[ad_1]

JD.com shares, China's e-commerce service rivals Alibaba is on the rise today after the online retailer announced better than expected results for the fourth quarter of 2018, removing the uncertainty surrounding China's tech companies. .

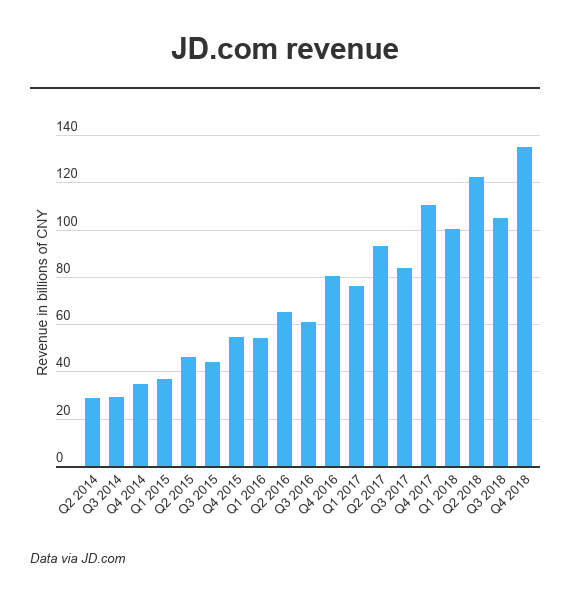

The company reported net sales of 134.8 billion RMB ($ 219.6 billion) for the last quarter of last year. Although the growth rate has been the lowest year-on-year since JD's publication five years ago (22.3%), it exceeds analysts' forecasts, which stood at $ 19.189 billion. JD.com also beat on earnings per share.

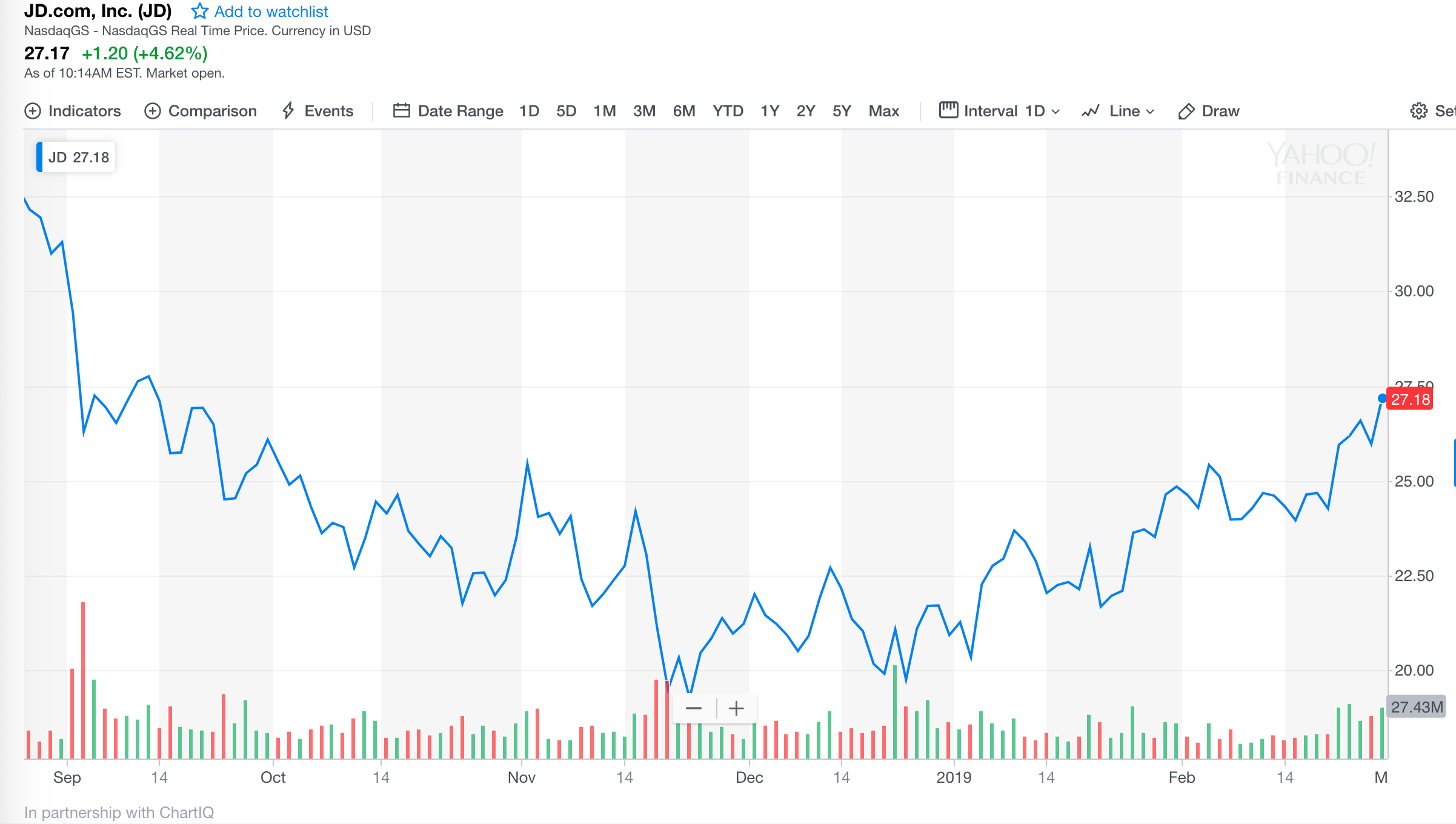

This combination has seen its Nasdaq share price rise by at least 14% in pre-market transactions, reports Reuters. The stock is up about five percent at the time of writing, according to Yahoo Finance data.

JD.com became public on the Nasdaq in 2014

Chinese startups are resisting the country's economic problems. Apple has recently reduced its quarterly revenue forecast due to the slowdown in China, while Chinese technology companies have gone further and cut costs.

Some of them include Didi dismissing 15% of his staff and NetEase making cuts on several units, while JD.com itself would separate 10% of its executive team in the context of downsizing. .

JD.com's revenue growth reached its lowest level as a public company in the fourth quarter of 2018

In this context, exceeding expectations was sufficient to attract investor interest despite slowing growth in JD.com's business. The last quarter of the year is typically the most lucrative in terms of revenue, thanks to the singles day shopping festival. That said, the company recorded a quarterly net loss of 4.8 billion RMB, or $ 700 million, in the fourth quarter.

The annual performance of JD.com saw revenues increase by 27.5 percent in 2018 to reach 462.0 billion RMB ($ 67.2 billion), with a loss of RMB 2.5 billion or $ 400 million. of dollars. In 2017, the company reported a net profit of 116.8 million RMB, which was converted to 18 million dollars at the time.

On the technological front, JD.com has invested heavily in drones, automated deliveries and automated warehouses, preferring to play the "long-term game" of advanced technology rather than generating short-term investments.

However, the scandal that followed the arrest of CEO Richard Liu in the United States on suspicion of sexual misconduct, however, caused a scandal. Ultimately, Liu was not charged after the authorities had admitted that it was not possible to prove beyond a reasonable doubt the charges against him.

[ad_2]

Source link