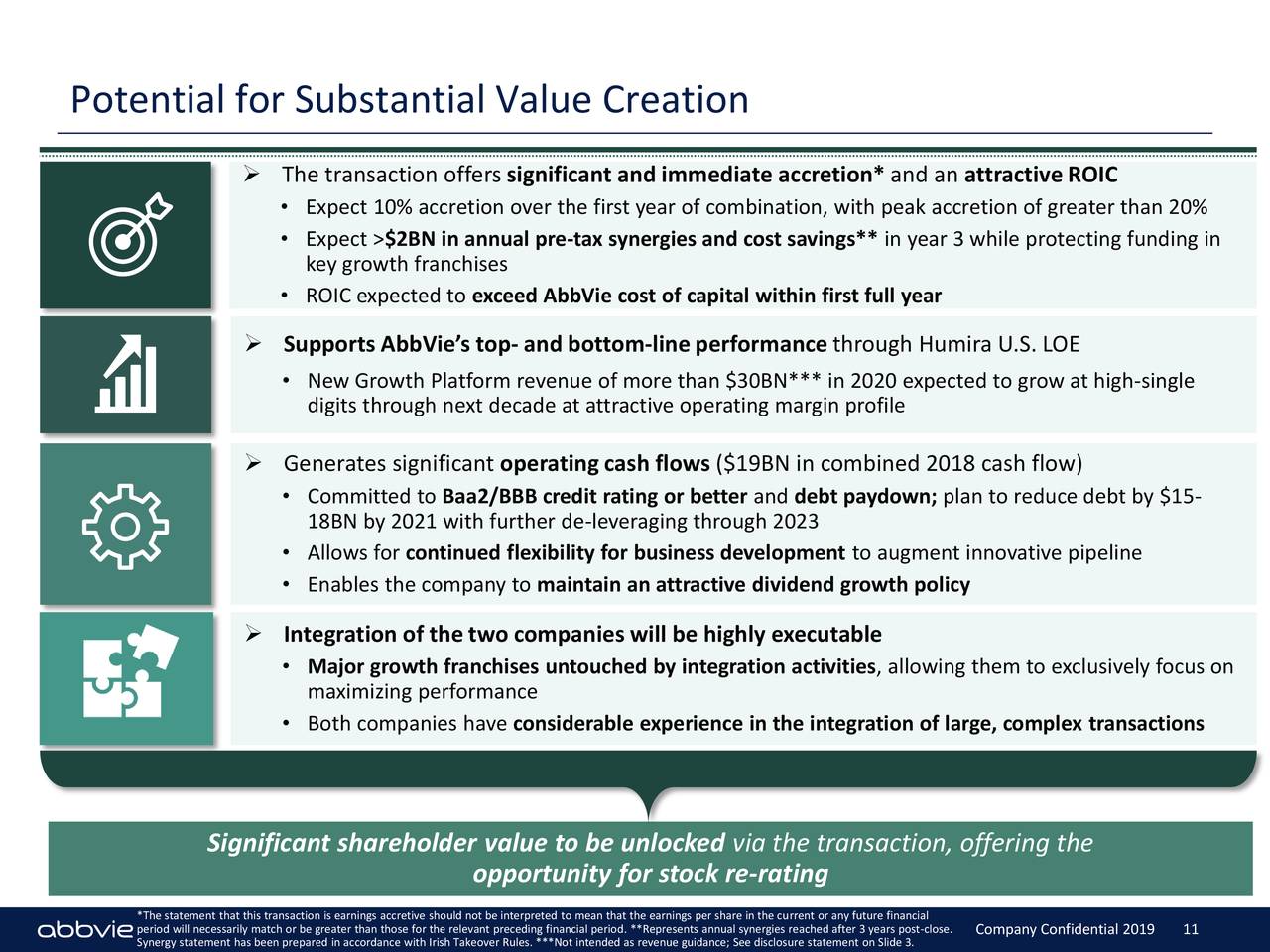

The company is also making impressive promises in connection with this proposal.

(Source: Slideshow AbbVie – Looking for alpha)

Those of us who remember AbbVie's unfortunate contracts are well aware of risk-taking in a M & A where synergies do not materialize for one reason or another.

As one of the products targeted in this proposal, Botox, is already widely available and used, however, these risks are not very relevant to this potential supply. The acquisition of Allergan and its products (including Botox), as such, aims to stabilize the Company's revenues until 2023 and beyond, allowing AbbVie to use Humira's sales to repay the acquired debt, if this transaction were to succeed.

In addition, Allergan is not limited to Botox. Let's review the company in question.

Allergan – Quick Comment

Founded in the 1950s, Allergan acquires, researches, develops and markets branded drugs. It sells primarily to the American health care system, and AbbVie's offer for society is not the only one it has been awarded (we'll talk about it later).

The company generates revenues of about $ 15 billion a year and employs nearly 18,000 people worldwide.

His portfolio includes:

- Botox, which can be used for cosmetic and medical purposes.

- Memantine, the 147th most prescribed drug in the United States (4 million prescriptions), is a treatment for Alzheimer's disease.

- Restasis, with 2 million prescriptions in the United States, is an eye drop used to increase the production of tears.

- Linzess, a medicine against IBS and constipation.

- Bystolic, a beta-blocker with 5 million prescriptions in the United States.

- Juvéderm, a popular injectable filler.

- Latisse, a drug used to treat high eye pressure, with about 1 million prescriptions.

- Teflaro, an effective antibiotic.

- Dalvance, another successful antibiotic …

… and much more. Allergan is active in the fields of aesthetics / plastic surgery, central nervous system, vision care, women's health and urology, cardiovascular diseases, infectious diseases, cystic fibrosis and gastrointestinal diagnoses.

In short, what AbbVie offers to buy here is not a business that depends on a singular drug, which could end up failing (like Rova-T). This is the suggested idea of mergers and acquisitions with a company with strong names – we could suggest others as strong as Humira, or almost. Allergan is an attractive company, a company on which I have also often looked for an investment.

Until here everything is fine.

Why the negative reaction of the market?

In response to the news, AbbVie's shares have fallen a bit. The market did not like the proposal. Equities have since recovered and are currently trading at about 8.55 times forward earnings – which, by the way, remains cheap from a historical and fundamental valuation point of view.

The reasons?

More importantly, AbbVie's debt to make a difference is no small feat. In 1Q19, it had about $ 6.7 billion and its net debt currently stood at about $ 30 billion. The company is now considering expanding this system to bring total debt to about $ 92 billion in net debt. This will increase not only the company's debt, but also interest expense – at a time of potential market volatility. In addition, Allergan has not, in recent years, demonstrated the utmost rigor in complying with its own guidelines and objectives.

So I think the market is saying that leverage is a concern and that the proposed company should not be as good as you would like – and I agree to a certain extent here. Let me clarify a little.

M & A Analysis

I bought AbbVie, knowing very well that the company was counting on Humira, as well as on the risks for the future. My article saying that AbbVie was not a SWAN is definitely always true to my mind. However, by doing what AbbVie is doing, it is targeting my main concern with this investment. Humira's trust will be reduced, though Botox / Humira, together, will account for a significant share of potential new company sales.

So, to the extent that it reduces dependence, the deal is attractive.

The Company's current forecast is that combined profit will be approximately $ 18.5 billion, excluding the additional interest expense generated by the new debt (~ 8.8 / share per share for AbbVie and approximately 16.55 per share for Allergan). By combining the number of shares of these companies and accounting for the terms of the merger and the acquisition, we get a combined EPS of about 9.5 to 9.9 USD / share – and this before the synergies. Quick calculation seems logical, at least on the surface.

Once again, the case is appealing here.

(Source: Humira)

In terms of future risk for each company, we see similarities between AbbVie and Allergan. Both companies face a loss of exclusivity (LoE) in the coming years. AbbVie during the defeat at Humira in 2023 in the United States (and already lost in Europe), and Allergan during many early LoE losses in 2018 and extending until 2023. The most important of they are Restasis, where The company will lose more than $ 1.1 billion in annual revenue, losing its exclusivity in 2019 and Bystolic in 2021. Bystolic – a drug for high blood pressure – represents a turnover additional about $ 580 million.

When I was investing in AbbVie, I knew that the company should eventually find a way to reduce its dependence on Humira. I did not expect this to come in the form of this proposal, even though I was expecting some merger and acquisition actions.

The reason I do not consider the proposal as negative (and why I'm staying an AbbVie bull) is that I think AbbVie is actually paying a good price for Allergan. We know that the pharmaceuticals and health care sector is not up to the general market at the moment, which has resulted in rather depressed valuations for many companies, including Allergan.

I consider the price from a historical point of view. As I said earlier, Allergan has already been blocked. Pfizer (PFE) was interested in buying the company – and Pfizer's offering at that time was $ 363.63 / share. If you compare this price to the current price paid by AbbVie, the question that may arise is this: do you believe that Allergan has lost about 50% of its market value over the past three or four years? (if you think the offer was made at the time?) pretty decent evaluation)? Obviously, I do not think so. The assessment is not limited to this – but the fact is that I do not consider that a 45% premium over a depressed stock market is a bad deal, even if we consider some of Allergan's LoE until 2023.

summary

The fundamental question boils down to: What do AbbVie pay and what is the end result?

Following a merger-acquisition, AbbVie:

- Reduce your addiction to Humira and add to its Botox range as well as several impressive drugs.

- Further expand existing product lines in women's health and gastroenterology, adding new positions in the areas of medical aesthetics, plastic surgery and neuroscience.

- Form the new merged company in both parts of the "growth platform", responsible for investment and development, while using existing leadership positions to generate acceptable revenue growth over the next 10 years years, as well as the Humira part, which will play the role of cash cow to repay the debt incurred in connection with this transaction.

- Become a much bigger competitor, with the financial power and the strengths of the company, to meet the challenges of the market and investments.

- Buy Allergan at a bargain price and at a very depressed discount compared to the past 2015 offer.

However, as part of this merger, AbbVie:

- Borrow excessive debt, increasing leverage to at least 4X over EBITDA.

- Acquire a company that, in recent years, has not achieved excellent results, in addition to losing the exclusivity of several essential drugs in the coming years.

- Subscribe to a strategy that for some companies in Europe has not really worked well. It's not always a solution to just "buy" an asset / company and staple it to another company to solve a structure / dependency problem.

- Issue new shares at a price significantly lower than some of its redemption prices (over $ 100), as well as leverage and leverage at a depressed stock market, which is still far from ideal .

As you can see above, it is possible to defend both a bull thesis and a doctoral thesis on this pharmaceutical company as a result of this transaction. The key seems to be this: can management leverage the promised synergies, reduce the debt and take advantage of the growth opportunities presented here?

If they can not, you are planning to lose patent protection by a company in 4 years without significant replacement of many products. The stock price would probably follow this downward trend and sooner or later the company should reduce its impressive dividend.

If they can, it marks a very attractive entry or possibility of adding more actions.

(Source: F.A.S.T graphs)

Other contributors focus on double-digit returns to market valuation in the event that AbbVie returns to normal P / E valuation. Due to the risks involved, I use the historic discount and assume the absolute worst: AbbVie continues to fall.

As we can see in this case, even at later discounted valuations, if the company does not cut or significantly affect its growth rate, you will not lose money in this investment as long as things are moving. . somewhat in a positive sense.

We can also mention that this society very rarely misses estimates by far, or the fact that if AbbVie returns to a somewhat normal valuation, you would earn annual returns of almost 30% including dividends – and this is not, in my opinion, an unlikely thing.

Thesis

My thesis on AbbVie has been and remains a thesis centered on the firm understanding of risks. The risk you have taken before is that management must find a significant replacement for its dependence on Humira after 2023.

Now the management has come out and said, "Here's our solution – let's buy Allergan!"

For me, this becomes a classic value exercise, in which we can look at something as fundamental as the management of a business. Just as management was a reason for me to trust the company enough to invest several months back, so does management at that time, a reason for me to believe that she can:

- Clear quickly enough to solve the debt problem before the LoE for Humira / other drugs.

- Capitalize on growth opportunities and synergies.

Because if the company and management are unable to do it, the debt, the price of purchase – none of this will really matter in the face of headwinds.

The CEO, Rich Gonzales, and the other members of management are the ones where, in this case, I put a lot of confidence. Due to his tenure as President of ABOT Laboratories (ABT) and CEO of AbbVie since 2011, his experience here is unparalleled. His selection as CEO is another point in his favor, as well as the impressive results he and other leaders have brought to the company.

Do not mistake yourself. Management alone is not enough. AbbVie is an attractive company at an attractive price, as we can see above in the valuation section. In my opinion, these depressed valuations take into account that AbbVie is unable to create synergies and capitalize on growth opportunities.

I disagree with the negatives here. AbbVie's record is eloquent – and I think the company will show us once again that it can excel in an extremely competitive field.

That's why, as a result of this merger and acquisition project, I remain an AbbVie bull and have somewhat extended my position.

Recommendation

Regarding this article, I consider AbbVie as a "buy" at levels of about 75 USD / share. I have myself slightly increased the exposure to society. I do think that investors should define their positions accordingly and with regard to their own risk tolerance.

I will update this article or publish an updated thesis if things change and / or at the same time as future updates of the results.

Disclosure: I am / we have been ABBV for a long time. I have written this article myself and it expresses my own opinions. I do not receive compensation for this (other than Seeking Alpha). I do not have any business relationship with a company whose shares are mentioned in this article.

Additional disclosure: Although this article may appear to be financial advice, please note that the author is not a CFA nor authorized in any way to give financial advice. It can be structured as such, but it is not financial advice. Investors are required and are required to do their own due diligence and to carry out research prior to any investment.

[ad_2]

Source link